A Russell 2000 rally infused with rising interest in value- and momentum-based investments is helping to propel the Invesco S&P SmallCap Value with Momentum ETF (XSVM) to a 53% YTD performance.

Small caps have already been strong performers coming out of the gate in 2021. A resilient value-over-growth narrative gives XSVM even more punch.

If that wasn’t enough, the fund also seeks holdings that exhibit strong momentum. Like anything else in this world, once momentum gets going, it’s hard to stop. In the case of the case of the capital markets, momentum is the ongoing global economic recovery. A vaccine deployment combined with stimulus dollars is giving small cap investors more tailwinds.

At a total expense ratio of 0.39%, XSVM seeks to track the investment results (before fees and expenses) of the S&P Small Cap 600 High Momentum Value Index. The fund generally will invest at least 90% of its total assets in the securities that comprise the underlying index.

Strictly in accordance with its guidelines and mandated procedures, the index provider compiles, maintains, and calculates the underlying index, which is designed to track the performance of approximately 120 stocks in the S&P SmallCap 600® Index that have the highest “value” and “momentum” scores.

Is Another Rally Forthcoming?

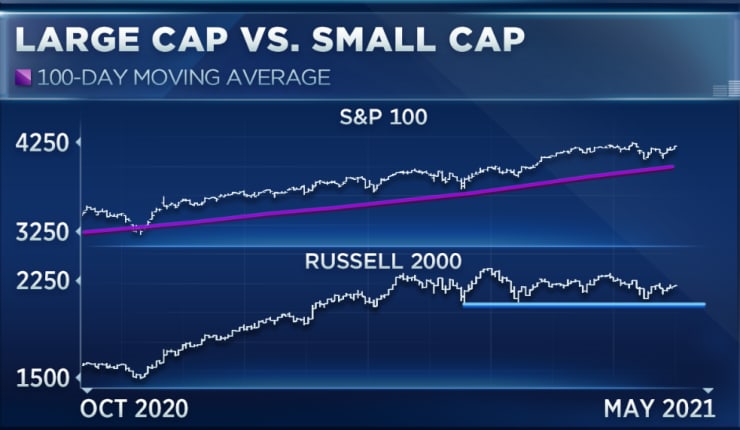

Small caps have taken a breather in May. Nonetheless, the Russell 2000 index is still up 15% on the year.

“We note that seasonals are a tail wind through July, for the first part of the summer, and we think that the market has already endured an internal consolidation that really dates back over the last three months,” said Ari Wald, head of technical analysis at Oppenheimer. “It’s almost as if the internals have coiled and truth be told that spring could uncoil in either direction.”

Nonetheless, this could all be a set-up for a rally come summertime.

“Our expectation [is]for a summertime rally. We’re going to use the Russell 2000 as our signal here. I think [our forecast is]intact as long as the Russell is above its March low at 2,085 support. As long as that’s the case, which it is, rallies should continue and below there would derail our positive view,” Wald added.

For more news and information, visit the Innovative ETFs Channel.