A Democratic “blue wave” in the White House is already prompting traders to position themselves for gains should a new administration under presidential hopeful Joe Biden take over as the leader of the free world.

Nigel Green, the CEO of one of the world’s largest independent financial advisory and fintech organizations, noted that certain sectors would benefit from this blue wave.

“The last debate was certainly more civil than the previous encounter, but it didn’t add much more to what we already know about the candidates’ personal and policy differences,” Green said in an email. “Therefore, we can expect the markets to continue pricing-in a Biden win, something which has begun in earnest in recent weeks.”

“This has been evidenced by investors piling into renewables, industrials and other sectors that could benefit from Joe Biden sweeping into power on a ‘blue wave’ victory,” added Green. “Conventional wisdom suggests a Democratic win would be negative for markets due to higher taxes, more regulation, and higher spending amongst other things. But there’s nothing conventional this time around.”

As far as which sectors would benefit, Green posited that “Cyclical stocks are likely to outperform on the back of this fiscal stimulus and the inflationary expectations. This scenario would prompt most analysts to upgrade U.S. economic growth forecasts.”

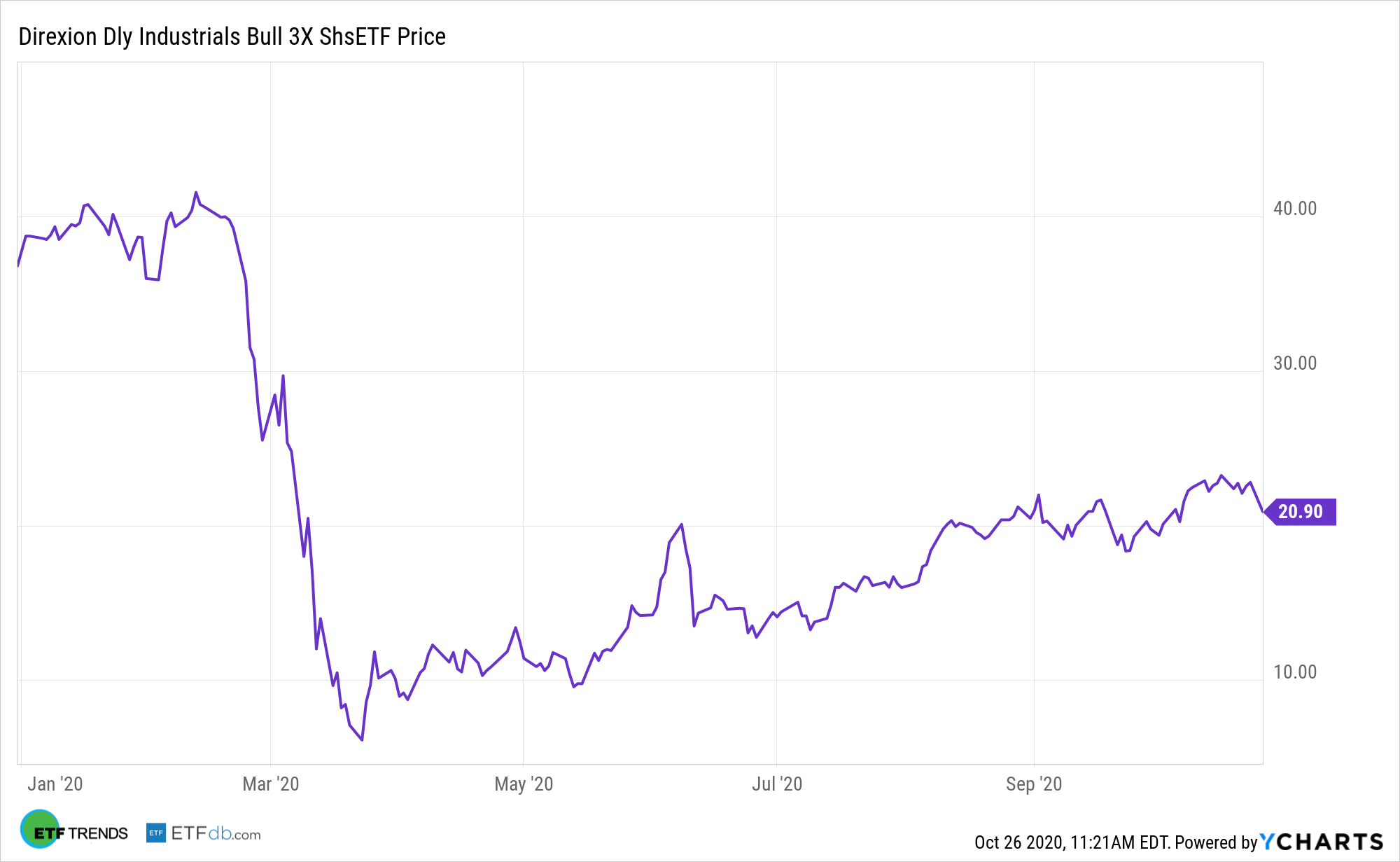

Traders looking for leveraged opportunities in the industrial sector can examine the Direxion Daily Industrials Bull 3X Shares (DUSL). The fund seeks daily investment results, before fees and expenses, of 300% of the daily performance of the Industrials Select Sector Index.

