After one of the most volatile summers in recent market history, traders are looking forward to the relative placidity that September historically brings (historical underperformance be damned). However, while liquidity might pick up as traders come back from their summer vacations, they’ll return to an economic environment riddled with the same headwinds that plagued traders in the summer months: trade wars, slow growth and geopolitical uncertainty.

One benefit to this continuity is that traders can look to thematic-ETFs to see where the market’s mindset has been in the past three months and get a sense of where it might be headed for the end of 2019. To that end, below are three of the top-performing ETFs from Direxion’s stable of leveraged vehicles over the past 3 months.

Trading Treasurys

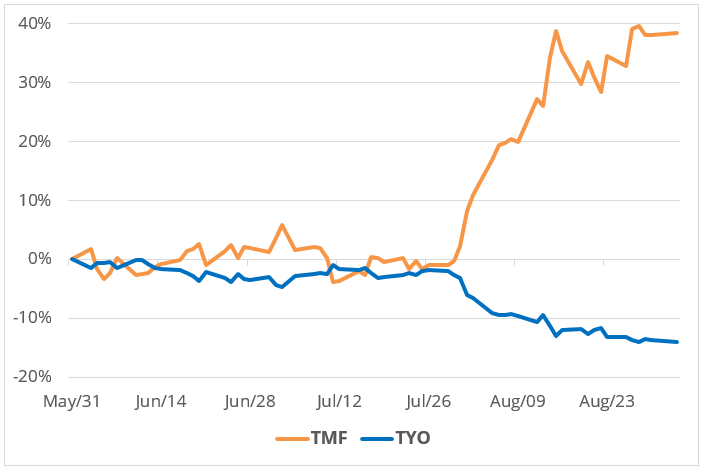

As volatility and uncertainty rises, so too does the desire for safety and predictability. This explains the summer’s stampede-like rush to fixed income investments, particularly treasury notes. The buying spree led to a craterous drop in already low yields in fixed income (since the yield on existing notes moves inverse to the value of new ones), which in turn resulted in several inversions of the 2-year and 10-year yield charts.

All of which forced the Direxion Daily 20+ Year Treasury Bull 3X Shares (TMF) to rise by 38% between June and August. The Direxion Daily 7-10 Year Treasury Bull 3X Shares (TYD) posted gains over that period, of 15%.

Source: Yahoo Finance; Data as of Sept 3, 2019. Past performance is not indicative of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For standardized performance and the most recent month-end performance, click here.

Heading into autumn, traders can likely expect more attention paid to the fixed-income market and other rate-sensitive instruments as all eyes turn to the Federal Reserve for three more planned meetings of the FOMC. Because the Fed’s current monetary policy plan seems to be “there is no plan,” traders will certainly be eager for whatever hints the Fed members might be willing to drop prior to the September, October and December meetings.

All that Glitters is Gold Miners

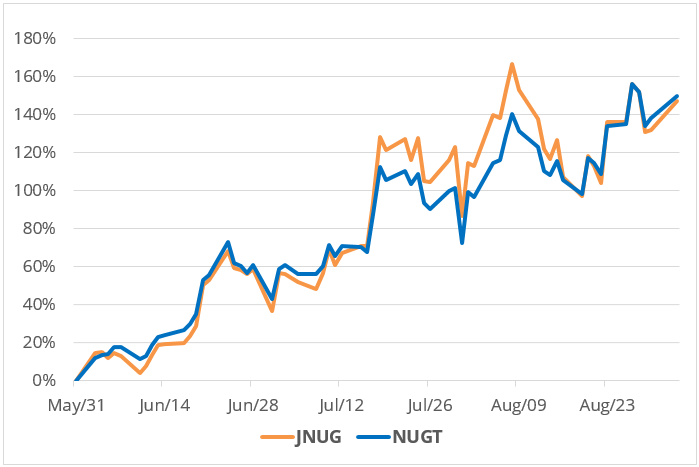

It should come as no surprise to anyone with even a passing knowledge of the precious metals markets that gold has seen a precipitous rise in value over the past three months, reaching highs it hasn’t seen since 2013, and even then, only briefly. Since the start of June, gold has climbed 20% to trade at prices it’s only held during a two-year span between mid-2011 and early-2013, during which it topped out at $1,837/oz.

This of course put gold miners in the catbird seat and propelled the Direxion Daily Gold Miners Index Bull 3X Shares (NUGT) and its junior miner counterpart the Direxion Daily Junior Gold Miners Index Bull 3X Shares (JNUG) up 121% and 114%, respectively.

Source: Yahoo Finance; Data as of Sept 3, 2019. Past performance is not indicative of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For standardized performance and the most recent month-end performance, click here.

While treasury bonds have a strong dollar to help fuel faith in the government debt instruments, the miners are essentially running higher on fear. Despite the U.S. dollar sitting near multi-year highs and a stock market that is not far removed from its own high-water mark, fear might be all they need to keep the price of the yellow metal climbing. With no sign that the U.S.-China trade war is abating, and increased evidence that the global economy is nearing a slowdown, there’s no shortage of anxiety on display in the financial markets.

Bearish Energy

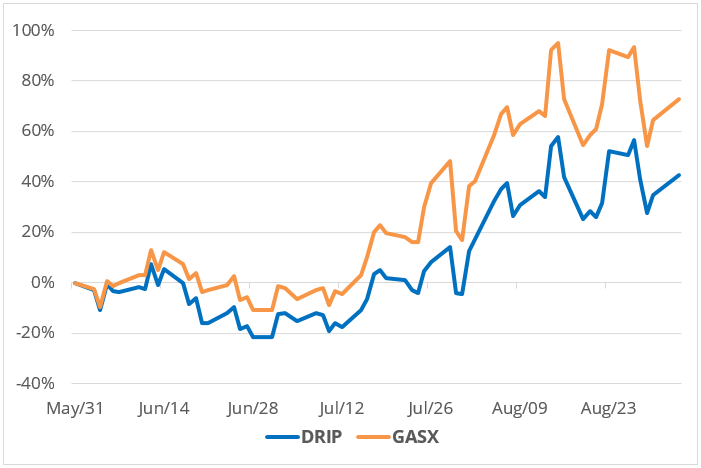

If traders have rediscovered their love for gold, they’ve also uncovered a new-found aversion to everything energy. Oil prices have hobbled through 2019, mostly due to the twin anchors of high supply and low demand. However, beyond simply oil, energy markets overall have been burdened with a global glut, and none more so than the liquified natural gas industry, which has seen prices fall to a more than 15-year low.

As a result, the Direxion Daily S&P Oil & Gas Exp. & Prod. Bear 3X Shares (DRIP) gained 47% percent during summer 2019, while the Direxion Daily Natural Gas Related Bear 3X Shares (GASX) was up 77% over that same period.

Source: Yahoo Finance; Data as of Sept 3, 2019. Past performance is not indicative of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For standardized performance and the most recent month-end performance, click here.

While continued efforts from OPEC and OPEC-sympathetic nations like Russia to curb the oversupply of oil may stabilize prices, demand looks to remain anemic thanks to the ongoing tensions in global trade and high production from the U.S. The story is similar for LNG, however, prices typically do show increased signs of life as the colder weather sets in on the northern hemisphere.