Amid the hand wringing over whether the U.S. and China are coming closer together or further apart on a trade deal, a dark horse has emerged in sector investing that seems immune to the cyclic boom and bust of this headline-driven market.

That underdog is homebuilders. Compared to tumultuous year in tech, semiconductor, and industrial markets, the Direxion Daily Homebuilders & Supplies Bull 3X Shares (NAIL) has quietly chugged along to produce one of the most consistently positive charts in Direxion’s stable of leveraged thematic ETFs.

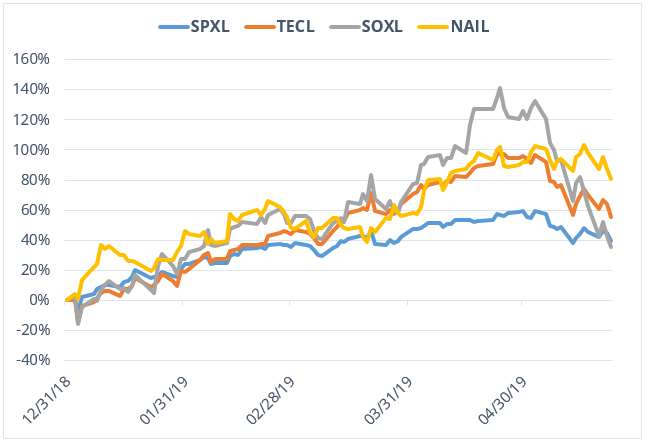

Take a look at this year-to-date chart comparing NAIL to the tech-heavy Direxion Daily Technology Bull 3X Shares (TECL) and Direxion Daily Semiconductor Bull 3X Shares (SOXL), two of Direxion’s other top performing ETFs of 2019.

Source: Bloomberg. Date range: 12/31/2018 – 5/31/2019. Past performance is not indicative of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For standardized performance and the most recent month-end performance, click here.

Although both TECL and SOXL have reached much higher peaks this year, they have also cratered fairly significantly two or three times. NAIL, on the other hand, has moved higher at a fairly consistent rate, trading sideways through March before resuming an upward climb as the rest of the market continued to waver into the spring.

And, while homebuilders continue to show bullish signals following a strong earnings season in which big names like D. R. Horton Inc. Toll Brothers Inc. and PulteGroup, Inc. blew expectations out of the water, other indications, like plateauing housing starts, persistently high material costs, and rising inventory of existing homes could begin to put a damper on the gains seen by homebuilders at the start of the year.

While real estate will likely remain in demand through the summer building (and buying) months, another area to consider are rental properties in the form of REITs.

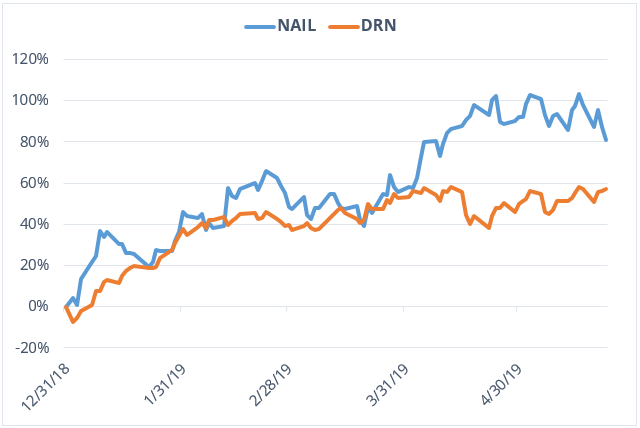

Take a look at the solid gains being made in the Direxion Daily MSCI Real Estate Bull 3X Shares (DRN) against NAIL.

Source: Bloomberg. Date range: 12/31/2018 – 5/23/2019. Past performance is not indicative of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For standardized performance and the most recent month-end performance, click here.

While certainly less impressive than NAIL’s astounding performance, DRN has at times outpaced the highflying homebuilders through 2019. And, with May’s recent headwinds, the two ETFs are neck-and-necak on the year as two of Direxion’s best performing ETFs.

