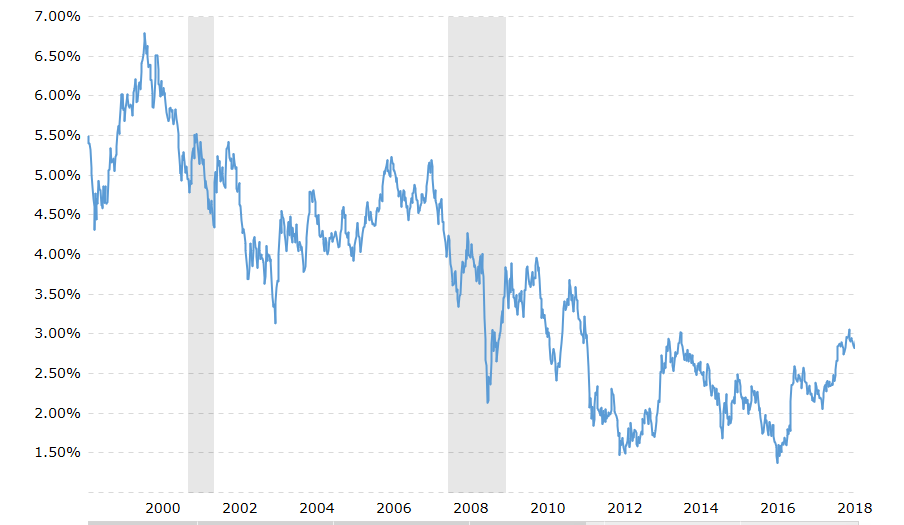

While the benchmark 10-year Treasury yield slipped to 2.934 today, 5% yields are not beyond the realm of possibilities in the government debt space, according to JPMorgan Chase CEO Jamie Dimon.

“I think rates should be 4 percent today,” said Dimon. “You better be prepared to deal with rates 5 percent or higher — it’s a higher probability than most people think.”

In addition to the benchmark Treasury 10- year yield, the 30-year yield also edged lower to 3.077 as of 2:45 p.m. ET. The 5-year yield ticked lower to 2.802 while the 2-year yield notched higher to 2.649.

Not since 2006 has Treasury yields reached the 5% mark. Of course, that served as a precursor to the financial crisis that would occur in 2008.

![]()

Dimon’s prediction also hints at a robust economy, especially with the Commerce Department announcing a 4.1% increase in GDP during the second quarter, which was spurned by a mix of tax cuts, deregulation and spending increases. The Fed expects GDP to rise 2.8 percent for 2018 in the aggregate, but diminish to 2.4 percent in 2019 followed by 2 percent in 2020.

Related: Possible Carnage in the Bond Market