Beverage names make up about 25 percent of the funds, with household products making up the second largest weighting at 20 percent. The five largest holdings as of the end of November are Procter Gamble (11.99 percent), Coca-Cola (10.44 percent), Phillip Morris (9.65 percent), PepsiCo (9.49 percent), and Walmart (7.59 percent).

Not every name in the index has been strong of late, of course. But with a general sense of uncertainty gripping markets right now, it appears the volatility will continue through the end of the year. If that were to happen we can expect a flight to defensive names in this sector, bringing with it an opportunity for traders.

Technicals

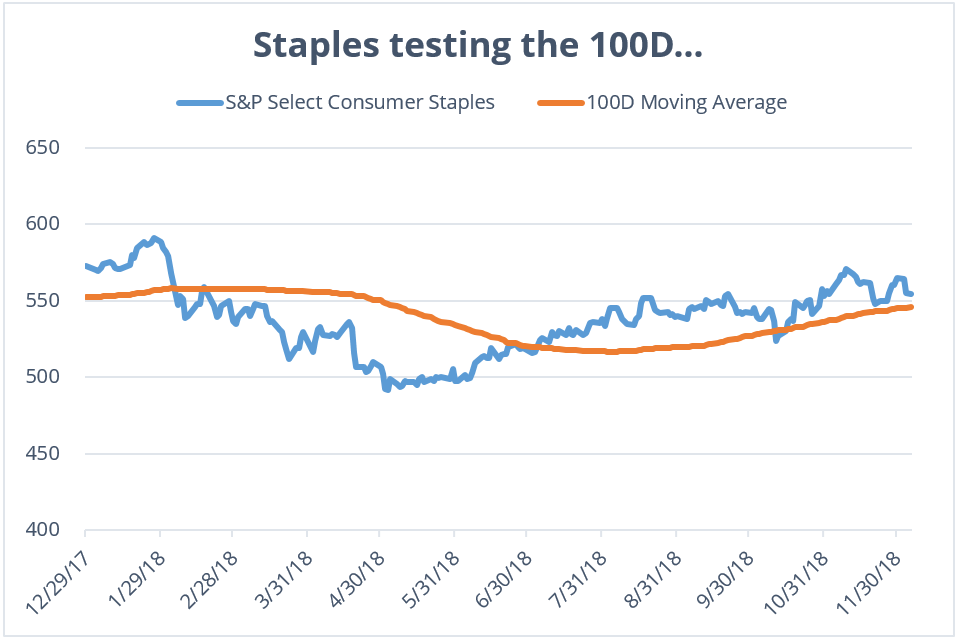

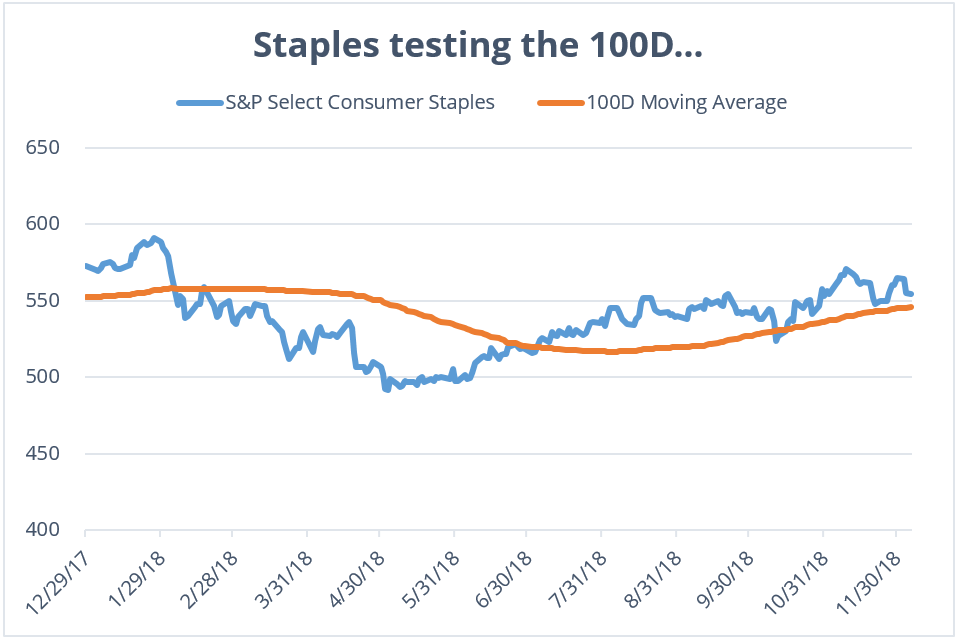

The S&P Select Consumer Staples Index tested the 100-Day moving average intraday on December 6th, but closed notably off the session lows. Technical traders may believe that this means the consumer staples basket is trading near a pivotal level. An upside move off of a support level can be magnified with the NEED. Traders seeking to capitalize on a breakdown of this longer term support, may consider LACK.

Data Range: 12/29/2017 – 12/6/2018. Source: Bloomberg. The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost; current performance may be lower or higher than the performance quoted. For standardized performance and the most recent month-end performance, click here.

Related Leveraged ETFs

Each leveraged ETF seeks investment results that are 300% of the return of its benchmark index for a single day. Each Fund should not be expected to provide returns which are three times the return of benchmark’s cumulative return for periods greater than a day. Investing in a Direxion Shares ETF may be more volatile than investing in broadly diversified funds. The use of leverage by a Fund increases the risk to the Fund. The Direxion Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged investment results and intend to actively monitor and manage their investment.

NEED/LACK Risks – An investment in each Fund involves risk, including the possible loss of principal. Each Fund is non-diversified and includes risks associated with the Funds’ concentrating their investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Each Fund does not attempt to, and should not be expected to, provide returns which are three times the return of their underlying index for periods other than a single day. Risks of each Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Counterparty Risk, Intra-Day Investment Risk, risks specific to the Consumer Staples Sector, for the Direxion Daily Consumer Staples Bull 3X Shares, Daily Index Correlation/Tracking Risk and Other Investment Companies (including ETFs) Risk, and for the Direxion Daily Consumer Staples Bear 3X Shares, Daily Inverse Index Correlation/Tracking Risk, and risks related to Shorting and Cash Transactions. Consumer staples companies are subject to government regulation affecting their products which may negatively impact such companies’ performance. The consumer staples sector may also be adversely affected by changes or trends in commodity prices, which may be influenced or characterized by unpredictable factors. Please see the summary and full prospectuses for a more complete description of these and other risks of each Fund.

Consumer Staples Select Sector Index (IXRTR) – Provided by S&P Dow Jones Indices and includes domestic companies from the consumer staples sector which includes the following industries: food and staples retailing; household products; food products; beverages; tobacco; and personal products. One cannot directly invest in an index.