Traders have to be basking in the latest volatility as the U.S.-China trade war looks like it could be a protracted one. As far as which sectors to look at when it comes to opportunities, it appears technology is still king.

“In the face of trade wars, security breaches and federal inquiries, technology has proven that it is still the market’s darling,” wrote Direxion Investments in their latest “Xchange” blog post.

Technology has been a hot-button issue during the U.S.-China trade war drama, which is causing a healthy dose of volatility within the sector. While this might unnerve the majority of investors not used to these stomach-churning market movements, it’s been a boon for traders looking for leveraged technology ETF plays.

Just when the capital markets were responding positively to the 25-basis point rate cut by the Federal Reserve, U.S. President Donald Trump’s imposition of tariffs sent the markets back down. Trump’s announcement that a 10 percent tariff would be applied to another $300 billion worth of Chinese goods, effective Sept. 1, sent the major indexes on a rollercoaster last week.

If that wasn’t enough, China responded with their own tariffs, causing the Dow Jones Industrial Average to experience losses of over 950 points on Monday before settling for a 767-point decline.

As the protracted trade war continues, new issues come to the forefront like currency manipulation.

China dropped the price of their currency to an almost a historic low. It’s called “currency manipulation.” Are you listening Federal Reserve? This is a major violation which will greatly weaken China over time!

— Donald J. Trump (@realDonaldTrump) August 5, 2019

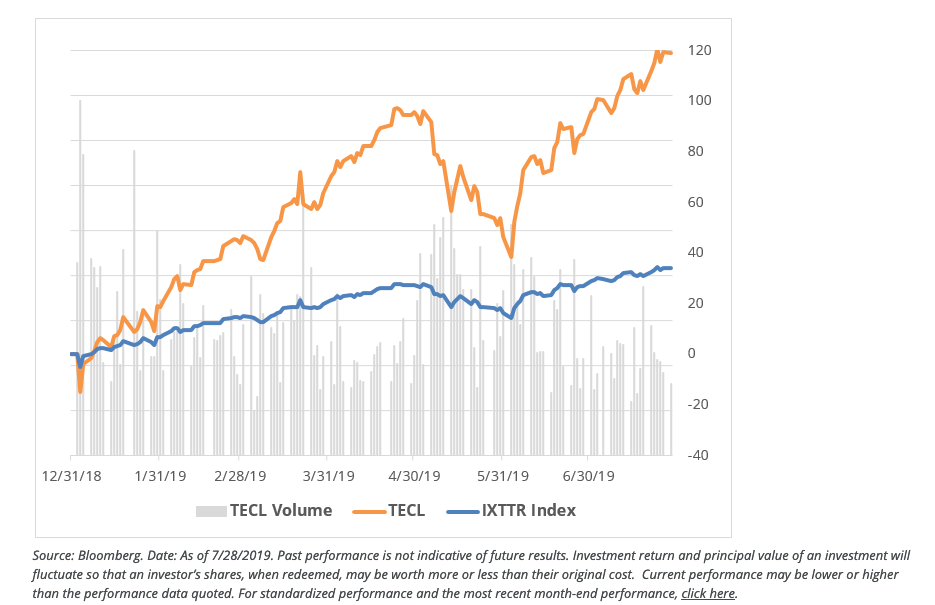

ETF traders can use the volatility for opportunities in the Direxion Daily Technology Bull 3X ETF (NYSEArca: TECL) as well as the Direxion Daily Technology Bear 3X ETF (NYSEArca: TECS). So far, it’s the bulls who are charging through 2019 with gusto via a 79.46 percent year-to-date gain versus a 53.83 percent loss for TECS and the bears.

TECL seeks daily investment results, before fees and expenses, of 300% of the daily performance of the Technology Select Sector Index. The index includes domestic companies from the technology sector.

“As of the July 28 close, the Direxion Daily Technology Bull 3X Shares ETF (TECL) was up 119% YTD, making it one of the best-performing ETFs on the market YTD,” Direxion Investments wrote.

TECS seeks daily investment results, before fees and expenses, of 300% of the inverse (or opposite) of the daily performance of the Technology Select Sector Index. The index is provided by S&P Dow Jones Indices and includes domestic companies from the technology sector.

For more market trends, visit ETF Trends.