Although markets are currently hovering around all-time highs, this year wasn’t without its share of volatility.

Whether due to trade concerns, flip-flopping monetary policy, or some cracks in economic data, traders battled through an array of bearish sentiment to push major indexes to new highs in July.

Beyond the volatility, there were some clear front runners from the first half of the year. With that in mind, let’s take a look at the top performing leveraged ETFs from Direxion and see which areas of the stock market showed the most momentum through July.

SOXL Rips

Despite a rocky first six months for computer chip and GPU manufacturers as a result of the still unresolved U.S.-China trade war, the sector as a whole still managed lead the pack, with the Direxion Daily Semiconductor Bull 3X Shares ETF (SOXL) rising 133% through YTD.

![]()

Source: Bloomberg. Date: As of 7/28/2019. Past performance is not indicative of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For standardized performance and the most recent month-end performance, click here.

Interestingly, the ETF saw $192 million in outflows in the first quarter, but saw $12 million of inflows in the second quarter (through June 30), a dramatic shift in fund flow for one of our most actively traded products.

The sector’s initial performance through 2019 was widely supported by companies throughout the industry. However, its most recent resurgence followed positive trade developments, and can be credited to strong earnings from Micron Technology and bullish commentary on Nvidia Corporation from Wedbush.

Homebuilders NAIL it.

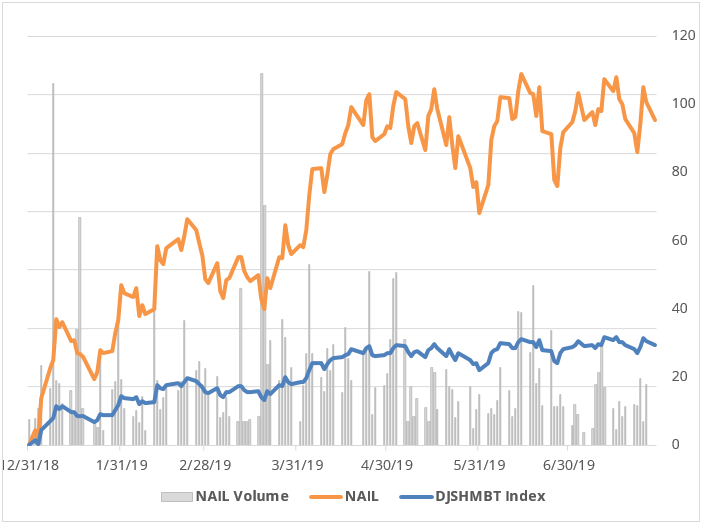

As semiconductors’ year started with extreme bouts of buying and selling, the upward trend was a homebuilders traders’ friend. You can see this in the chart for the Direxion Daily Homebuilders & Supplies Bull 3X Shares ETF (NAIL), which rose 98% YTD.

Source: Bloomberg. Date: As of 7/28/2019. Past performance is not indicative of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For standardized performance and the most recent month-end performance, click here.

NAIL’s trajectory is pretty closely mirrored by the performance of key index constituents like Lennar Corporation, D. R. Horton Inc. and PulteGroup, Inc., all of which were up over 20% YTD. On the other hand, 2019 standouts like NVR, Inc., up over 40% YTD, and Masco Corp., up 33% YTD, likely managed to elevate the ETF above some of the negative headlines that impacted the industry, like those pertaining to a slowdown in housing demand and the potential recessionary implications of that.

While these fears might spell some turbulence, other positive signals like multi-year-low mortgage rates and a likely upcoming rate cut might help homebuilders sustain their momentum through buying season and beyond.

