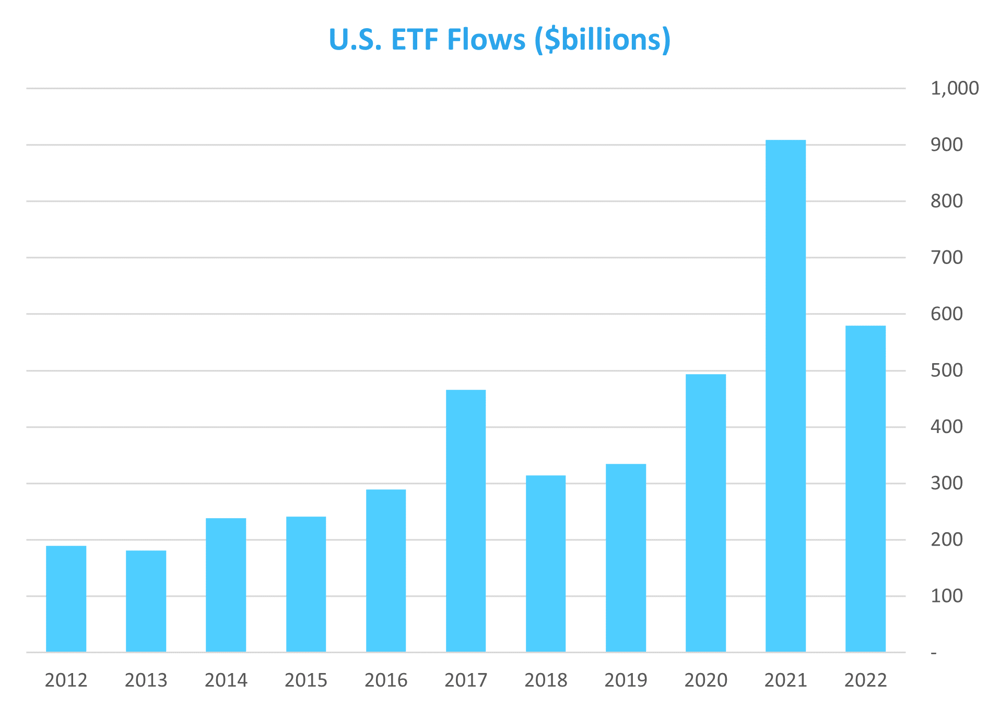

The U.S. ETF industry closed 2022 with $6.5 trillion in assets, a decline from $7.3 trillion the previous year. Five and ten years ago, total U.S. ETF assets were $3.4 trillion and $1.3 trillion, respectively.

Data Sources: BondBloxx, Bloomberg, VettaFi (etfdb.com) | Data as of 12/31/22

Important Disclosure

Carefully consider each Fund’s investment objectives, risks, charges, and expenses before investing. This and other information can be found in each respective Fund’s prospectus or, if available, the summary prospectus, which may be obtained by visiting bondbloxx.com. Read the prospectus carefully before investing.

There are risks associated with investing, including possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Investing in mortgage- and asset ¬backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on.

Distributor: Foreside Fund Services, LLC.

BondBloxx Investment Management Corporation (“BondBloxx”) is a registered investment adviser. The content of this communication is intended for informational purposes only and is not intended to be investment legal, tax, accounting, regulatory, or other advice.

Nothing contained in this presentation constitutes investment, legal, tax, accounting, regulatory, or other advice. Information contained in this presentation does not constitute an offer to sell or a solicitation of an offer to buy any shares of any BondBloxx ETFs. The investments and strategies discussed may not be suitable for all investors and are not obligations of BondBloxx.

Decisions based on information contained in this presentation are the sole responsibility of the intended recipient. You should obtain relevant and specific professional advice before making any investment decision. This information is subject to change without notice.

BondBloxx makes no representations that the contents are appropriate for use in all locations, or that the transactions, securities, products, instruments, or services discussed are available or appropriate for sale or use in all jurisdictions or countries, or by all investors or counterparties. By making this information available, BondBloxx does not represent that any investment vehicle is available or suitable for any particular investor. All persons and entities accessing this information do so on their own initiative and are responsible for compliance with applicable local laws and regulations.

Bond ratings are grades given to bonds that indicate their credit quality as determined by private independent ratings services, such as Standard & Poor’s, Moody’s and Fitch. These firms evaluate a bond issuer’s financial strength or it’s ability to pay a bond’s principal and interest in a timely fashion. Ratings are expressed as letters ranging from ‘AAA’, which are the highest grade, to ‘D’, which is the lowest grade.

Index performance is not illustrative of fund performance. One cannot invest directly in an index. Please visit bondbloxxetf.com for fund performance.