How can you seek risk-adjusted performance and increase diversification without additional capital? By seeking returns that are 125% of their benchmark index for a single day, PortfolioPlus ETFs may provide long-term investors the tools for more efficient deployment of capital.*

SCENARIO

Market conditions have caused you to consider adding diversification to your portfolio and protect against volatility. Although you believe that further diversification would be a benefit, you don’t have the luxury of additional capital to invest in order to maintain your core position.

SOLUTION: EFFICIENT USE OF CAPITAL STRATEGY

PortfolioPlus ETFs, with their additional 25% daily exposure to broad based indexes, enable investors to add diversification to a portfolio while maintaining equivalent exposure to your original allocation. By employing leverage to free up capital, proceeds can be invested into non-correlating assets.

HERE’S A PRACTICAL APPLICATION OF THIS STRATEGY

By adding investments that have little or no correlation to existing portfolios, returns may potentially be improved and volatility may be decreased. PortfolioPlus ETFs can provide an effective solution by bringing the investment leverage needed to execute this strategy when additional capital is not available.

STRATEGY IN ACTION

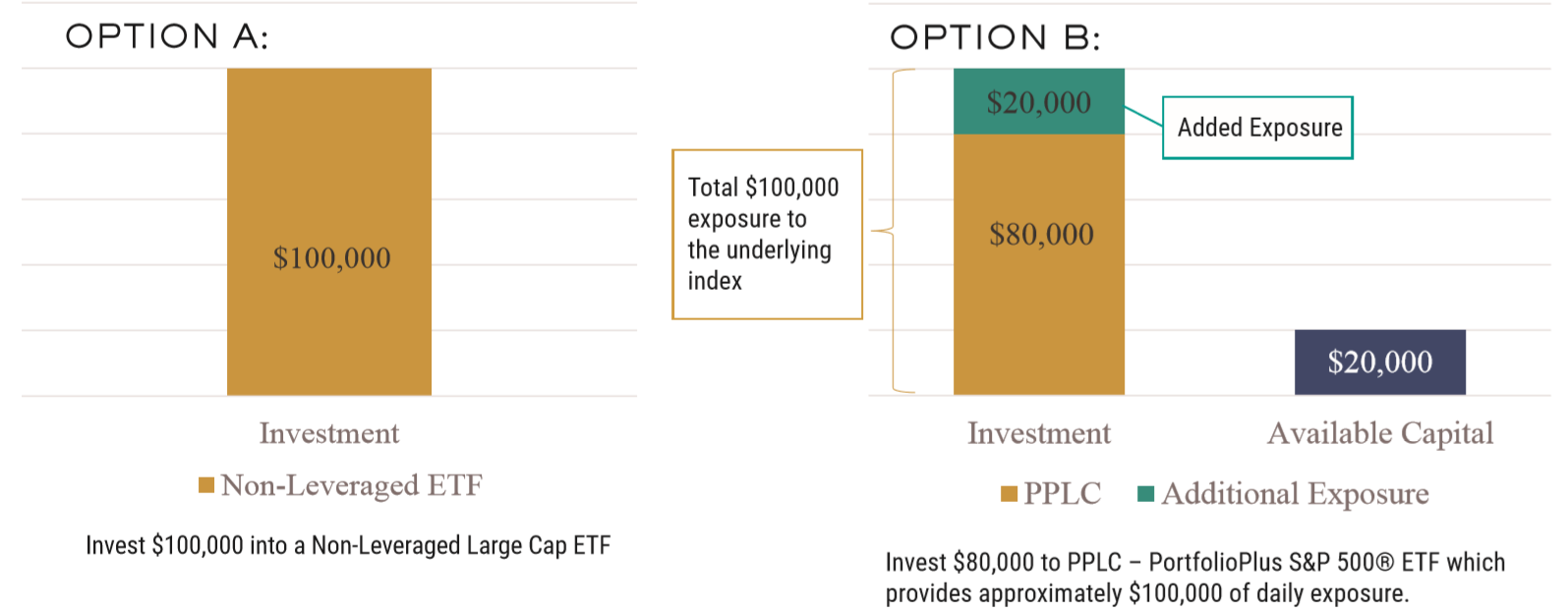

Scenario: Investor would like to apply a percentage of a $100,000 large-cap allocation to an alternative asset class, while maintaining her exposure to large cap equities.

![]()

By allocating just $80,000 to PPLC – PortfolioPlus S&P 500® ETF, $20,000 becomes available for investment in non-correlating asset classes to seek greater portfolio diversification. It’s that simple.

*MAGNIFIED RETURNS MAY BE POSITIVE OR NEGATIVE.

PortfolioPlus ETFs seek returns that are 125% the return of their benchmark indexes for a single day. The funds should not be expected to provide 1.25 times the return of their benchmarks’ cumulative return for periods greater than a day. Investing in PortfolioPlus ETFs may be more volatile than investing in broadly diversified funds. Compounding affects all investments, but has more impact on leveraged funds, particularly during periods of higher index volatility and longer holding periods. Due to periods of negative compounding caused by index volatility, a fund’s return may be negative in the same period that its index’s return is flat or positive. PortfolioPlus ETFs are intended to be used by investors who understand leverage risk and the effects of compounding, and intend to monitor their portfolios.

STRATEGY BENEFITS

- Maintain original core portfolio exposure

- Add diversification without additional capital

- More efficient allocation of investment capital: instead of spending 100% of investment dollars to get 100% market exposure, just 80% percent can be used to get the same exposure with PPLC

- Provides potential for greater return and reduced volatility (dependent on investment selection)

TAKE AWAYS

- By utilizing a PortfolioPlus ETF in an Efficient Use of Capital strategy, assets may be invested in a manner that potentially increases diversification, lowers volatility and increases the total return of a portfolio.

- Investing in securities or strategies that have a low correlation to the market (commodities, utilities, real estate, precious metals, etc.) may help provide more consistent returns that are less dependent on the performance of the equity market.

- Investors can maintain existing exposure to their portfolios while freeing up capital to invest in other investments or strategies.

If you focus primarily on broad asset diversification and long-term risk premium capture with little focus on short-term market movements, PortfolioPlus ETFs combine the benefits of passive indexing with leverage and the potential to outperform the markets.

DISCLOSURES