International Equity Trades: Russia, Mexico and Korea

Although much of the market’s attention has been zeroed in on large cap U.S. stocks (and rightly so) international markets have also found renewed footing heading into the final quarter of 2020.

Evidence of this global equity resurgence can be seen in a smattering of Direxion’s Daily Leveraged ETFs. And while the catalysts underlying the growth of each fund may differ, all three of the funds explored below offer traders the opportunity for diversified exposure to international markets, which could serve as an alternative to those afraid of heights in U.S. stocks.

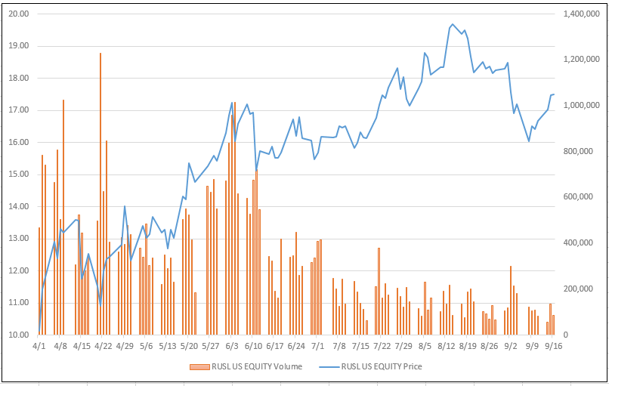

Russia Rides High On Energy and Metals

Having trended sideways through the first half of the summer, the Direxion Daily Russia Bull 2X Shares (RUSL) has shown renewed momentum through July and August, gaining about 25% from July 13th.

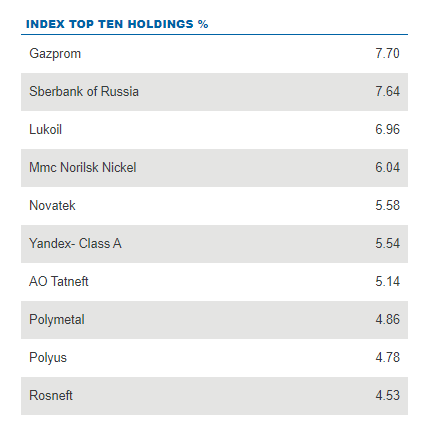

While individual stocks have contributed to the growth of RUSL in recent weeks (like internet firm Yandex, which has surged thanks to broad enthusiasm for tech stocks and its potential inclusion to the MSCI Russia Index), the broad performance of the ETF’s underlying MVIS Russia Index can be chalked up to rising natural gas and mineral prices that have benefitted the country’s vast array of energy and mining companies.

For the fund’s standardized and most recent month end performance click here www.direxion.com/etfs

Source: Bloomberg Data as of 09/09/2020. Past performance is not indicative of future returns. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

On the energy front, Russia’s two largest natural gas firms are both experiencing a resurgence in their share price thanks to a steep rebound in LNG prices of almost 50% following a July lull. State-owned Gazprom and privately-owned Lukoil have generally moved in sympathy with the fluctuating natural gas market, which in mid-August broke well above the $2.20 level it had traded under since January.

A similar picture is playing out among the nation’s mining outfits as both precious and base metals find new yearly or — in the case of gold — all-time highs. While this has moderately helped boost shares of Norilsk Nickel, whose operations include nickel and palladium mines, Russia’s main precious metal miners, Polymetal International and Polyus, have garnered the lion’s share of the growth, far surpassing their previous all-time highs.

Mexican Industrials Signal a Strong Foundation

While Russia’s recent equity resurgence has been relatively sudden, the component performance of the Direxion Daily MSCI Mexico Bull 3X Shares (MEXX) has been more measured. The ETF, which tracks the MSCI Mexico IMI 25/50 Index, rose almost 40% from its recent low in July, before early September’s selloff.

For the fund’s standardized and most recent month end performance click here www.direxion.com/etfs.

Source: Bloomberg Data as of September 9, 2020. Past performance is not indicative of future returns. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

This growth has been built on the steady path charted by a variety of companies primarily within the nation’s industrial sector. One of the key components of this sector is building materials company Cemex, which has spent much of the prior six months retaking levels it lost during the pandemic-driven sell-off in March. While still in the red for 2020, Cemex has gained about 25% since mid-July.

Other top-performers within Mexico’s industrial sector have been centered more in the transportation segment. These include mining and rail concern Grupo Mexico and airport operator Grupo Aeroportuario, each of which has risen by more than 20% since mid-July following encouraging earnings results.

