The results have been favorable with TNA up 15.54% year-to-date and up 60% in the past year.

3. Direxion Dly S&P Oil&Gs Ex&Prd Bl 3X ETF (NYSEArca: GUSH)

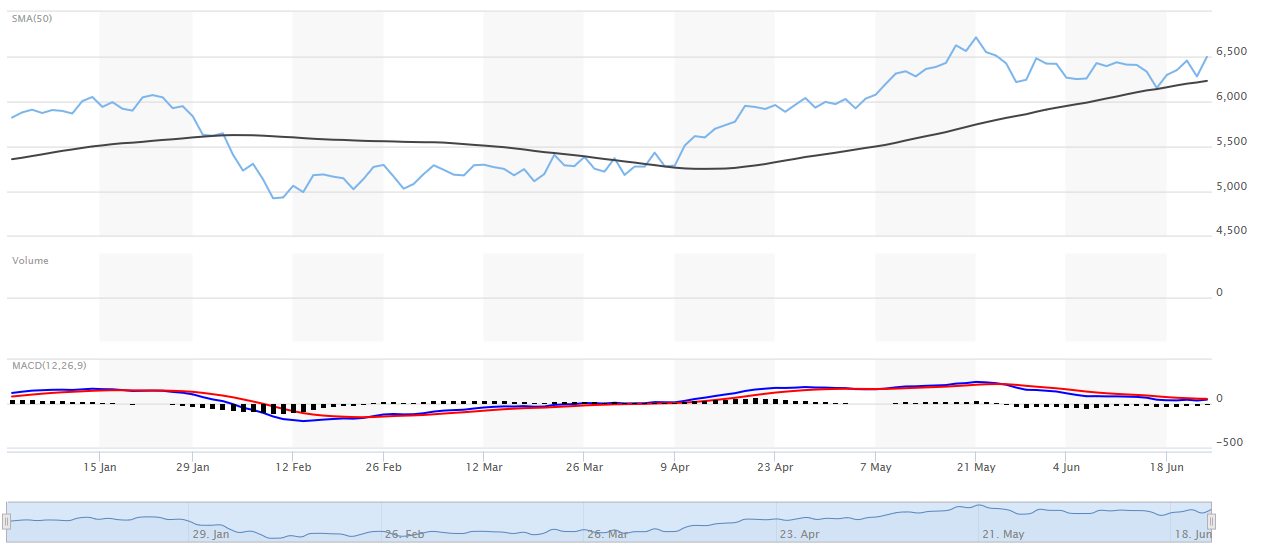

Oil has been in the news lately with the recent announcement by OPEC to raise its output. GUSH aims to seek 300% of the daily performance of the S&P Oil & Gas Exploration & Production Select Industry Index, which is on an upward trajectory relative to its simple moving average in the past few months.

![]()

GUSH has been a beneficiary of the oil production increase within the past year with its year-to-date performance up 28.86% and 71.54% total return in the past year. According to Jablonski, things look even better in the months ahead.

GUSH has been a beneficiary of the oil production increase within the past year with its year-to-date performance up 28.86% and 71.54% total return in the past year. According to Jablonski, things look even better in the months ahead.

“Oil and gas trading sentiment is picking up with a potential warm summer ahead,” said Jablonski.

4. Direxion Daily Nat Gas Rltd Bull 3X ETF (NYSEArca: GASL)

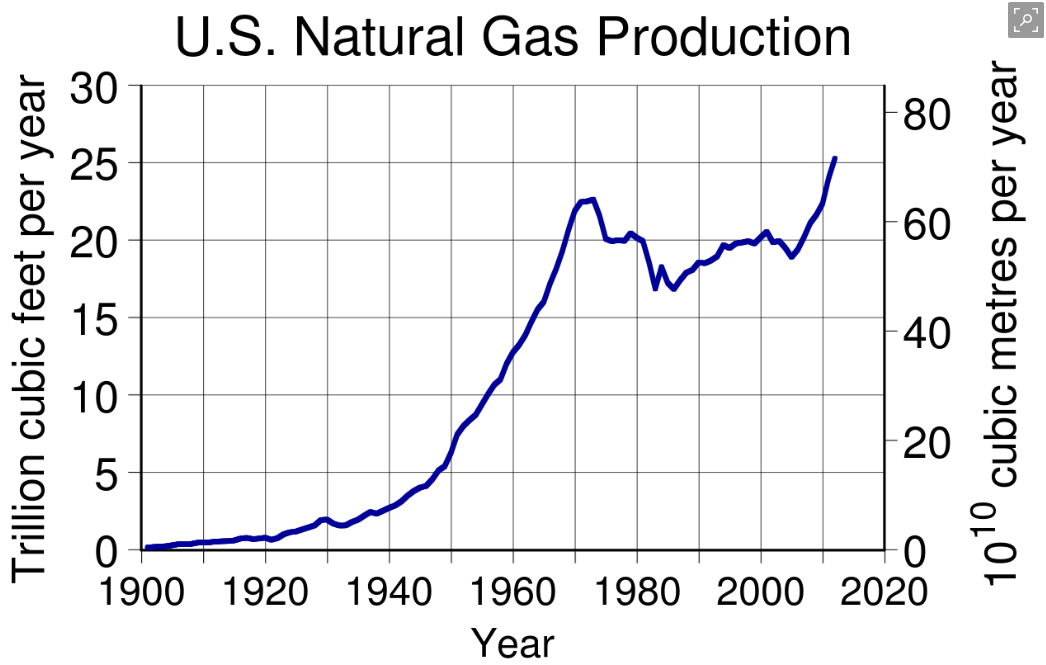

GASL investment seeks daily investment results of the inverse of the daily performance of the ICE U.S. Treasury 20+ Year Bond Index. Natural gas production has stagnated and fallen after the Financial Crisis of 2007-08, but production has ramped up and is expected to surge in the forthcoming years according to a recent study.

Nonetheless, GASL was still able to eke out a total return of 2.74% the past year.

Nonetheless, GASL was still able to eke out a total return of 2.74% the past year.

5. Direxion Daily 20+ Yr Trsy Bear 3X ETF (NYSEArca: TMV)

TMV seeks daily investment results before fees and expenses of 300% of the inverse of the daily performance of the ICE U.S. Treasury 20+ Year Bond Index. With interest rates on the move by 25 basis points last week and hints of more to come, Jablonski is identifying opportunities with “flows into TMV, which leads us to believe traders are bullish on rate hikes and looking to either participate in bond prices falling by using the bear fund to express the view or to hedge out duration.” TMV is up 10.38% year-to-date.

Check out an interview with Sylvia Jablonski below:

For more trends regarding Direxion ETFs, click here.