Oil climbed on Monday following U.S. President Donald Trump ending waivers on companies wishing to purchase Iranian oil without facing stiff sanctions. The price of Brent crude went up by 2.77 percent while WTI crude was up 2.43 percent as of 10:45 a.m. ET.

“This decision is intended to bring Iran’s oil exports to zero, denying the regime its principal source of revenue,” White House Press Secretary Sarah Sanders said in a statement Monday.

“The U.S., Saudi Arabia and the United Arab Emirates, three of the world’s great energy producers, along with our friends and allies, are committed to ensuring that global oil markets remain adequately supplied,” the statement added.

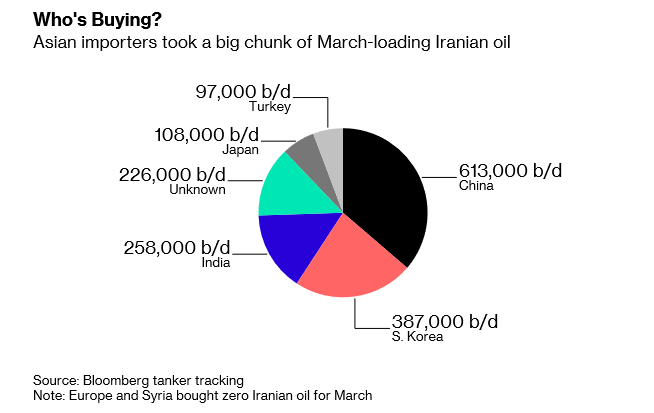

The companies affected most by the waivers were China, Greece, India, Italy, Japan, South Korea, Taiwan and Turkey, which are all set to expire on May 2.

Saudi Arabia and others in OPEC will more than make up the Oil Flow difference in our now Full Sanctions on Iranian Oil. Iran is being given VERY BAD advice by @JohnKerry and people who helped him lead the U.S. into the very bad Iran Nuclear Deal. Big violation of Logan Act?

— Donald J. Trump (@realDonaldTrump) April 22, 2019

Leveraged Oil ETFs Respond

Leveraged-inverse exchanged-traded funds (ETFs) acted positively to the news–United States 3x Oil (NYSEArca: USOU) was up 7.44 percent, ProShares UltraPro 3x Crude Oil ETF (NYSEArca: OILU) went 7.40 percent higher and Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 3X Shares (NYSEArca: GUSH) gained 5.45 percent.

Global investment bank RBC Capital Markets is expecting more increases in oil prices, going as far as saying that crude could reach the $80 price level this summer. Overall, RBC Capital Markets is forecasting Brent crude prices to average $75 for 2019–up from a previous 2019 forecast of $69.50 per barrel.

Furthermore, their outlook for U.S. West Texas Intermediate crude rose from $61.30 per barrel to $67 for 2019.

“We see price risk asymmetrically skewed to the upside spurred by geopolitically infused rallies that could shoot prices toward or even beyond our high-end, bull-case scenario and test the $80/bbl mark for intermittent periods this summer,” RBC strategists Michael Tran, Helima Croft and Christopher Louney said in a research note.

Fears of a global economic slowdown are also weighing on the minds of oil traders. After the U.S. central bank kept interest rates unchanged last month, Federal Reserve Chairman Jerome Powell said that “we’ve noted some developments at home and around the world that bear our close attention.”

That dovishness has translated into more cautious investors who are unwilling to dial up the risk with respect to capital allocation. A global economic slowdown could also keep oil prices in check with the prospect of weaker demand.

For more market trends, visit ETF Trends.