“Make no mistake, bond investors in China are betting that more forceful stimulus is in the offing,” Spiro added.

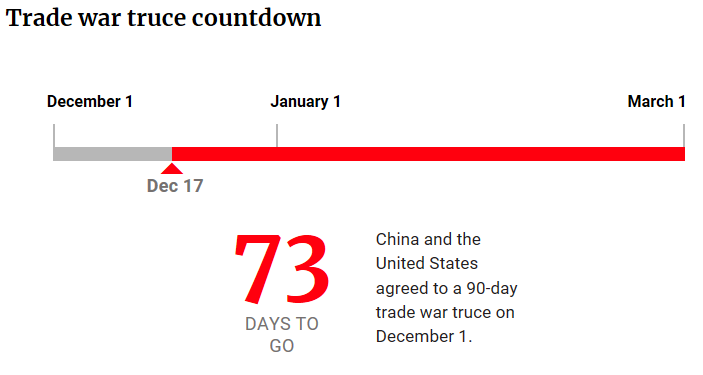

Day 17 of Ceasefire

U.S. President Donald Trump and Chinese president Xi Jinping agreed to cease fire on their tariff-for-tariff battle. The truce reached at the G-20 Summit didn’t quell investor fears as markets in the U.S. and China have been fretting on the notion that a trade deal can only materialize after lengthy discussions between the two economic superpower. Furthermore, contentious topics like forced technology transfer and intellectual property could derail negotiations.

Trump and Jinping met at the G-20 Summit in Buenos Aires, putting global markets on pause as the two economic superpowers met to hopefully ameliorate their trade differences. As part of the agreement, both nations agreed to withhold imposing further tariffs on each other for 90 days while they work out a firm, ironclad deal.

With the clock ticking and 17 days into the truce, the markets have been reaching for any type of media olive branch thrown its way in the form of positive news. However, if trade negotiations continue to progress to a point where a final, tangible trade deal with permanence is the byproduct, then YINN traders will obviously feel the benefits.

For more market trends, visit ETF Trends.

For more market trends, visit ETF Trends.