And with top components like industrial REIT Prologis Inc, data center REIT Equinix, Inc. and medical REIT Welltower Inc. each receiving a host of “Buy” and “Outperform” ratings from the likes of Goldman Sachs, BMO and Raymond James in the wake of stellar first-quarter earnings, it may not be a question of commercial or residential real estate, but commercial and residential real estate.

Related Leveraged ETFs

- Direxion Daily Homebuilders & Supplies Bull 3X Shares (NAIL)

- Direxion Daily Technology Bull 3X Shares (TECL)

- Direxion Daily Semiconductor Bull 3X Shares (SOXL)

- Direxion Daily MSCI Real Estate Bull 3X Shares (DRN)

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 646-569-9363 or click here. A Fund’s prospectus and summary prospectus should be read carefully before investing.

This leveraged ETF seeks investment results that are 300% of the return of its benchmark index for a single day. The ETF should not be expected to provide returns which are three times the return of its benchmark’s cumulative return for periods greater than a day. Investing in a Direxion Shares ETF may be more volatile than investing in broadly diversified funds. The use of leverage by an ETF increases the risk to the ETF. The Direxion Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged investment results and intend to actively monitor and manage their investment.

NAIL Risks – An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and include risks associated with the Fund concentrating its investments in a particular industry, sector, or geography which can increase volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause its price to fluctuate over time. The Fund does not attempt to, and should not be expected to, provide returns which are three times the performance of its underlying index for periods other than a single day. Risks of the Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Aggressive Investment Techniques Risk, Liquidity Risk, Counterparty Risk, Intra-Day Investment Risk, Daily Index Correlation/Tracking Risk, Other Investment Companies (including ETFs) Risk, and risks specific to investment in the securities of the Consumer Good Sector, Consumer Services Industry and the Homebuilding Industry. The homebuilding industry includes home builders (including manufacturers of mobile and prefabricated homes), as well as producers, sellers and suppliers of building materials, furnishings and fixtures. Companies within the industry may be significantly affected by the national, regional and local real estate markets, changes in government spending, zoning laws, interest rates and commodity prices. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

TECL Risks – An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and includes risks associated with the Fund concentrating its investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. The Fund does not attempt to, and should not be expected to, provide returns which are three times the return of its underlying index for periods other than a single day. Risks of the Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Aggressive Investment Techniques Risk, Liquidity Risk, Counterparty Risk, Intra-Day Investment Risk, risks specific to the Technology Sector. The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles. Additional risks include Daily Index Correlation/Tracking Risk and Other Investment Companies (including ETFs) Risk. Please see the summary and full prospectuses for a more complete description of these and other risks of each Fund.

SOXL Risks – An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and includes risks associated with the Fund concentrating its investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. The Fund does not attempt to, and should not be expected to, provide returns which are three times the return of its underlying index for periods other than a single day. Risks of the Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Aggressive Investment Techniques Risk, Liquidity Risk, Counterparty Risk, Intra-Day Investment Risk, and risks specific to the Semiconductor Industry. Companies that are in the semiconductor industry may be similarly affected by particular economic or market events, which may, in certain circumstances, cause the value of securities of all companies in the semiconductor sector of the market to decrease. Additional risk include Daily Index Correlation/Tracking Risk and Other Investment Companies (including ETFs) Risk. Please see the summary and full prospectuses for a more complete description of these and other risks of each Fund.

DRN Risks – An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and includes risks associated with the Fund concentrating its investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. The Fund does not attempt to, and should not be expected to, provide returns which are three times the performance of its underlying index for periods other than a single day. Risks of the Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Aggressive Investment Techniques Risk, Liquidity Risk, Counterparty Risk, Intra-Day Investment Risk, risks specific to investment in the securities of the Real Estate Sector. Real estate securities are subject to risks similar to those associated with direct ownership of real estate, including changes in local and general economic conditions, vacancy rates, interest rates, zoning laws, rental income, property taxes, operating expenses and losses from casualty or condemnation. Additional risks include Daily Index Correlation/Tracking Risk and Other Investment Companies (including ETFs) Risk. Please see the summary and full prospectuses for a more complete description of these and other risks of each Fund.