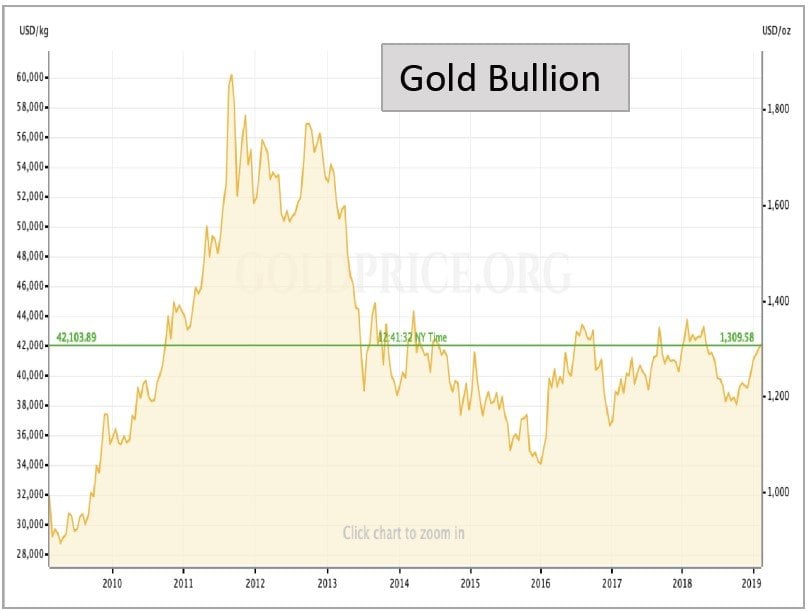

Here’s a chart showing Gold – try to spot the SURGING and SOARING:

No worries if you cannot see this either.

Don’t read headline news

So, just to be clear:

- Stocks are not crashing

- US Dollar is not plummeting

- Gold is not surging

Naturally, we know these factual and truthful observations are hurting the feelings of many investors.

After all, we know of investment managers who have been completely out of the stock market for the last 6 years. And with stocks declining sharply on Christmas Eve – these managers were absolutely [prematurely]popping the cork.

Gold investors too have been taking it on the chin for a few years now. And every single time the shiny rock bounces from lower lows, it’s inevitable for them to email me with anecdotes over their investment precognitions. No doubt the current bounce convinced these investors too, to pop the corks over their recent success.

And then we have the single, most important investment in the world today – the USD.

And due to a myriad of reasons – it is also the most hated currency in the world. Seemingly every investment expert, novice and weekend warrior has developed a spectacularly strong dislike for the greenback. This dislike is borderline impractical, unhealthy and most importantly – unrealistic.

Seemingly everyone agreed – with stocks declining aggressively, with President Trump shutting down the federal government and not reaching any trade deals with China, and with the Federal Reserve putting a complete halt to interest rate hikes – the USD was about to hit the fan and splatter from sea to shining sea.

But it didn’t.

We like to remind investors that today’s financial markets have been overwhelmingly influenced, supported and simultaneously suppressed by 10 years of unorthodox, never-before-tried, and fantasy-like monetary policies by the world’s biggest central banks.

At IceCap we have consistently communicated that this environment has started to unravel, and the result will be a crisis across bonds, currencies and interest rates that will drive enormous amounts of foreign capital to seek safety in the USD.

THIS is why, despite the current sharp movements in many markets – the USD fails to crash as the majority expect.

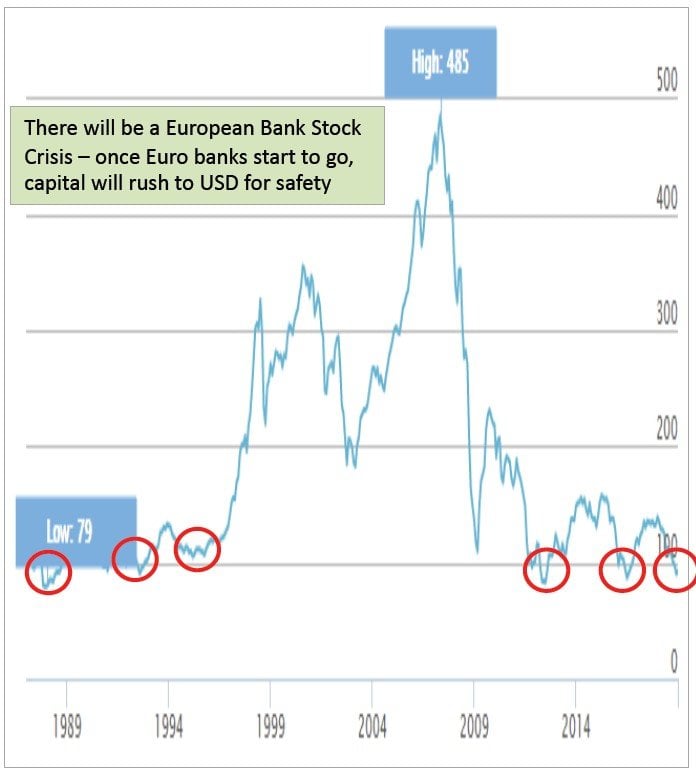

Something else that catches our eye and should catch EVERYONE’S eye is the performance of European bank stocks.

Chart next page shows the performance of European bank stocks.

In a normal functioning economy, banks do VERY well.

Read the full article here by IceCap Asset Management

For more market trends, visit ETF Trends.