![]() In times when markets are frantic and investors need to unload quickly, high liquidity is a boon and that is where an ETF like SPDR Blmbg Barclays High Yield Bd ETF (NYSEArca: JNK) can be advantageous. The focus of the ETF is to track the price and yield performance of the Bloomberg Barclays US High Yield Very Liquid Index (VLI).

In times when markets are frantic and investors need to unload quickly, high liquidity is a boon and that is where an ETF like SPDR Blmbg Barclays High Yield Bd ETF (NYSEArca: JNK) can be advantageous. The focus of the ETF is to track the price and yield performance of the Bloomberg Barclays US High Yield Very Liquid Index (VLI).

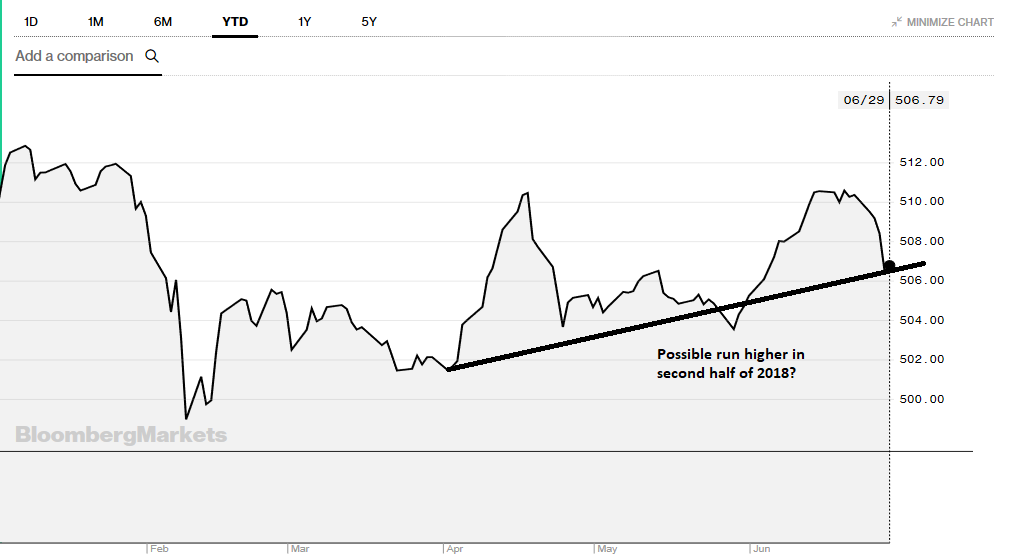

Eighty percent of JNK’s total assets comprise the Bloomberg Barclays VLI and based on the chart below, a steady climb of the higher bottom levels may signal a possible run up in the second half of 2018. Thus far, JNK has been able to extract a 2.53 percent total yield in the last three years.

![]()

Related: Global Corporate Debt Growing at Rapid Pace

The Bloomberg Barclays VLI measures the performance of publicly issued U.S. dollar denominated high yield corporate bonds with above-average liquidity–this is where JNK thrives in that it can easily exit in and out of debt positions quicker due to the higher liquidity. The index uses the same eligibility criteria as the US Corporate High Yield Index, but includes only the three largest bonds from each issuer that have a minimum amount outstanding of $500 million and less than five years from issue date.