SJNK seeks to provide investment results that correspond generally to the price and yield performance of the Bloomberg Barclays US High Yield 350mn Cash Pay 0-5 Yr 2% Capped Index. SJNK invests its total assets in the securities comprising the index, which is designed to measure the performance of short-term publicly issued U.S. dollar-denominated high yield corporate bonds. SJNK has returned 1.20% year-to-date, 2.94% the past year and 3.76% the last three years.

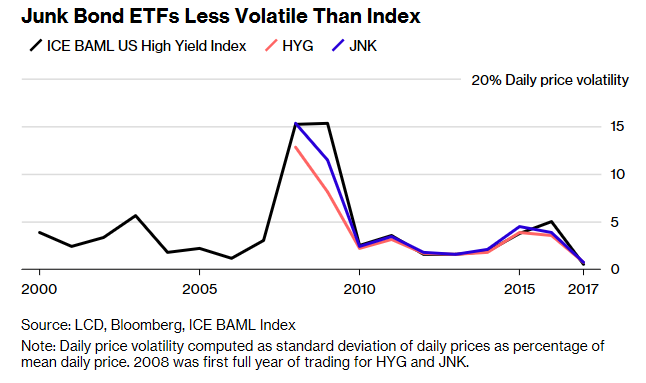

While junk bond ETFs like JNK and SJNK have a higher degree of credit risk, it’s interesting to note that Bloomberg recently revealed that these ETFs are actually less volatile than the indexes they track.

![]()

Interest in Short-Term Debt

Short-term corporate bond ETFs like the Vanguard Short-Term Corporate Bond ETF (NASDAQ: VCSH) also saw an uptick in activity. VCSH experienced $258.70 million in trading activity the past 24 hours, more than doubling the daily average volume of $124.68 million in trading activity.

VCSH tracks the performance of the Bloomberg Barclays U.S. 1-5 Year Corporate Bond Index–a market-weighted corporate bond index with a short-term dollar-weighted average maturity. In addition to VCSH allocating capital towards debt issues that are investment-grade, fixed-income investors will like the reduced exposure to duration with maturities between 1 and 5 years.

For more trends in fixed income, visit the Fixed Income Channel.