Facebook reported its third-quarter earnings with positive results, besting analysts’ expectations with strong revenue growth. For investors sensing an opportunity within the technology sector, it may be time to befriend funds that focus on social media.

Facebook’s earnings results as reported by CNBC:

- Earnings: $2.12 vs. $1.91 per share forecast by Refinitiv.

- Revenue: $17.65 billion vs. $17.37 billion forecast by Refinitiv.

- Daily active users: 1.62 billion vs. 1.61 billion forecast by FactSet.

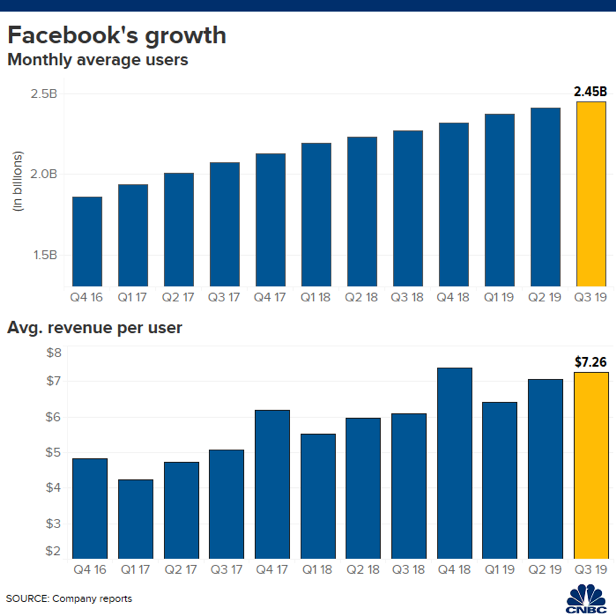

- Monthly active users: 2.45 billion vs. 2.45 billion forecast by FactSet.

- Average revenue per user: $7.26 vs. $7.09 forecast by FactSet.

“We had a good quarter and our community and business continue to grow,” said Facebook CEO Mark Zuckerberg in a statement. “We are focused on making progress on major social issues and building new experiences that improve people’s lives around the world.”

“At the end of the third quarter, Facebook reported daily active users of 1.62 billion, an increase of 9% year-over-year, and monthly active users of 2.45 billion, an increase of 8%,” said a report by The Street. “The company estimates that 2.2 billion people use Facebook, Instagram, WhatsApp, or Messenger every day on average, and around 2.8 billion people use at least one of those apps each month.”

“The $17.65 billion quarterly revenue figure represents a year-over-year increase of 29%, and places its ARPU (average revenue per user) at $7.26, compared to $7.09 expected by analysts,” the report added.

ETF investors who want to capitalize on social media can use the Global X Social Media ETF (NasdaqGM: SOCL). SOCL seeks to provide investment results that correspond generally to the price and yield performance of the Solactive Social Media Total Return Index.

The index tracks the equity performance of the largest and most liquid companies involved in the social media industry, including companies that provide social networking, file sharing, and other web-based media applications.

Benefits of using SOCL:

- Efficient Access: Efficient access to a broad basket of social media companies around the world.

- Targeted Thematic Exposure: The fund is a targeted thematic play on the global social media industry.

Fund’s top 10 holdings:

- Facebook Inc-Class A: 11.17%

- Twitter Inc: 9.23%

- Tencent Holdings Ltd: 8.56%

- Naver Corp: 8.19%

- Iac/Interactivecorp: 5.35%

- Netease Inc-Adr: 5.26%

- Alphabet Inc-Cl A: 5.20%

- Spotify Technology Sa: 4.89%

- Snap Inc – A: 4.86%

- Yandex Nv-A: 4.53%

The fund is up over 16% YTD based on Yahoo Finance performance numbers.