Over two years ago, VelocityShares, the exchange traded note business of the Janus Henderson Group, debuted the first suite of 4x or 400% leveraged exchange-traded products (ETPs) for the traders looking for supersized returns. How are these ETFs doing so far?

The 4x suite of ETFs are pegged to a foreign currency versus the U.S. dollar. Has strength in U.S. equities in 2019 translated to a stronger dollar versus the rest of the world’s currencies?

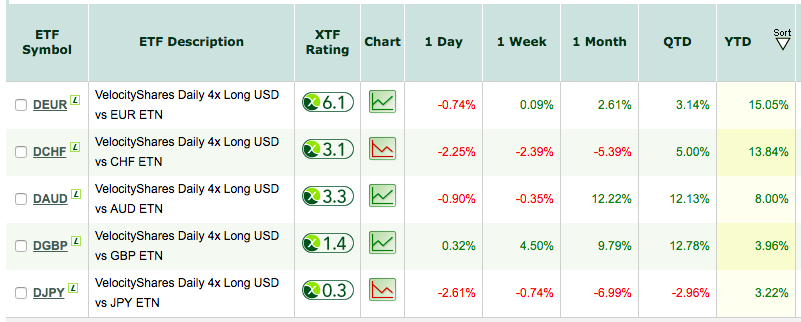

Here are the five best performers year-to-date (YTD):

VelocityShares Daily 4X Long USD vs. EUR (NYSEArca: DEUR): seeks to track the daily performance of the VelocityShares Daily 4X Long USD vs. EUR Index. The index is designed to provide 4 times leveraged exposure, reset daily, to changes in the spot exchange rate between an underlying pair of currencies consisting of the U.S. dollar and the Euro. It provides long exposure to one currency (the “long currency”) in the underlying currency pair relative to the other currency (the “reference currency”).

VelocityShares Daily 4X Long USD vs. CHF (NYSEArca: DCHF): seeks to track the daily performance of the VelocityShares Daily 4X Long USD vs. CHF Index. The index is designed to provide 4 times leveraged exposure, reset daily, to changes in the spot exchange rate between an underlying pair of currencies consisting of the U.S. dollar and the Swiss franc. It provides long exposure to one currency (the “long currency”) in the underlying currency pair relative to the other currency (the “reference currency”).

VelocityShares Daily 4X Long USD vs. AUD (NYSEArca: DAUD): seeks to track the daily performance of the VelocityShares Daily 4X Long USD vs. AUD Index. The index is designed to provide 4 times leveraged exposure, reset daily, to changes in the spot exchange rate between an underlying pair of currencies consisting of the U.S. dollar and the Australian dollar. It provides long exposure to one currency (the “long currency”) in the underlying currency pair relative to the other currency (the “reference currency”).

VelocityShares Daily 4X Long USD vs. GBP (NYSEArca: DGBP): seeks to track the daily performance of the VelocityShares Daily 4X Long USD vs. GBP Index. The index is designed to provide 4 times leveraged exposure, reset daily, to changes in the spot exchange rate between an underlying pair of currencies consisting of the U.S. dollar and the pound sterling. It provides long exposure to one currency (the “long currency”) in the underlying currency pair relative to the other currency (the “reference currency”).

VelocityShares Daily 4X Long USD vs. JPY (NYSEArca: DJPY): seeks to track the daily performance of the VelocityShares Daily 4X Long USD vs. JPY Index. The index is designed to provide 4 times leveraged exposure, reset daily, to changes in the spot exchange rate between an underlying pair of currencies consisting of the U.S. dollar and the Japanese yen. It provides long exposure to one currency (the “long currency”) in the underlying currency pair relative to the other currency (the “reference currency”).

For more market trends, visit ETF Trends.