Today, Innovator Capital Management announced that the upside cap ranges and return profiles for the October Series of Innovator S&P 500 Defined Outcome ETFs will be available for Cboe listing on Oct. 1, 2018.

Innovator S&P 500 Defined Outcome ETFs seek to offer investors exposure to the S&P 500 Price Return Index (S&P 500) to a Cap, with downside buffer levels of 9%, 15%, or 30% over an Outcome Period of approximately one year, at which point each ETF will reset.

All three ETFs provide investors with broad-based exposure to the price return of the S&P 500, but rather than go through the traditional route of S&P 500 ETFs that track the index through individual equities, the Innovator ETFs construct their portfolio using customized exchange-traded Cboe S&P 500 FLEX® Options that carry various strike prices and the same expiration date.

In order to realize the return profile associated with each ETF, an investor must hold each ETF for the duration of the outcome period (approximately one year), but the products can be held indefinitely if the investor so chooses. Furthermore, the cap levels associated with the Defined Outcome ETFs will reset on an annual basis.

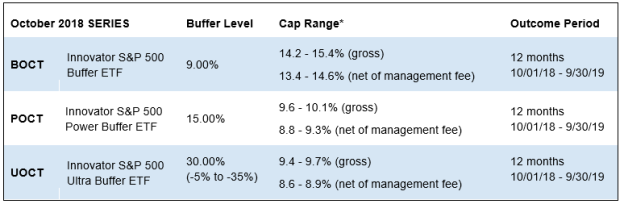

Return profiles for October 2018 Series – Innovator Defined Outcome ETFs, as of 9/14/18

![]()

* The Cap Range is based on the highest and lowest Cap as illustrated by each Fund’s strategy from 8/31/2018 to 9/14/2018 and is shown gross and net of the 0.79% management fee. The actual Cap for each Fund will be set at the beginning of the Outcome Period, and is dependent upon market conditions at that time. As a result, the Cap set by each Fund may be higher or lower than the Cap Range. “Cap” refers to the maximum potential return, before fees and expenses and any shareholder transaction fees and any extraordinary expenses, if held over the full Outcome Period. “Buffer” refers to the amount of downside protection the fund seeks to provide, before fees and expenses, over the full Outcome Period. Outcome Period is the intended length of time over which the defined outcomes are sought.

The Funds have characteristics unlike many other traditional investment products and may not be suitable for all investors. For more information regarding whether an investment in the Fund is right for you, please see “Investor Suitability” in the prospectus.

Innovator S&P 500 Defined Outcome ETFs – October Series

Innovator S&P 500 Buffer ETF (Cboe: BOCT): Designed to track the return of the S&P 500 (up to a predetermined Cap) while buffering investors against the first 9% of losses over the Outcome Period, before fees and expenses.