In the case of the former, Grupo Mexico managed to report year-over-year earnings growth of 25% despite a small drop off in sales from the previous quarter. The airport operator, on the other hand, managed to garner investor attention by only seeing a -62.3% decline in passenger traffic in its terminals. While by no means strong, the results compare well to American air traffic statistics that show passenger traffic down by about -90% in that same period.

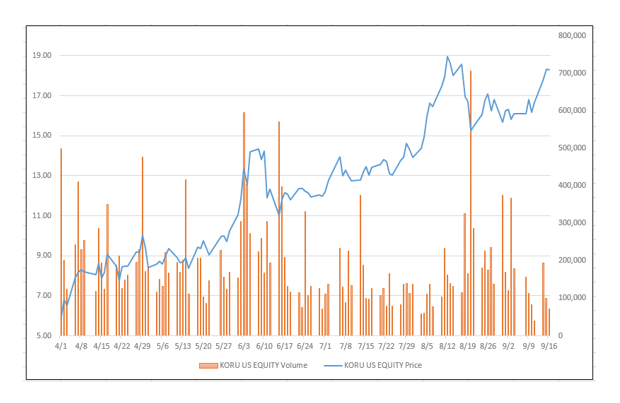

Tech and Biotech Trends Bolster South Korea

Finally, the country seeing the largest growth in equity investment in recent weeks has been South Korea. The Direxion Daily MSCI South Korea Bull 3X Shares (KORU) and its associated MSCI Korea 25/50 Index have surged through the summer months. Since mid-July KORU has climbed nearly 40% to approach 6-month highs.

For the fund’s standardized and most recent month end performance click here www.direxion.com/etfs.

Source: Bloomberg Data as of September 9, 2020. Past performance is not indicative of future returns. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Leading the charge in this growth is the nation’s array of technology and biotech firms, many of which find themselves at new 52-week highs.

Within the information technology sector, internet companies Naver Corporation and Kakao Corporation are both higher by more than 110% year-over-year thanks to the broad strength online companies have seen globally throughout 2020. And while not a pure technology play, LG Chemical, which supplies batteries for Tesla’s Model 3 electric vehicle, spiked 40% in sympathy with Tesla after the company delivered strong Q2 production numbers.

While South Korea’s tech sector is riding high on the global technology investment trend, even those results are dwarfed by the performance of the nation’s biotech firms with exposure to COVID-19 testing and treatment. South Korean biotech giants Celltrion and Samsung Biologic both experienced a 40% rally in early June following record-breaking annual revenue growth of 118% and 294%, respectively.

Celltrion’s results were supported by sales of the company’s COVID-19 testing kits as well as encouraging preclinical tests of its Covid-19 antibody treatment. The heightened investment in Samsung Biologics, on the other hand, comes as a result of its high demand as a contract manufacturer of therapeutics being used by the likes of Bristol-Myers Squibb, Roche and Vir Biotechnology in each of their COVID-19 antibody candidates.

So while domestic markets attempt to take over where they left in March, traders shouldn’t ignore the equity advances being made beyond their borders.

Investing in a Direxion Shares ETF may be more volatile than investing in broadly diversified funds. The use of leverage by an ETF increases the risk to the ETF. The Direxion Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged, or daily inverse leveraged, investment results and intend to actively monitor and manage their investment. The Direxion Shares ETFs are not designed to track their respective underlying indices over a period of time longer than one day.

RUSL as of 6/30/2020

MEXX as of 6/30/2020

KORU as of 6/30/2020

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-301-9214 or visit our website at direxioni.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Market Disruptions Resulting from COVID-19. The outbreak of COVID-19 has negatively affected the worldwide economy, individual countries, individual companies and the market in general. The future impact of COVID-19 is currently unknown, and it may exacerbate other risks that apply to the Funds.

Shares of the Direxion Shares are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 pm EST (when NAV is normally calculated) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense reimbursements or recoupments and fee waivers in effect during certain periods shown. Absent these reimbursements or recoupments and fee waivers, results would have been less favorable.

Direxion Shares Risks: An investment in the ETFs involves risk, including the possible loss of principal. The ETFs are non-diversified and include risks associated with concentration that results from an ETF’s investments in a particular industry or sector which can increase volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. The ETFs do not attempt to, and should not be expected to, provide returns which are a multiple of the return of their respective index for periods other than a single day. For other risks including leverage, correlation, daily compounding, market volatility and risks specific to an industry or sector, please read the prospectus.

Distributor: Foreside Fund Services, LLC.