The technology sector is in pole position thus far year-to-date, outpacing the S&P 500 that recently hit an all-time high with a 27 percent gain versus the latter’s 17.5 percent jump. However, all good things must come to an end, so investors may want to take a more strategic approach and focus on certain corners of the tech sector via software via the SPDR S&P Software & Services ETF (NYSEArca: XSW).

“Tech is one of the few S&P sectors with +50% non-U.S. revenues and profits,” wrote Nick Colas, co-founder of DataTrek Research, in a note to clients. “The exact number is 58% non-U.S. sales, the highest of any industry group. That makes it the poster child for international trade, and not just with China. Markets were hoping that a calm resolution to U.S.-China trade disputes would pave the way for other agreements.”

Key Features of XSW:

- The SPDR® S&P® Software & Services ETFseeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P® Software & Services Select Industry® Index (the “Index”)

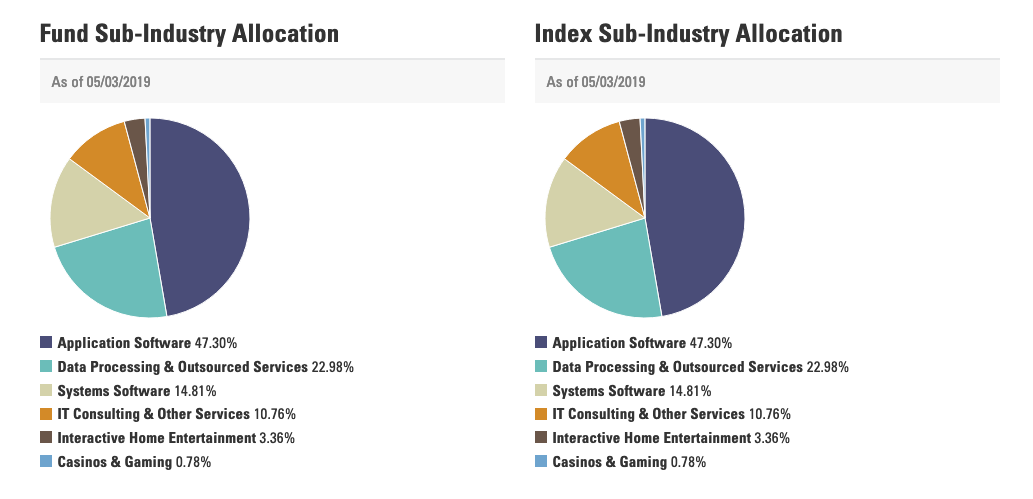

- Seeks to provide exposure to the software and services segment of the S&P TMI, which comprises the following sub-industries: Application Software, Data Processing & Outsourced Services, Home Entertainment Software, IT Consulting & Other Services, and Systems Software

- Seeks to track a modified equal weighted index which provides the potential for unconcentrated industry exposure across large, mid and small cap stocks

- Allows investors to take strategic or tactical positions at a more targeted level than traditional sector based investing

Under the hood, XSW doesn’t have the big name tech giants that many technology ETFs boast, but its 32.32 percent gain YTD shows it’s not necessary to have the Amazons and Apples in a portfolio. Furthermore, XSW is accomplishing this performance via an equal-weighted strategy.

Even as U.S. equities continue to see a resurgence in the first quarter of 2019, investors can still see a wall of worry growing in the backdrop, which is sparking concerns of a global economic slowdown. Even if a permanent trade deal between the U.S. and China gives equities a healthy boost in the short-term, it won’t allay long-term concerns–this is where defensive positioning comes into play.

Whether it’s delving into safe havens like commodities or more specifically, precious metals like gold, investors are looking to play defense despite the run up in equities as of late. Additionally, investors are looking to play more defense against volatility, but at the same time, don’t want to do so at the expense of higher costs.

That being said, the search for low-cost alpha hasn’t stopped investors from pouring into the technology sector. As such, investors should give XSW a look with its 0.35 percent expense ratio.

For more market trends, visit ETF Trends.