By Jacob Mintz

Jacob Mintz is Chief Analyst of Cabot Options Trader and Cabot Option Trader Pro, published by Cabot Wealth Network which was founded in 1970. He was formerly a market maker for a Chicago options trading firm and lectures and coaches on options trading. Read more by him at cabotwealth.com/options

It is becoming more and more apparent that the Federal Reserve is going to be patient in raising interest rates. In fact, several high profile hedge fund managers have recently said they expect the Fed will CUT rates in 2019 or 2020.

Because of this monetary policy, it remains difficult to create yield based on savings alone.

But there is another way to create yield against your stock holdings: sell covered calls on dividend stocks.

How Covered Calls Work

A covered call is an options strategy in which the trader holds a long stock position and sells a call option on the same stock in an attempt to generate income. For every 100 shares of stock you own, you can sell one call. If you own 500 shares of stock, for instance, you can sell five calls.

A covered call is a VERY conservative strategy that requires no margin. It’s a great way to create yield and lower your cost basis on your stock position. It’s important to keep in mind there is a downside to this approach — you give up the potential for explosive upside gains, but that’s not usually likely for stable blue-chip dividend stocks and Dividend Aristocrats.

The best stocks to use this strategy on share the following characteristics:

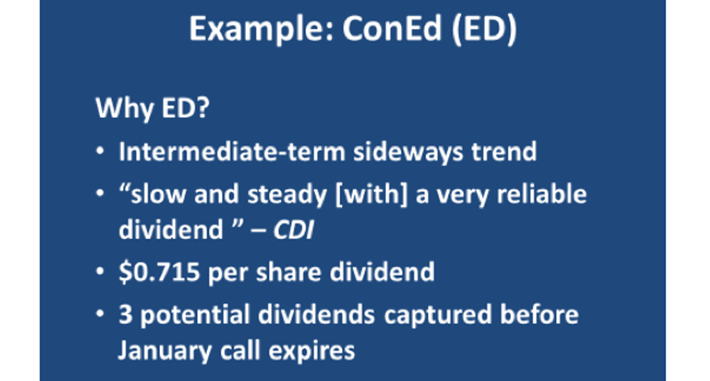

I had an opportunity to give a talk recently on covered calls. For that talk I used the example of Consolidated Edison (ED) and that’s what I’m going to use here too. At the time ED was trading at 79 so I have used that price in my analysis.

In this example we bought ED at 79, and sold the January 82.5 Call for $2.25. After the trade was executed, here is how you price the breakeven on this position:

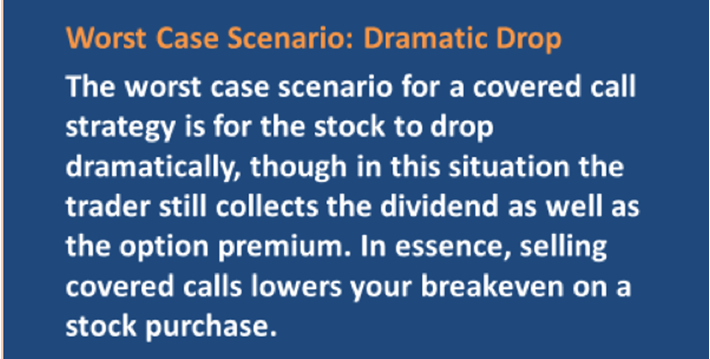

As you can see, by selling a call against a stock position, it actually drops your breakeven. It’s why this is considered a conservative strategy.

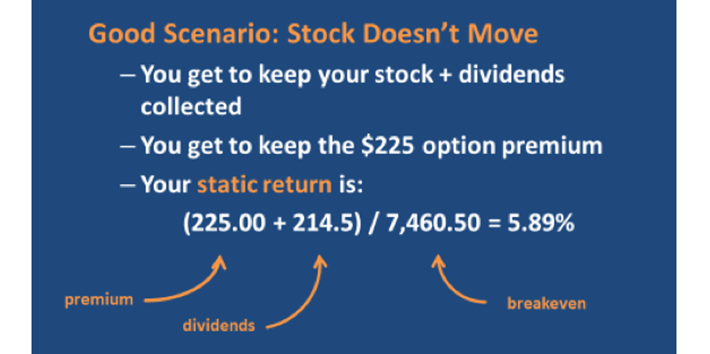

And here is the breakdown on each scenario of this trade, starting with if ED stock doesn’t move:

If ED doesn’t move, the option that you sold expires worthless, and you have collected the three dividends. I refer to this scenario as the static return.

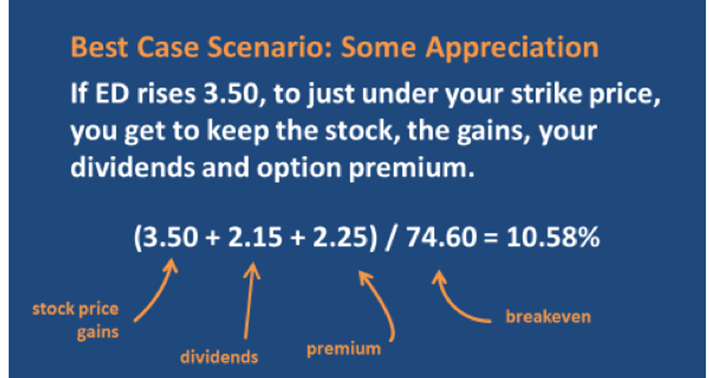

Next is the best-case scenario:

In this case you made $350 on the stock rise, collected the dividends, and the call expired worthless. And because the stock closed below the strike price of the call you sold, you keep your stock.

Here is the worst-case scenario:

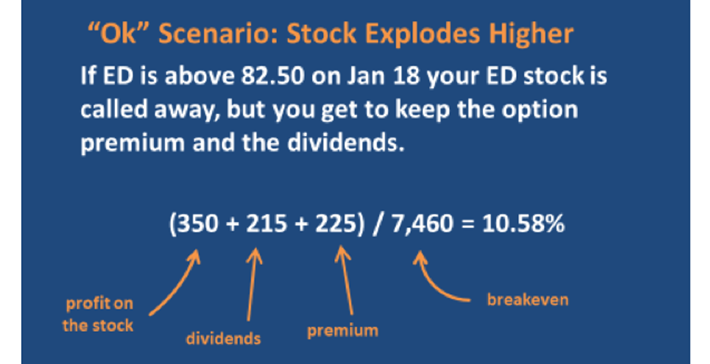

And here is the “OK” scenario:

In this scenario the stock trades above $82.5 on January expiration and the trader who bought the call from you exercises his right to buy the stock from you. You no longer own the stock. However, you have made $350 from the stock appreciation, collected the dividends, as well as the call premium. The trade worked, though you don’t own the stock anymore, and may miss out on further gains.

Virtually every investor I know has stocks in their portfolio that they have been holding for too long, and are not profiting from. Executing a covered call strategy is a great way to create income against those holdings, and should be a part of every investor’s trading repertoire.

Once you become familiar with the strategy, you can execute more covered calls. By adding this strategy to your investing arsenal, you can create more yield for your portfolio every month.

For more market trends, visit ETF Trends.