As economies around the world continue to recover amidst a Covid-19 vaccine rollout, the S&P 500 has gained over 8% in the past few months. This is helping bullish traders using the Direxion Daily S&P 500® Bull 3X Shares ETF (SPXL).

Traders’ aversion to bearishness has been apparent as of late in what’s been a lack of short interest in ETFs, according to a recent Bloomberg article.

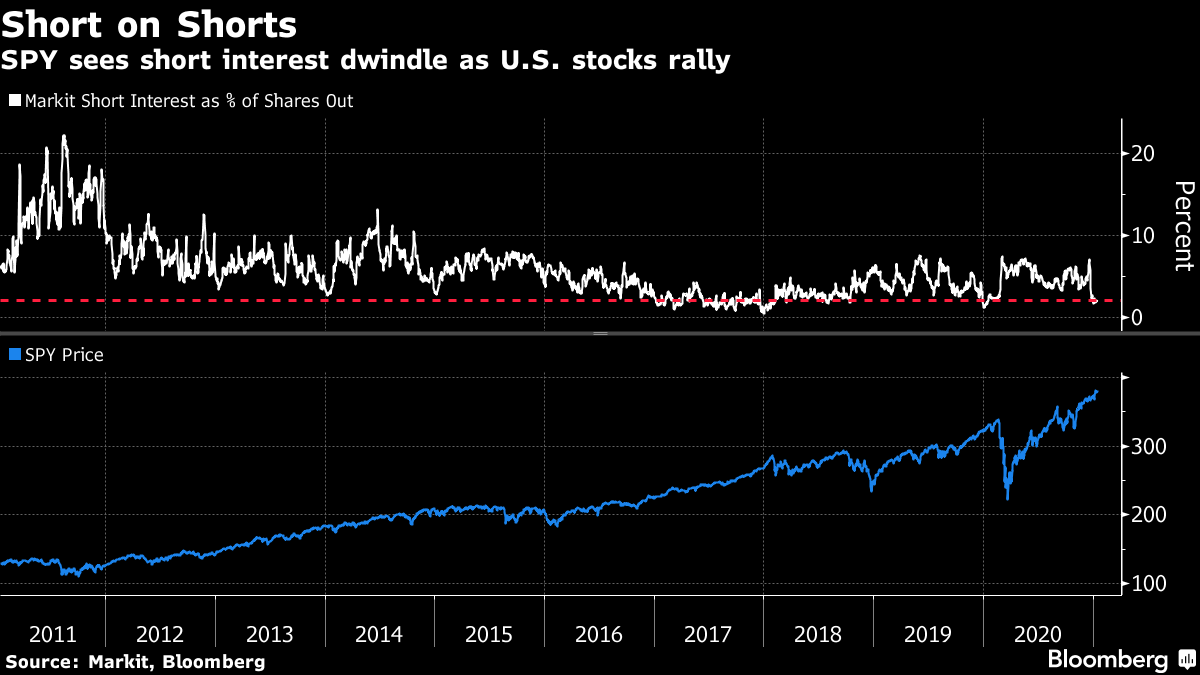

“Bets against the world’s largest exchange-traded fund have plunged back to pre-pandemic levels seen about a year ago, before the onset of the fastest stock bear market in history,” the Bloomberg report noted. “Fueled by vaccine hopes and reflationary signals, short interest in the $334 billion SPDR S&P 500 ETF Trust (SPY) now sits at just 2% of shares outstanding, according to IHS Markit Ltd. data.”

“Barring melt-ups in 2017 and early 2020, these levels have rarely been seen over the past decade,” the report added.

Traders can lebverage S&P 500 strength with SXPL. The fund seeks daily investment results equating to 300% of the daily performance of the S&P 500® Index.

SXPL, under normal circumstances, invests at least 80% of its net assets (plus borrowing for investment purposes) in financial instruments, such as swap agreements, and securities of the index, ETFs) that track the index and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index.

SPXL has jumped 25% over the past three months.

For Investors, Growing Faith in a Stock Recovery

The confluence of events leading to the rally is certainly underscoring investors’ renewed faith in the stock market. As the Bloomberg article noted, a lack of short interest only confirms that notion.

“Falling short interest generally indicates growing faith in a stock rally because it suggests holders are unwilling to lend out the shares they own or that demand to borrow and bet against them has dropped,” the article said. “Still, as speculative mania engulfs Wall Street from Tesla Inc. and Bitcoin to call options, vanishing shorts may be seen as yet-another sign of market complacency.”

“First-quarter euphoria has taken hold,” said Peter Chatwell, head of multi-asset strategy at Mizuho. “The second quarter’s likely massive growth rebound is viewed as sufficient to protect equity markets against downside in the coming months.”

For more news and information, visit the Leveraged & Inverse Channel.