Fears of an inverted yield curve racked the markets during 2018’s fourth quarter sell-off, but they returned on Friday as the short-term 3-month and longer-term 10-year yield curve did as such–unveil an inversion that hasn’t been seen since 2007–just ahead of the financial crisis.

“Could it be that the yield curve is signaling weak global economic growth and low inflation without necessarily implying a recession in the US? We think so, and the US stock market apparently supports our thesis,” Ed Yardeni of Yardeni Research said in his morning note Friday. “So why are global stock markets also doing so well? Perhaps there is too much pessimism about the global economic outlook.”

The spread between the 3-month and 10-year notes fell below 10 basis points for the first time in over a decade. This strong recession indicator contrasted a more upbeat central bank on Wednesday, but investors were quick to sense the cautiousness.

During Wednesday’s interest rate announcement by the Fed, Chairman Jerome Powell gave mention to the strength of the economy, but did acknowledge that economic concerns exist domestically and abroad.

The major indexes were awash with red ink last Friday as fears of a global economic slowdown was compounded by market noise of an inverted yield curve blaring from the bond community. To former Federal Reserve Chairman Janet Yellen, this shouldn’t sound the trumpet on a recession, but a rate cut.

“I don’t see it as a signal of recession,” Yellen said during a question and answer session at the Credit Suisse Asian Financial Conference.

The spread between the 3-month and 10-year notes fell below 10 basis points for the first time in over a decade. This strong recession indicator contrasted a more upbeat central bank on Wednesday, but investors were quick to sense the cautiousness.

Yellen’s assessment comes after the central bank’s decision to keep interest rates unchanged last week. In move that was widely anticipated by most market experts, the Federal Reserve on Wednesday elected to keep rates unchanged, holding its policy rate in a range between 2.25 percent and 2.5 percent. In addition, the central bank alluded to no more rate hikes for the rest of 2019 after initially forecasting two.

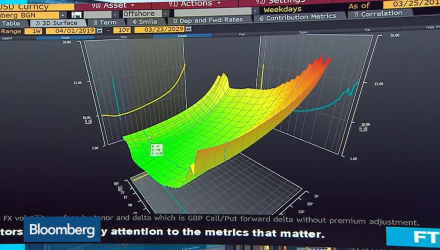

In the video below, Elsa Lignos, global head of FX strategy at RBC, and Ben Ritchie, deputy head of European equities at Aberdeen Standard Investments, examine economic signals from gilts and the U.S. yield curve inversion. They speak on “Bloomberg Surveillance.”

For more market trends, visit ETF Trends