Following the Federal Reserve interest rate decision on Wednesday to raise rates another 25 basis points, a flight to long duration government debt was apparent with Direxion Daily 20+ Year Treasury Bull 3X ETF (NYSEArca: TMF) gaining as much as 4 percent.

As widely expected by the capital markets, the Federal Reserve raised interest rates to make it a fourth and final rate hike for 2018. The Fed proceeded with their rate-hiking policy despite the latest rumblings in the stock markets. The Dow Jones Industrial Average has lost over 3 percent year-to-date, while the S&P 500 has lost 3.79 percent.

Meanwhile, the tech-heavy Nasdaq Composite has lost close to 14 percent within the last three months of what’s been a volatile market. The Dow and S&P were not immune to the market fluctuations with 9.37 percent and 11.57 percent lost, respectively, in the last three months.

Analysts have been citing rising interest rates as one of the causes for the latest declines in U.S. equities.

Related: Fed Chair Sees ‘Growth Moderating Ahead’

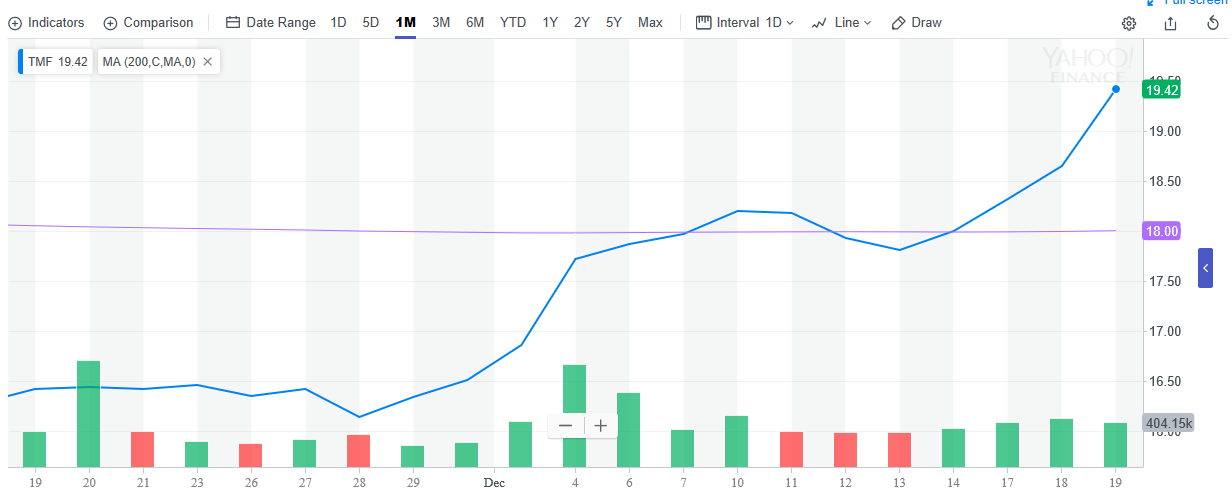

TMF Moves Past 200-Day MA

In the past month, TMF has risen past its 200-day moving average, supporting the risk-off sentiment that has taken hold of the capital markets with fears of a global economic slowdown permeating investors’ psyche. It’s certainly welcome news for the bond markets as inflows of capital flood the fixed-income space, but to equities investors, it could be a sign of more pain to come.