Since 1997, Direxion has been providing investment solutions with their innovative ETFs and 20 years later, they have $13.4 billion worth of assets under management.

If you haven’t already, check out the 5 ETFs below that are trending this week – and are worth keeping an eye on during the second half of 2018.

Related: Direxion Adds Bullish Innovative Tech ETF Play

1. Direxion Daily S&P Biotech Bull 3X ETF (NYSEArca: LABU)

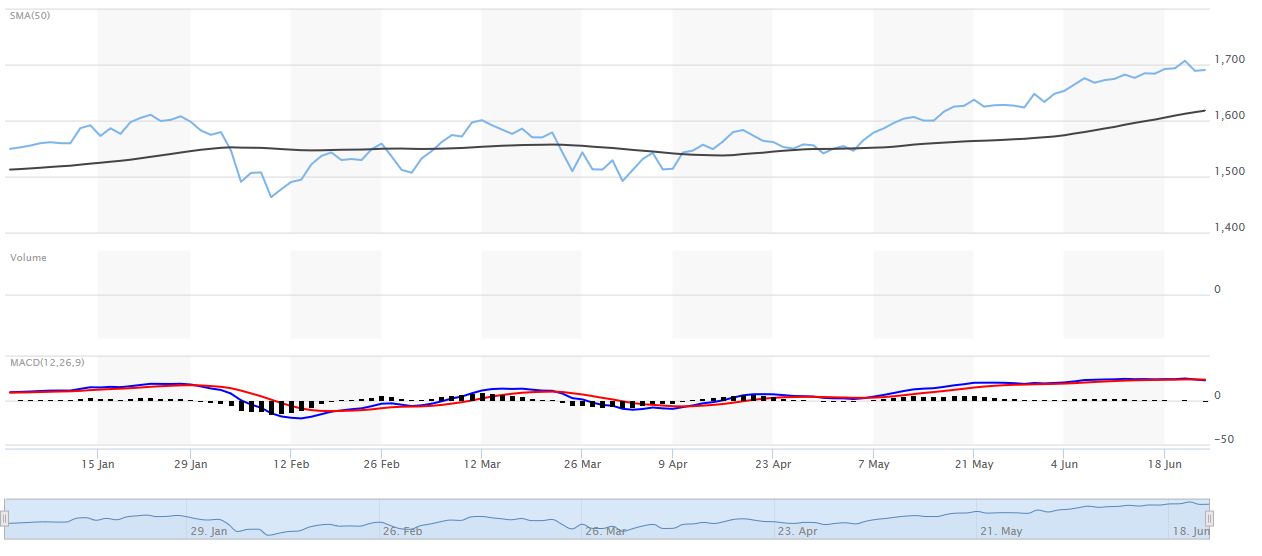

Despite all the talk regarding trade wars with the United States and China, one sector that has been shrugging off the market noise is the biotechnology sector. The NASDAQ Biotechnology Index has been well above its simple 50-day moving average as evidenced in the chart below:

![]()

According to Sylvia Jablonski, Managing Director and Institutional ETF Strategist for Direxion, the continued performance in this sector is due to a mix of “favorable public policy for drug makers, increased research and development, as well as pre-approvals and approvals on various drugs.” As such, LABU, which seeks 300% of the daily performance of the S&P Biotechnology Select Industry Index, has been performing admirably–up 124.91% in the past year and up 25.33% year-to-date.

2. Direxion Daily Small Cap Bull 3X ETF (NYSEArca: TNA)

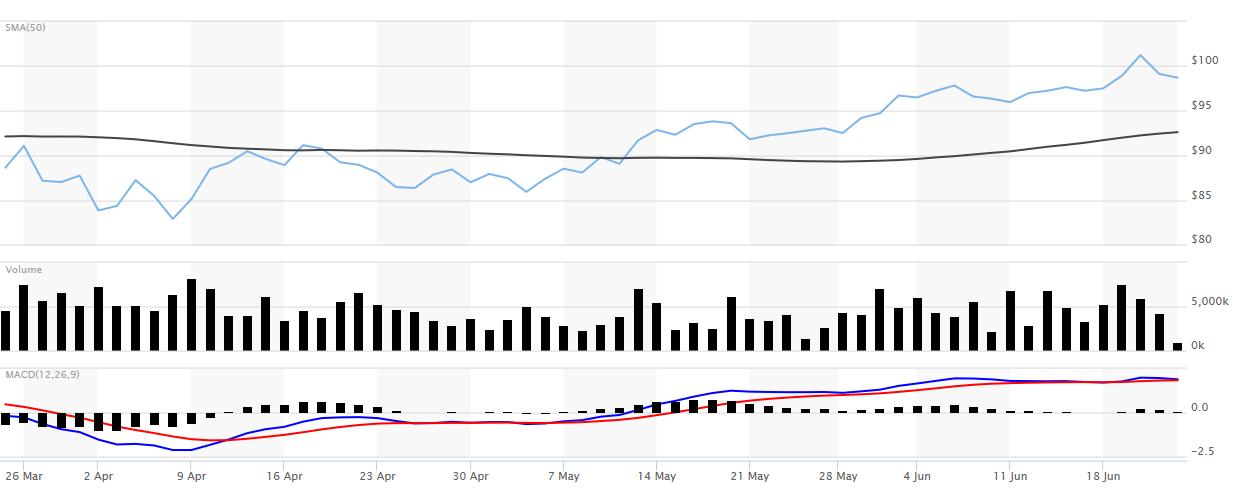

Unfortunately, emerging markets have felt the shrapnel of the market explosions coming from the tariff-for-tariff battle between the U.S. and China, but TNA’s small cap focus precludes this market with no international exposure. TNA seeks 300% of the daily performance of the Russell 2000 Index, which is also above its 50-day simple moving average.