Last month, oil continued its serendipitous climb following U.S. President Donald Trump ending waivers on companies wishing to purchase Iranian oil without facing stiff sanctions. The companies affected most by the waivers were China, Greece, India, Italy, Japan, South Korea, Taiwan and Turkey.

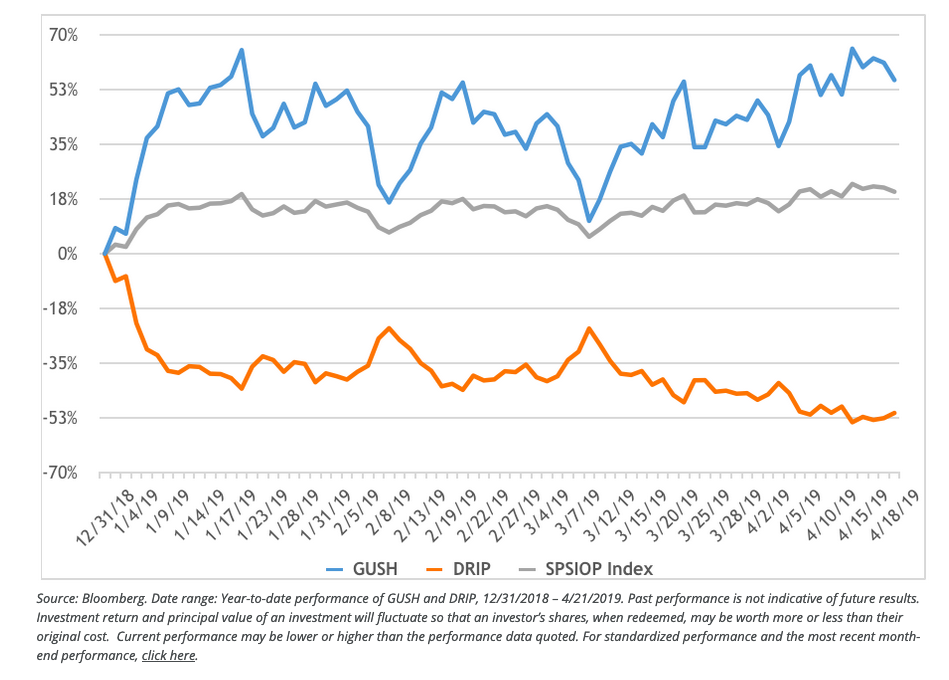

Since then, oil prices have been going through the proverbial roof with exchange-traded funds benefiting from the gains. Leveraged-inverse exchanged-traded funds (ETFs) to play: United States 3x Oil (NYSEArca: USOU), ProShares UltraPro 3x Crude Oil ETF (NYSEArca: OILU) and the Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 3X Shares (NYSEArca: GUSH).

Oil faces a number of possible headwinds, but thus far, it’s been ignoring these risks.

“Oil & Gas bears may point to concerns stemming from the potential for a global recession, as Europe grapples with a slowdown and continues to deal with the uncertainties of Brexit,” a Direxion post noted. “During the Global Financial Crisis, the oil demand fell of the table in a relatively short period. Don’t forget that trade negotiations between the US and China still loom. If discussions break down, oil demand could drop not just because of less physical trade, but also because of possible broader negative impact on the global economy. Also, because oil is priced in US dollars, if the greenback continues to rise, it could put negative pressure on prices.”

Global investment bank RBC Capital Markets is expecting more increases in oil prices, going as far as saying that crude could reach the $80 price level this summer. Overall, RBC Capital Markets is forecasting Brent crude prices to average $75 for 2019–up from a previous 2019 forecast of $69.50 per barrel.

Furthermore, their outlook for U.S. West Texas Intermediate crude rose from $61.30 per barrel to $67 for 2019.

“We see price risk asymmetrically skewed to the upside spurred by geopolitically infused rallies that could shoot prices toward or even beyond our high-end, bull-case scenario and test the $80/bbl mark for intermittent periods this summer,” RBC strategists Michael Tran, Helima Croft and Christopher Louney said in a research note.

Fears of a global economic slowdown are also weighing on the minds of oil traders. After the U.S. central bank kept interest rates unchanged last month, Federal Reserve Chairman Jerome Powell said that “we’ve noted some developments at home and around the world that bear our close attention.”

That dovishness has translated into more cautious investors who are unwilling to dial up the risk with respect to capital allocation. A global economic slowdown could also keep oil prices in check with the prospect of weaker demand.

For more market trends, visit ETF Trends.