ETFGI, a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported today that equity-based Smart Beta ETFs and ETPs listed globally gathered net inflows of $7.38 billion during the month of January.

According to ETFGI, total assets invested in the global Smart Beta ETF and ETP industry increased 10.1%, from US$618 billion at the end of December, to US$680 billion, according to ETFGI’s January 2019 ETF and ETP Smart Beta industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- In January 2019, Smart Beta ETFs/ETPs attracted $7.38 Bn in net new assets.

- During the month, 23 Smart Beta ETFs/ETPs were launched by 19 providers.

- 36th consecutive month of net inflows into Smart Beta ETFs/ETPs.

At the end of January 2019, there were 1,322 Smart Beta classified ETFs/ETPs, with 2,404 listings, assets of $680 Bn, from 164 providers listed on 40 exchanges in 32 countries. Following net inflows of $7.38 Bn and market moves during the month, assets invested in Smart Beta ETFs/ETPs listed globally increased by 10.1%, from $618 Bn at the end of December 2018, to $680 Bn.

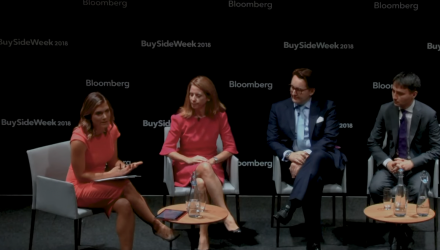

In the video below, Lars Kalbreier, chief investment officer wealth management and managing director at Vontobel Wealth Management, Vitali Kalesnik, partner at Research Affiliates, and Lorraine Sereyjol-Garros, global head of sales ETF at BNP Paribas Asset Management, sit down with Bloomberg’s Dani Burger at the Bloomberg Invest ETF Summit in London to discuss whether investors would use factor based ETFs as alternatives to traditional active investment strategies.

For more market trends, visit ETF Trends.