Despite the recent market volatility, the Direxion Daily Homebuilders and Supplies Bull and Bear 3X Shares (NYSEArca: NAIL) keeps on building off its previous gains. The fund continues to be a stellar performer despite trade wars racking markets during the month of May.

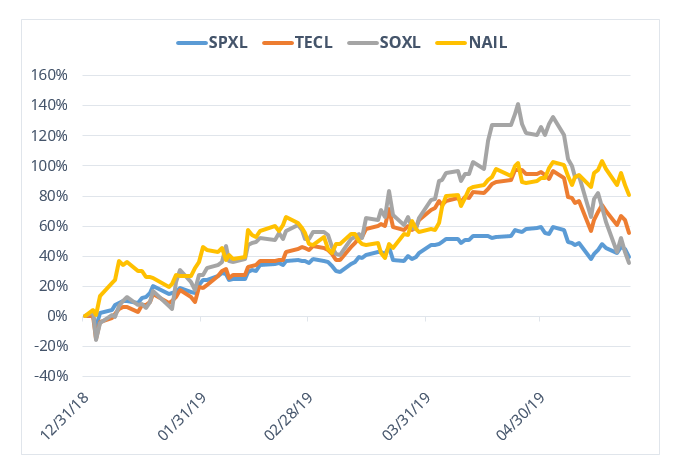

Thus far this year, NAIL is up a whopping 68 percent and is looking to build more gains in the future if the housing market happens to stay immune from the trade war news.

“Amid the hand wringing over whether the U.S. and China are coming closer together or further apart on a trade deal, a dark horse has emerged in sector investing that seems immune to the cyclic boom and bust of this headline-driven market–that underdog is homebuilders,” a Direxion Investments post noted.

NAIL seeks daily investment results equal to 300% of the daily performance of the Dow Jones U.S. Select Home Construction Index. The fund invests at least 80% of its net assets in financial instruments and securities of the index, ETFs that track the index and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index.

The index measures U.S. companies in the home construction sector that provide a wide range of products and services related to homebuilding, including home construction and producers, sellers and suppliers of building materials, furnishings and fixtures and etc.

Low Rates An Added Boost

With the expectation that the central bank will stand pat on interest rates or even cut rates, this could give NAIL an added boost. Lower mortgage rates could give the housing market a much needed boost, which could translate to more strength for homebuilders.

Rising rates, low affordability and rising homebuilder costs due to tariffs have been thorns in the side for the housing market. Last month, the central bank decided to keep interest rates unchanged.

In move that was widely anticipated by most market experts, the Federal Reserve elected to keep rates unchanged, holding its policy rate in a range between 2.25 percent and 2.5 percent. Once again, however, the rising costs of supplies could keep home prices rising, but that could be tempered if the current labor market remains robust.

“And, while homebuilders continue to show bullish signals following a strong earnings season in which big names like D. R. Horton Inc. Toll Brothers Inc. and PulteGroup, Inc. blew expectations out of the water, other indications, like plateauing housing starts, persistently high material costs, and rising inventory of existing homes could begin to put a damper on the gains seen by homebuilders at the start of the year,” Direxion added.

For more market trends, visit ETF Trends.