Earnings week can exhibit bouts of volatility that make it ripe for traders, but those who want long-term exposure to popular broad-based markets sans the jet-fueled leverage of 200% or 300% of an index can opt for Portfolio Plus ETFs by Direxion to get that dash of extra exposure on a daily basis.

For traders who are accustomed to using 2x and 3x leverage, heavy doses of volatility for buy-and-hold investors might have them hesitant to jump back into these products. Portfolio Plus ETFs can still give these investors the extra exposure that they seek, but the added downside protection with less exposure.

“Spikes in volatility levels can impact returns on a fund’s portfolio,” Direxion noted in an article. “The relatively low leverage point (1.25X) for PortfolioPlus ETFs provides less impact of negative compounding than highly leveraged ETFs, making them potentially more suitable for long-term investors.”

The Suite of ETFs come in five different flavors to cater to the type of exposure investors are seeking. Of course, the added benefit is the extra 25% exposure to capture that extra gain should the markets turn in the investors’ favor.

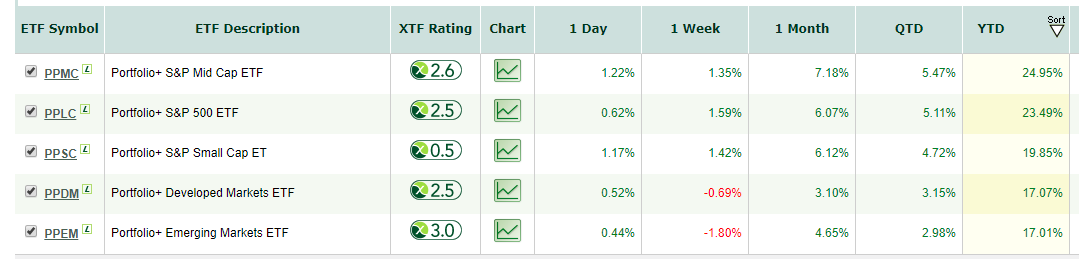

Thus far in 2019, all of them have been stellar performers.

Chart via XTF.com as of April 29, 2019.

- PortfolioPlus S&P Mid Cap ETF (NYSEArca: PPMC): PMC seeks daily investment results equal to 125% of the daily performance of the S&P Mid Cap 400® Index. The fund, under normal circumstances, invests at least 80% of its net assets (plus borrowing for investment purposes) in equities in the index, exchange-traded funds (“ETFs”) that track the index and other financial instruments that provide daily leveraged exposure to the index. The index measures the performance of 400 mid-sized companies in the United States.

- PortfolioPlus S&P 500 ETF (NYSEArca: PPLC): PPLC seeks daily investment results that equate to 125% of the daily performance of the S&P 500® Index. The fund, under normal circumstances, invests at least 80% of its net assets (plus borrowing for investment purposes) in securities of the index, exchange-traded funds (“ETFs”) that track the index and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index The index is a float-adjusted, market capitalization-weighted index.

- PortfolioPlus S&P Small Cap ETF (NYSEArca: PPSC): PPSC seeks daily investment results that comprise 125% of the daily performance of the S&P SmallCap 600® Index. The fund, under normal circumstances, invests at least 80% of its net assets (plus borrowing for investment purposes) in securities of the index, exchange-traded funds (“ETFs”) that track the index and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index. The index measures the performance of 600 small-capitalization companies in the U.S. It is a float-adjusted market capitalization weighted index.

- PortfolioPlus Developed Markets ETF (NYSEArca: PPDM): PPDM seeks daily investment results equal to 125% of the daily performance of the FTSE Developed All Cap ex US Index. The fund, under normal circumstances, invests at least 80% of its net assets (plus borrowing for investment purposes) in equities in the index, exchange-traded funds (“ETFs”) that track the index and other financial instruments that provide daily leveraged exposure to the index. The index is a market-capitalization weighted index representing the performance of large-, mid- and small-capitalization companies in developed markets, excluding the USA.

- PortfolioPlus Emerging Markets ETF (NYSEArca: PPEM): PPEM seeks daily investment results equal to 125% of the daily performance of the FTSE Emerging Index. The fund, under normal circumstances, invests at least 80% of its net assets (plus borrowing for investment purposes) in equities in the index, exchange-traded funds (“ETFs”) that track the index and other financial instruments that provide daily leveraged exposure to the index. The index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets.

For more market trends, visit ETF Trends.