With the Federal Reserve ready and willing to implement rate cuts in 2019 if needed, investors on the hunt for more income may need to look towards higher-risk, higher-yielding assets like emerging markets (EM). This could mean a push towards EM debt or other opportunities that corner other areas of the EM space like technology.

“What we are seeing is that late in the cycle, central banks are cutting interest rates. That’s really sucking the yield out of core government bonds,” said J.P. Morgan Asset Management Global Market Strategist Alex Dryden. “That is throwing the gauntlet down to investors, essentially forcing them to go looking for higher yielding assets in high yield and emerging market debt.“

The U.S.-China trade impasse heavily discounted a lot of U.S. equities, especially during the month of May, but it also put the red tag sale on emerging markets (EM). Combine the tariff battles with a cautious U.S. Federal Reserve, and it puts the EM space at an attractive valuation relative to its peers.

While most investors might have been driven away by the losses in EM during much of 2018, savvy investors who were quick to see the opportunity viewed EM as a substantial markdown. From a fundamental standpoint, low price-to-earnings ratios in emerging markets ETFs have made them prime value plays as capital inflows continue in 2019.

Ongoing U.S.-China trade negotiations and geopolitical tensions put emerging markets in a state of unease in 2018, but investors can now look to their resurgence through other broad-exposure ETFs like the iShares MSCI Emerging Markets ETF (NYSEArca: EEM) or iShares Core MSCI Emerging Markets ETF (NYSEArca: IEMG).

Investors are increasingly emphasizing low cost a prime motivator for allocating capital in 2019, which makes ETFs like IEMG an attractive option. The fund provides this core EM exposure at a paltry 0.14 percent expense ratio.

Marrying Tech and EM

Can’t make up your mind whether to invest in the plethora of emerging markets available in the ETF space or the Invesco QQQ Trust (NASDAQ: QQQ). The Emerging Markets Internet & Ecommerce ETF (NYSEArca: EMQQ) marries the idea of technology and EM in one ETF.

EMQQ invests in companies with exposure to the ecommerce and Internet sectors in emerging markets. Purchasing EMQQ provides exposure to companies that are positioned to benefit as emerging economies mature, the consumer class expands, and their populations increases their utilization of the Internet and ECommerce.

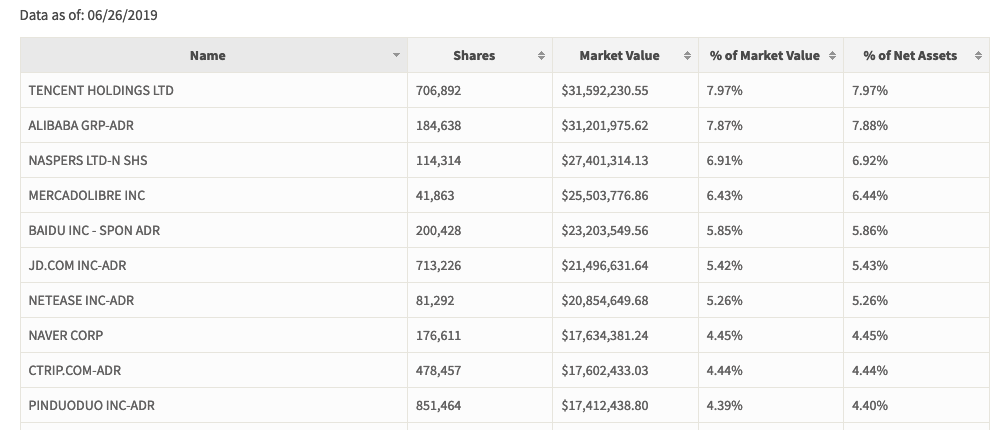

The fund provides broad-based exposure to the big names in tech overseas like Tenecent Holdings. Just take a look at its top 10 holdings:

To the outside world, these names may not be familiar, but in the global marketplace, they represent the equivalent of the Googles and Amazons in the U.S. In a late market cycle, it could be these equities investors may look to internationally once the U.S. exits out of this extended bull run.

To the outside world, these names may not be familiar, but in the global marketplace, they represent the equivalent of the Googles and Amazons in the U.S. In a late market cycle, it could be these equities investors may look to internationally once the U.S. exits out of this extended bull run.

For more market trends, visit the Innovative ETFs Channel.