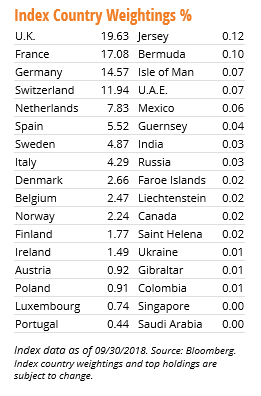

Looking at the fact sheet for EURL, the U.K. presents a large portion of its holdings so the 21-month transition could be a tenuous time for investors, depending on how smooth the transition takes place. Of course, with Brexit being such a large undertaking, a seamless transition could be immediately excluded from the equation.

“This is just about as bad as it could possibly be,” said former Foreign Secretary Boris Johnson. “What you’ve got is not only the U.K. remaining within the (EU) customs union forever and a day, so we can’t really do free trade deals to take back control of our laws. We remain in a regulatory alignment with the EU, accepting EU rules but unable to shape them.”

“This is just about as bad as it could possibly be,” said former Foreign Secretary Boris Johnson. “What you’ve got is not only the U.K. remaining within the (EU) customs union forever and a day, so we can’t really do free trade deals to take back control of our laws. We remain in a regulatory alignment with the EU, accepting EU rules but unable to shape them.”

With May getting the approval from the Cabinet, the EU Commission is expected to make the draft publicly available and for the sake of brevity, a much shorter declaration that outlines future security and economic Britain relations with the EU. In addition, the remaining member states in the EU will discuss the possibility of planning an emergency summit this month to sign off on the deal.

Ultimately, it will come down to the backing by the Parliament, which the BBC reported could take place in early December. For the risk averse trader, they might want to shy away from EURL, but for those who don’t mind the forthcoming volatility, EURL could be an interesting play as the Brexit saga unfolds.

For more market trends, visit ETF Trends.