By Independent Trader via ValueWalk

The number of publicly available data increases year by year. Every day we are overwhelmed with hundreds of news, some of which have nothing to do with reality. It is worth to ask yourself whether being “up to date” with the news is the obligation for the successful investor or maybe intensive information processing brings more harm than good.

Examples from the recent weeks

At the beginning of December, the news about the trade truce between US and China has been released. According to that agreement, the plan to impose additional tariffs on Chinese goods on January 1st have been postponed for two months. Both countries gave themselves extra weeks to work out a compromise that would protect the world from negative effects of ongoing trade war.

Source: zerohedge

As you can see, everyone who has invested after the news, quickly found himself in the red.

Another example is the fake news article from January 17th containing the information that the American side of the dispute was to withdraw from some of the tarrifs imposed on the Chinese products. News led stock indexes to 1% hike. After that, it turned out that the information was fake. Ultimately, the stock market quickly returned to its original state.

Source: dif broker

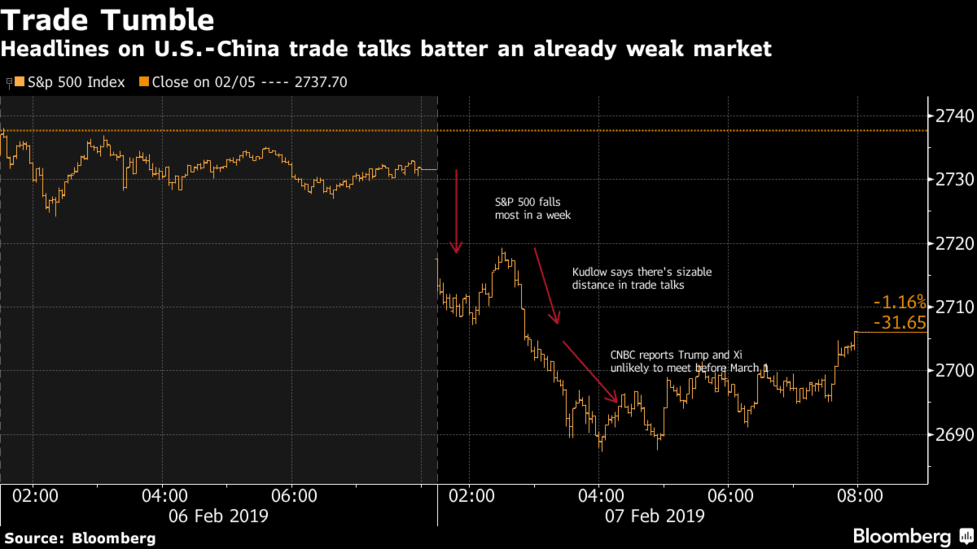

We have also experienced an interesting examples of market turbulence induced by the news during the recent days. No more than a week ago, during one session we have received a statement from Larry Kudlow that negotiations with China are far from a compromise, and later, on we have been informed that the meeting between Trump and Xi in February will likely not take place. Both news pushed shares prices down:

At this point, it is worth to remind the fact that Kudlow is the same “expert” who has been anticipating another great year for the American economy in the end of 2007. In addition, he has warned about problems with the economy in 1993. In both cases he was completely wrong.

To sum up our examples of news affecting share prices, we show below the recent case which, occured 2 days ago.

Source: zerohedge

The main reason for this price inflation was the planned deadline shift for China’s tarrifs. The same one that has already shifted at the beginning of December, as it was mentioned above.

You can go crazy, right? And let’s realize that in this case of many of these optimistic news, China press has presented US-China talks very differently.

Now think about how much time do you spend for checking what is going on. How many shallow stories have you read over the last year? How well the investors which you know react on kind of stories?

Above, we have shown you examples of situations in which people has been investing based on the news. As a result they either lost money (due to fake news) or they were two steps behind the market buying shares at higher prices, right after people or financial institutions who have had better access to information. Moreover, giving a lot of attention to the news turns even against those who do not make immediate investment decisions. Below are a few arguments in this matter.

Dobelli: Less news, more knowledge

We were inspired to write this article by Rolf Dobelli, a Swiss publicist who pay attention in his texts and speeches to the disadvantages of constantly tracking the news.