One cyclical sector traders can use is the Direxion Daily Financial Bull 3X ETF (NYSEArca: FAS). The fund seeks daily investment results, before fees and expenses, of 300% of the daily performance of the Russell 1000® Financial Services Index, which is a subset of the Russell 1000® Index that measures the performance of the securities classified in the financial services sector of the large-capitalization U.S. equity market.

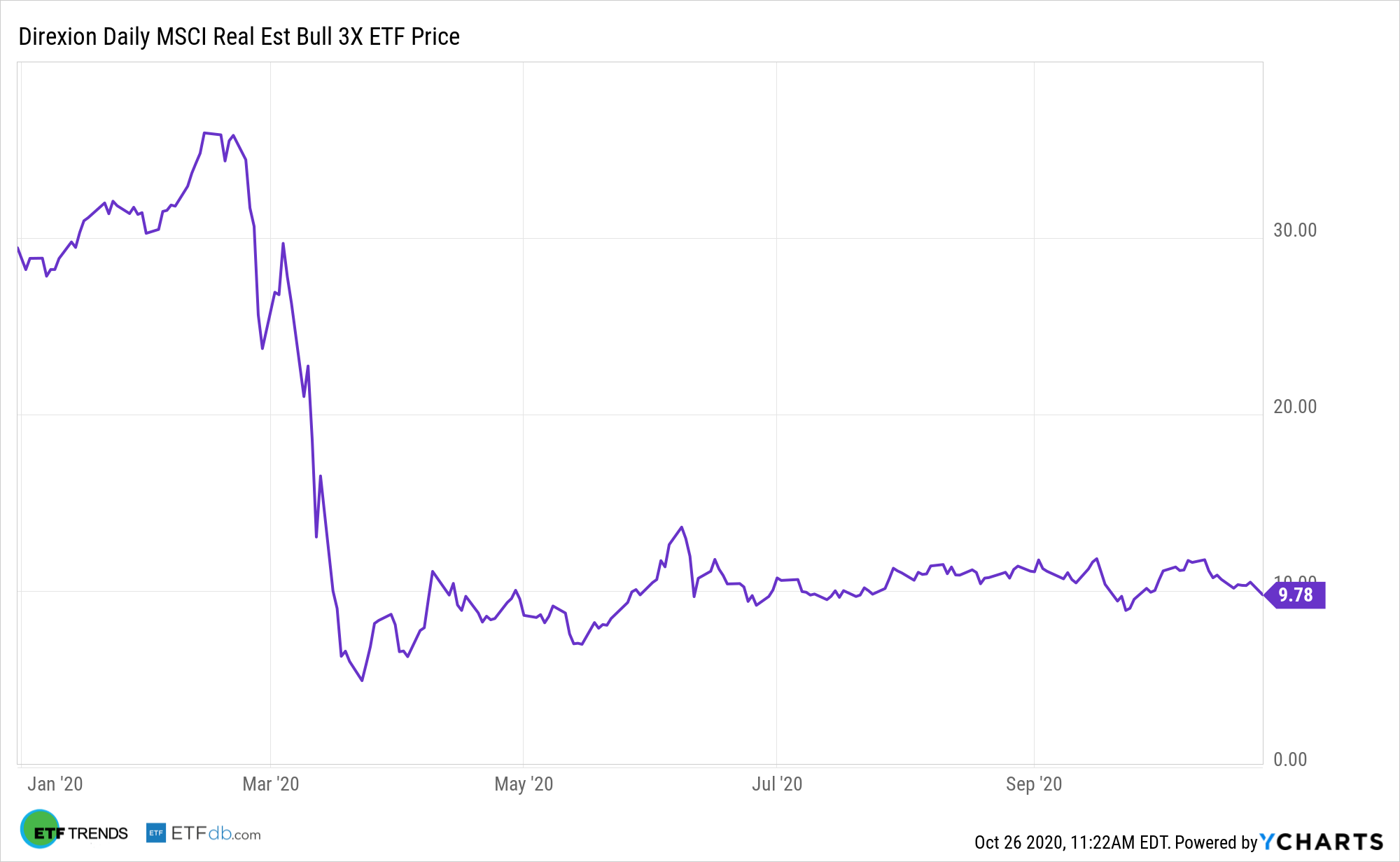

One last cyclical sector that could benefit, especially given the current low interest rates, is the Direxion Daily MSCI Real Estate Bull 3X ETF (NYSEArca: DRN). DRN seeks daily investment results equal to 300% of the daily performance of the MSCI US IMI Real Estate 25/50 Index. The index is designed to measure the performance of the large-, mid- and small-capitalization segments of the U.S. equity universe that are classified in the real estate sector as per the GICS.

For more market trends, visit ETF Trends.