The Dow Jones Industrial Average flexed its volatility muscle as it lost as much as 785 points before paring its losses down to just under 80 at the close of Thursday’s market session. These types of volatile swings in the market would certainly unnerve most investors, but “Shark Tank” television personality Kevin O’Leary reminds everyone to think of it as just another day in the market.

“When you see a violent day when the stocks go down 5 or 6 percent, get over it, it’s normal,” said O’Leary. “In fact, not having volatility is not normal.”

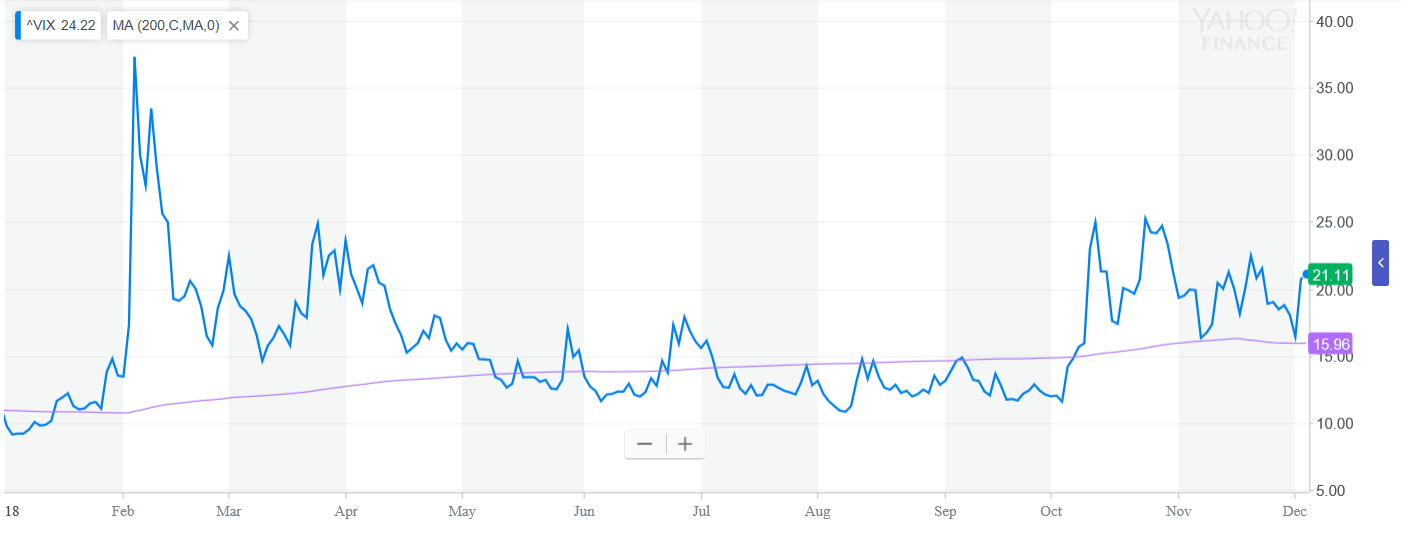

In fact, in the current economic landscape, volatility has been the new normal as evidenced by the CBOE Volatility Index stepping past its 200-day moving average since October. Investors who have grown accustomed to the steady returns seen during the thick of the extended bull market now have to adjust to this normalcy.

“We’ve been in a period of three years where there hasn’t been a lot of volatility,” O’Leary reminded investors. “So get used to these swings.”

When the markets are giving investors a ride on the roller coaster of volatility, O’Leary recommends staying invested regardless of what the prices are doing. As opposed to simply staying on the sidelines in cash to wait for the most opportune time to purchase, it’s best to utilize dollar cost averaging–an investment strategy that involves purchasing an investment on a regular basis, irrespective of the fluctuations in price–particularly when prices are low–resulting in an accumulation of the asset over a period of time.

“Don’t try and time the market,” said O’Leary. “When the market soars, it’s not necessarily time to sell. When the market collapses, it’s not always time to buy.”