As expected, this week the Fed raised the federal funds rate by 0.25%, its ninth increase in about a year. While Chairman Jerome Powell’s speech left the door open for further rate increases as needed to achieve their goal of 2% inflation, the Fed signaled an end to rate hikes is near.

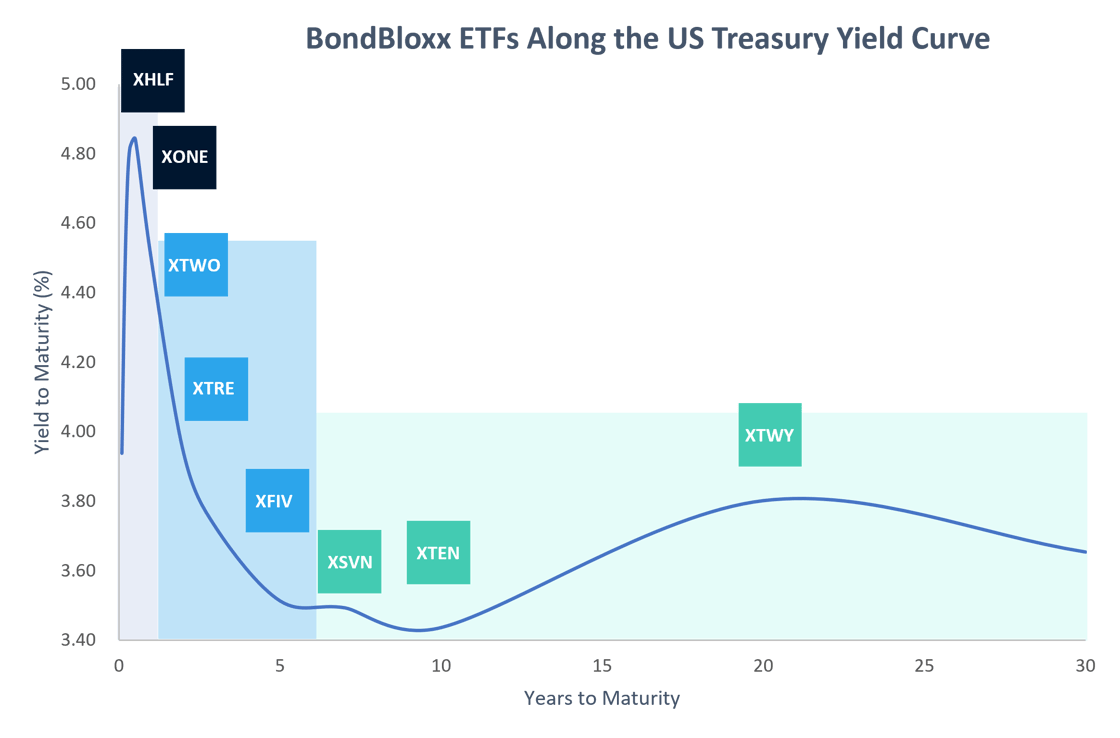

As investors consider what lies ahead for markets, there are opportunities at various points on the U.S. Treasury yield curve to align with specific views and needs. BondBloxx offers precise, low expense ratio U.S. Treasury ETFs that target specific duration exposures.

For investors uncertain about what’s ahead, consider short duration U.S. Treasuries

- Compelling yields – short duration U.S. Treasury yields are at the highest levels since 20071

For investors who believe the Fed may be nearing the end of rate hikes and/or in a slowing economy, consider the middle of the U.S. Treasury curve

- Potential return opportunity – reach slightly farther out the curve to capture potential return, as expectations of a cooling economy usually results in positive price returns for longer-dated U.S. Treasuries.

For investors who anticipate a harder landing for the economy, consider longer-dated U.S. Treasuries

- Potential return opportunity – bonds further out on the curve have historically performed well in hard landing scenarios, especially as expectations for inflation decline.

1 Source: Bloomberg, as of 3/23/23

To learn more about BondBloxx U.S. Treasury ETFs and use cases, read our publication.

Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the Fund, please call (800) 895-5089 or visit our website at bondbloxxetf.com. Read the prospectus carefully before investing.

The Fund is a newly organized entity and has no operating history. Investments in fixed income securities subject the holder to the credit risk of the issuer. Credit risk refers to the possibility that the issuer or other counter parties of a security will not be able or willing to make payments of interest and principal when due. Generally, the value of debt securities will change inversely with changes in interest rates. To the extent that interest rates rise, certain underlying obligations may be paid off substantially slower than originally anticipated and the value of those securities may fall sharply.

Distributor: Foreside Fund Services, LLC.

For more news, information, and analysis, visit the Institutional Income Strategies Channel.