Related: Industrial ETFs Are Outperforming Among U.S. Sector Picks

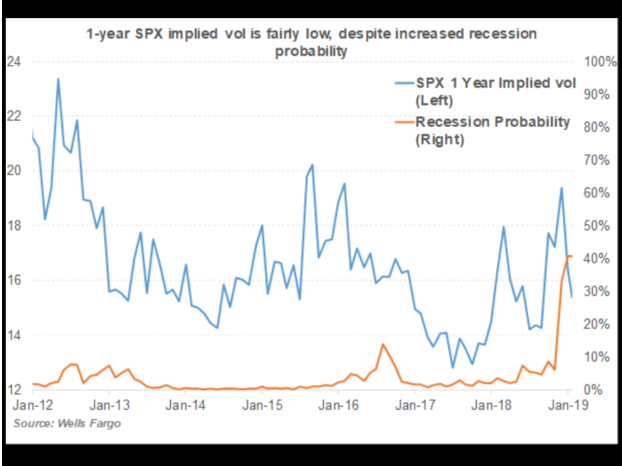

This disconnect between volatility and recession probability hearkens back to the financial crisis in 2008.

“In 2007, 1-year vol traded at very low levels despite recession risk having increased rapidly in 2006,’’ Chintawongvanich wrote. “It was only when Bear Stearns started running into trouble in summer 2007 that 1-year vol rapidly repriced.’’

If the markets are indeed poised for a rocky ride ahead, traders can take advantage of market oscillations with leveraged S&P 500 ETFs, such as the Direxion Daily S&P 500 Bull 2X ETF (NYSEArca: SPUU), Direxion Daily S&P500 Bull 3X ETF (NYSEArca: SPXL) for gains and the Direxion Daily S&P 500 Bear 1X ETF (NYSEArca: SPDN) for declines.

For more market trends, visit ETF Trends.