Technology is Still King

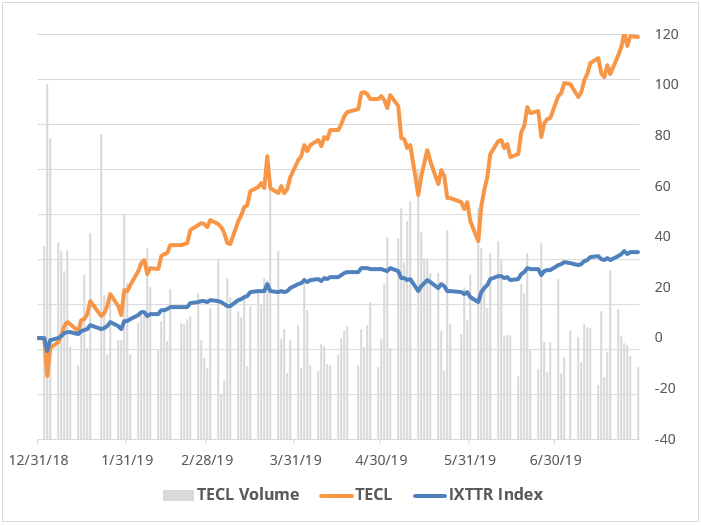

Finally, in the face of trade wars, security breaches and federal inquiries, technology has proven that it is still the market’s darling. As of the July 28 close, the Direxion Daily Technology Bull 3X Shares ETF (TECL) was up 119% YTD, making it one of the best-performing ETFs on the market YTD.

Source: Bloomberg. Date: As of 7/28/2019. Past performance is not indicative of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For standardized performance and the most recent month-end performance, click here.

Although blue chip tech names like Oracle Corporation and Microsoft Corporation have posted steady gains throughout 2019 to push the tech sector higher, the strongest performers in the Technology Select Sector Index, TECL’s corresponding index, are those with exposure to fintech. Visa, Mastercard and Paypal Holdings Inc., ended the first half of 2019 up by anywhere from 30-40%, at or near all-time highs.

While those issues mentioned at the top of the section could spell prolonged trouble for internet giants like Facebook, Inc. and Alphabet Inc., tech investors’ most pressing concern should be the slew of weak guidance from the likes of Intel Corporation, IBM, and Adobe.While these names weren’t leading the sector higher, the preponderance of weak revenue expectations could be a cue for softening growth at the core of the industry – and perhaps a leading indicator of a more widespread slowdown.

Whether you think the upward trends for these sectors and industries is the peak, or will continue into the fall trading season, Direxion Leveraged ETFs are tools to help you make bold trades on your convictions.

Related Leveraged ETF

- Direxion Daily Semiconductor Bull 3X Shares (SOXL)

- Direxion Daily Homebuilders & Supplies Bull 3X Shares (NAIL)

- Direxion Daily Technology Bull 3X Shares (TECL)

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 646-904-8818 or click here. A Fund’s prospectus and summary prospectus should be read carefully before investing.

These leveraged ETFs seek investment results that are 300% of the return of its benchmark index for a single day. The ETFs should not be expected to provide returns which are three times the return of their benchmarks’ cumulative return for periods greater than a day. Investing in a Direxion Shares ETF may be more volatile than investing in broadly diversified funds. The use of leverage by an ETF increases the risk to the ETF. The Direxion Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged investment results and intend to actively monitor and manage their investment.

Direxion Shares Risks – An investment in each Fund involves risk, including the possible loss of principal. Each Fund is non-diversified and includes risks associated with the Funds’ concentrating their investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Each Fund does not attempt to, and should not be expected to, provide returns which are three times the return of their underlying index for periods other than a single day.

SOXL Risks – Risks of the Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Aggressive Investment Techniques Risk, Liquidity Risk, Counterparty Risk, Intra-Day Investment Risk, and risks specific to the Semiconductor Industry. Companies that are in the semiconductor industry may be similarly affected by particular economic or market events, which may, in certain circumstances, cause the value of securities of all companies in the semiconductor sector of the market to decrease. Additional risks include, Daily Index Correlation/Tracking Risk and Other Investment Companies (including ETFs) Risk. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

NAIL Risks –Risks of the Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Aggressive Investment Techniques Risk, Liquidity Risk, Counterparty Risk, Intra-Day Investment Risk, Daily Index Correlation/Tracking Risk, Other Investment Companies (including ETFs) Risk, and risks specific to investment in the securities of the Consumer Good Sector, Consumer Services Industry and the Homebuilding Industry. The homebuilding industry includes home builders (including manufacturers of mobile and prefabricated homes), as well as producers, sellers and suppliers of building materials, furnishings and fixtures. Companies within the industry may be significantly affected by the national, regional and local real estate markets, changes in government spending, zoning laws, interest rates and commodity prices. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

TECL Risks –Risks of the Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Aggressive Investment Techniques Risk, Liquidity Risk, Counterparty Risk, Intra-Day Investment Risk, and risks specific to the Technology Sector. The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles. Additional risks include, Daily Index Correlation/Tracking Risk and Other Investment Companies (including ETFs) Risk. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.