How can you seek to take advantage of specific economic or market conditions, when you have conviction they will boost returns?

By seeking returns that are 125% of their benchmark index for a single day, PortfolioPlus ETFs may provide long-term investors the tools to overweight specific portfolio holdings.*

SCENARIO

Domestic fiscal policies have caused you to consider a greater allocation to U.S stocks. Although you believe there is an opportunity to outperform, you don’t have additional capital to invest, and don’t want to underweight any of your other core positions.

SOLUTION: OVERWEIGHT STRATEGY

PortfolioPlus ETFs, with their additional 25% exposure to broad based indexes, enable investors to overweight an asset class or sector in a portfolio while maintaining equivalent exposure to your original allocation. By employing leverage, an investor can gain greater exposure to specific performance streams, without the need for more capital.

HERE’S A PRACTICAL APPLICATION OF THIS STRATEGY

By allocating to PortfolioPlus ETFs, in lieu of single beta index ETFs, returns may be magnified to seek greater performance. PortfolioPlus ETFs can provide an effective solution by bringing the investment leverage needed to execute this strategy when additional capital is not available.

STRATEGY IN ACTION

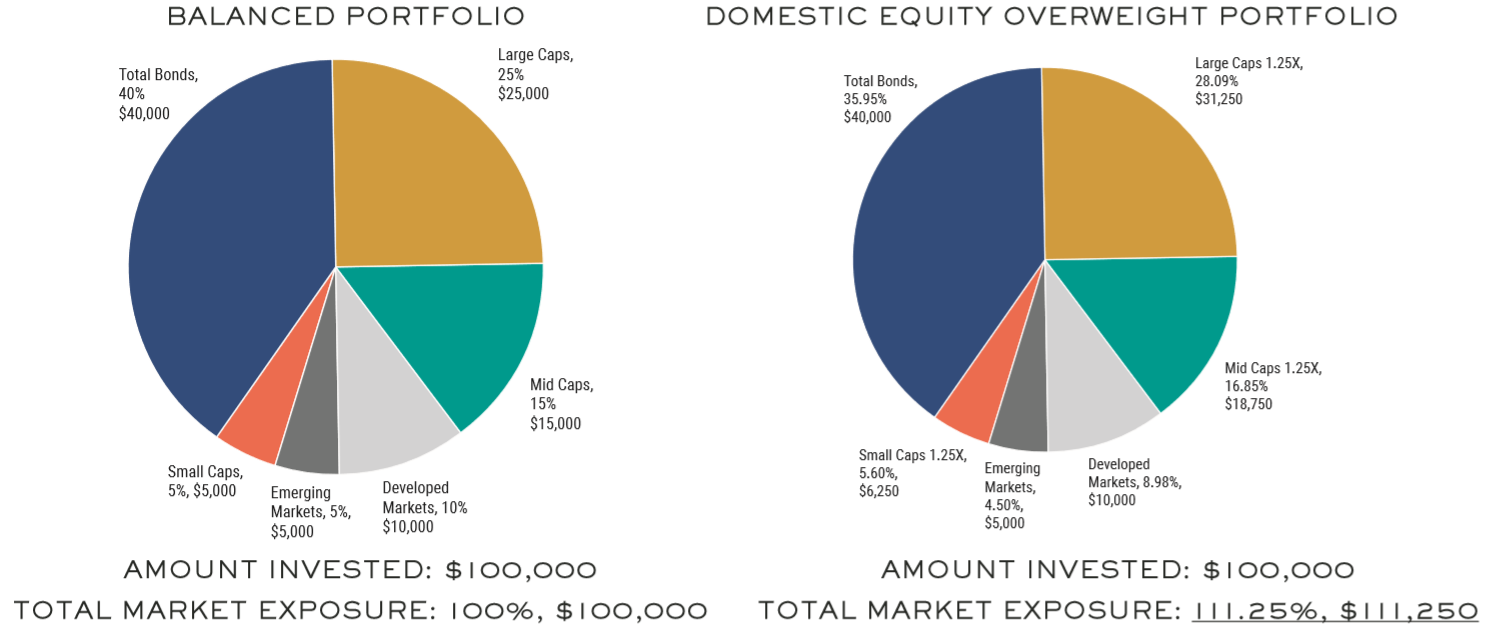

Scenario: An investor would like to gain additional domestic equity exposure in a $100,000 portfolio, while maintaining his exposure current exposure to other asset classes.

![]()

By allocating the same $45,000 to PPLC (PortfolioPlus S&P 500® ETF), PPMC (PortfolioPlus S&P Mid Cap® ETF) and PPSC (PortfolioPlus S&P Small Cap® ETF) – the investor is able to obtain an additional $11,250 worth of exposure to U.S. stocks – a total of $56,250 in total. It’s that simple.

*MAGNIFIED RETURNS MAY BE POSITIVE OR NEGATIVE.

PortfolioPlus ETFs seek returns that are 125% the return of their benchmark indexes for a single day. The funds should not be expected to provide 1.25 times the return of their benchmarks’ cumulative return for periods greater than a day. Investing in PortfolioPlus ETFs may be more volatile than investing in broadly diversified funds. Compounding affects all investments, but has more impact on leveraged funds, particularly during periods of higher index volatility and longer holding periods. Due to periods of negative compounding caused by index volatility, a fund’s return may be negative in the same period that its index’s return is flat or positive. PortfolioPlus ETFs are intended to be used by investors who understand leverage risk and the effects of compounding, and intend to monitor their portfolios.

STRATEGY BENEFITS

- Maintain original exposure amounts to other asset classes (fixed income and international equities).

- Additional exposure to domestic equities without having to raise additional capital.

- More efficient allocation of investment capital: get 100% exposure using 80% of the capital.

- Provides potential for greater returns.

TAKE AWAYS

- By utilizing a PortfolioPlus ETF in an Overweight strategy, assets may be invested in a manner that increases exposure, and potentially increases the total return of a portfolio.

- Investors can achieve additional levels of exposure to magnify returns (positively or negatively) in a cost-effective, transparent, liquid structure, in order to help their portfolios work harder.

If you focus primarily on broad asset class diversification and long-term risk premium capture with little focus on short-term market movements, PortfolioPlus ETFs combine the benefits of passive indexing with leverage and the potential to outperform the markets.

DISCLOSURES