Getting fixed income returns in today’s interest rate environment has proved to be an ongoing challenge. With the risk dial turned up by most investors, high-risk bonds aren’t the only option available. Preferred stocks like the Invesco Preferred ETF (PGX) are another potent option.

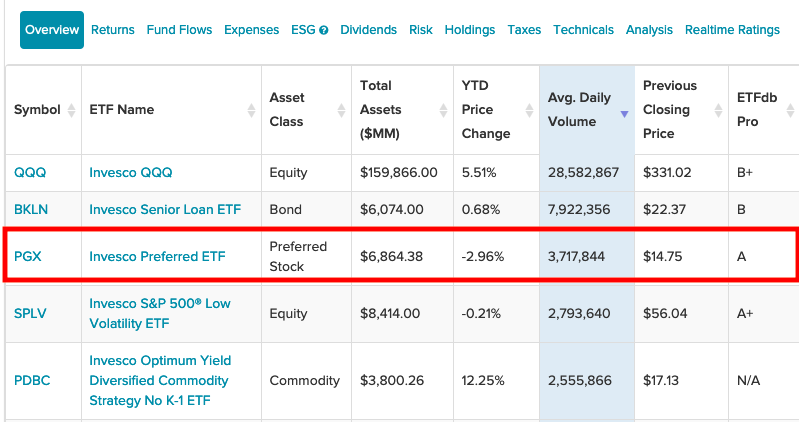

Looking at average daily volume, PGX has been one of the top funds in Invesco’s diverse roster of ETFs. Why are investors flocking to the ETF?

The fund seeks to track the investment results of the ICE BofAML Core Plus Fixed Rate Preferred Securities Index. The fund generally will invest at least 80% of its total assets in the components of the index.

Strictly in accordance with its guidelines and mandated procedures, ICE Data Indices, LLC selects securities for the index, which is a market capitalization-weighted index designed to measure the total return performance of the fixed rate U.S. dollar-denominated preferred securities market. PGX’s expense ratio comes in at 0.52%.

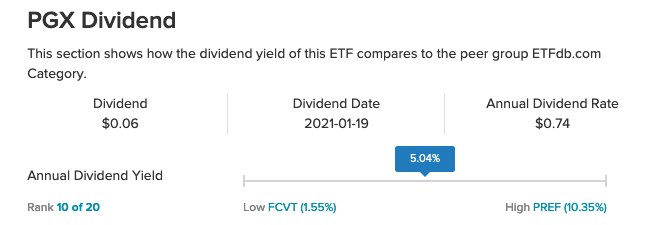

At an annual yield of 5.04%, PGX sits substantially higher than the current rate of the benchmark 10-year Treasury yield of 1.37%.

Why Investors Prefer Preferred Dividends

Preferred dividends can be an attractive option if investors are aware of its advantages as well as its disadvantages. Upcounsel breaks it down:

“Preferred dividends are the dividends that are accrued paid on a company’s preferred stock,” the Upcounsel article said. “Any time a company pays dividends, preferred shareholders have priority over common shareholders, which means dividends must always be paid to preferred shareholders before they are paid to common shareholders. If the company is unable to pay all the dividends, then claims to any preferred dividends will take precedence over claims to dividends on common shares.”

More importantly, investors appreciate the reliable source of income as compared to common stock dividends.

“Preferred dividends are link to preferred shares, which are a type of equity in the company, although these shareholders do not have any voting rights,” the article added further. “They offer more predictable income than common stock, but do not enjoy the same guarantee as creditors – so even though they have a prior claim on the company’s assets if liquidated, they are still subordinate to bondholders and creditors. Most shares do not have a maturity date, and if they do, then they are quite far in the future.”

For more news and information, visit the Innovative ETFs Channel.