The Direxion Daily Natural Gas Related Bull 3X ETF (NYSEArca: GASL) is up over 36 percent year-to-date despite some selling of natural gas futures following the Memorial Day weekend. Bespoke Weather Services identified higher production numbers as the primary reason for the natural gas sell-offs.

“Even though it still has not yet gotten back to its highs, the move was enough to pressure all of the natural gas curve, especially with the trend toward less heat once we move beyond this current week, as the strong eastern U.S. ridge that has led to numerous record highs in the Southeast finally weakens,” Bespoke Weather Services said. “…We made it through options expiration without many fireworks, as we weren’t quite close enough to either the $2.50 or $2.60 strikes to gravitate one way or the other, but suspect there can be noise around the June contract expiry.”

GASL seeks daily investment results equal to 300 percent of the daily performance of the ISE-Revere Natural Gas Index. The index is designed to take advantage of both event-driven news and long term trends in the natural gas industry.

Oil and Nat Gas Rose in Unison

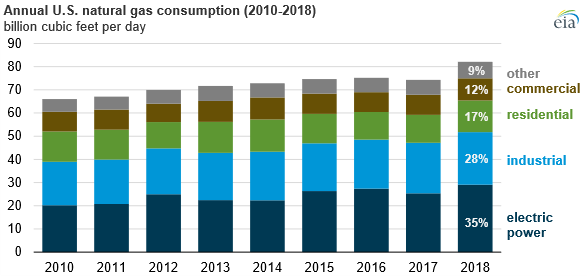

As oil prices rose to new heights in 2018, so did natural gas consumption in the United States as the Energy Information Administration (EIA) reported an increase of 10 percent compared to the previous year.

Consumption reached a record high of 82.1 Bcfd and came from across all sectors in 2018. The majority of the consumption came from the electric power sector due to a combination of recent natural gas-fired electric capacity additions and weather.

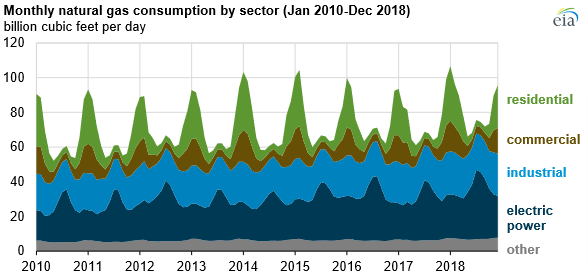

“As natural gas comprises a larger share of electricity generation, natural gas consumption increases both in the summer — when air conditioning demand is high — and in the winter, especially in places such as the South, where electric space heating is more common,” wrote Kallanish Energy in a blog post.

Per WorldOil.com, “In 2018, the U.S. experienced several periods of extremely warm and cold weather, contributing to record-high natural gas consumption. Much of the Lower 48 states experienced prolonged periods of colder-than-normal temperatures in January 2018, and record-high average monthly temperatures during summer 2018 increased natural gas use in the electric power sector.”

Last year, the natural gas markets didn’t experience any major disruptions despite potential headwinds from Chinese tariffs. However, as the U.S. and China, both heavy consumers of natural gas, work out a permanent trade deal, it’s preventing boatloads of capital investment from entering the markets.

Even if a permanent trade deal doesn’t materialize from ongoing negotiations, some analysts feel its only natural that the U.S. and China resume their natural gas trading.

“They’re just the elephant in the room and until there’s clarity on where China is going to source their natural gas … then it’s hard for other buyers to make decisions about which projects to attach themselves to,” said Katie Bays, head of energy and utilities, Height Capital Markets.

For more market trends, visit ETF Trends.