IceCap Global outlook for the month of February 2019, titled, “The Surprise Party”

Your closest friends, family and loved ones become giddy with excitement of the thought and hope of springing the ultimate surprise on you during your very special day.

Appreciated only by the surprise planners is all of the work put into planning the perfect moment to make your heart race, your eyes widen and your smile stretch to maximum lengths.

Surprise parties can also produce an unwelcomed surprise.

These are the parties where the intended surprise is nothing like the actual surprise.

In the financial world today, nearly 40 years of continuously declining long-term interest rates, combined with 10 years of zero and negative interest rates, added to 10 years of money printing, 10 years of growing zombie banks and lifetimes of governments overspending, is very close to launching the ultimate surprise party.

The question of course – will it be a happy, champagne supernova party? Or will the party produce the ultimate financial surprise?

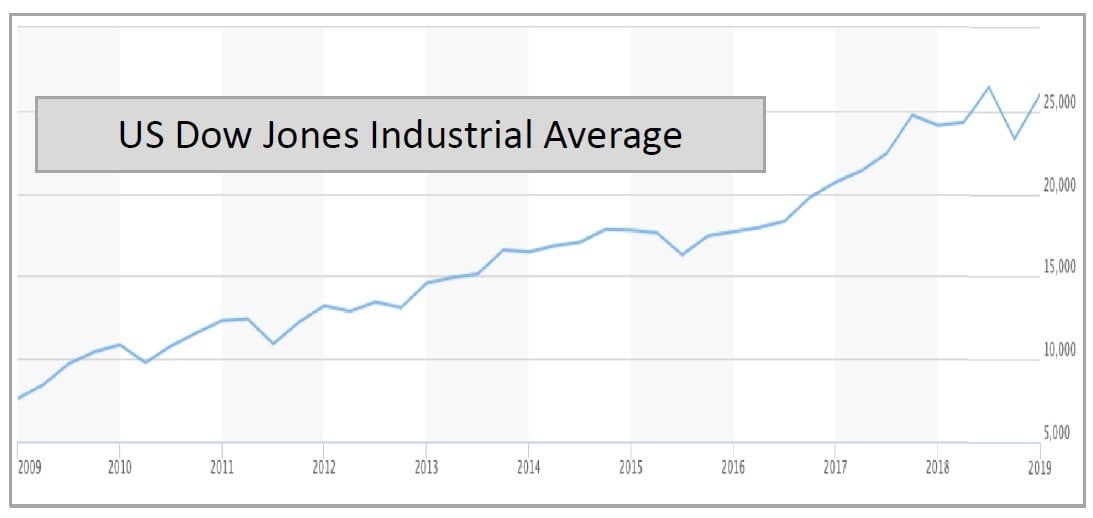

Understand, everyone in the world will be attending this party – you have no choice. And those who are smart and prepared will actually have a really nice time. Everyone else will not. February 2019 The Surprise Party US Dow Jones Industrial Average

Markets

Unless you’ve been off-grid, all investors know by now that recent market movements have been generating those eye-ball scratching, media-dreaming headlines emblazed with horrific words including CRASHING, DEVASTATING, and PLUMMETING.

With these headlines generated by real news networks, surely it must be true and it should give you a cause for concern.

However, as the brain works in different ways, sometimes it’s better to visualize these CRASHING, DEVASTING, and PLUMETTING markets.

Here’s a chart showing the US Dow Jones Industrial Average – we ask you to spot the CRASHING.

No worries if you cannot see the CRASHING – we can’t see it either.

Hard to see…

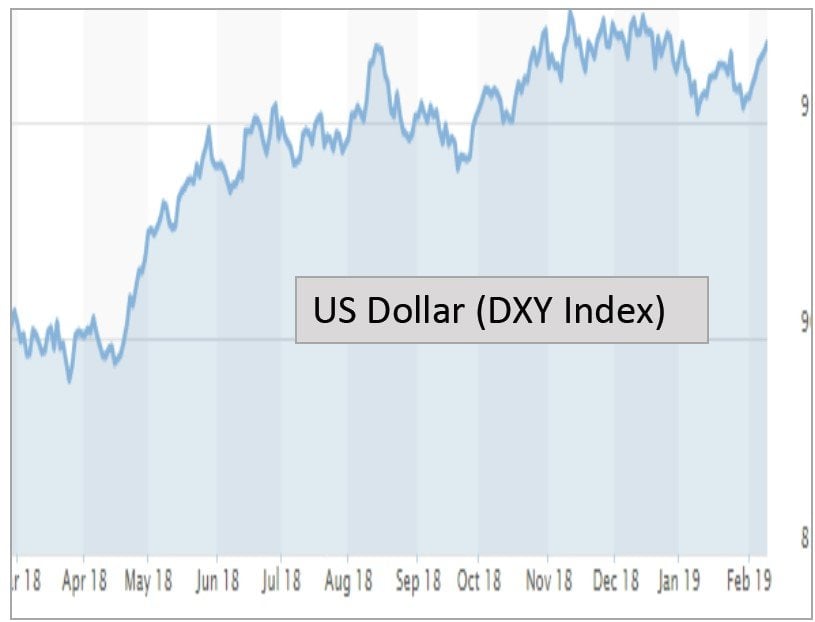

Next, considering the US Federal Reserve completely reversed its course on interest rate hikes AND the government in Washington fought and bickered over the budget – then obviously the US Dollar should be crashing as well.

Here’s a chart showing the US Dollar – this time, we ask you to spot the DEVASTATION:

No worries if you cannot see the DEVASTATION – we can’t see it either.

And then we have the hysteria created by the gold bulls – or gold bugs as they dislike to call each other.

In the minds of these shining investment experts, Gold Bullion is now surging higher than a kite and will once again (any day now) soar into the stratosphere.