Low interest rates and recent volatility call for an ETF that can address both issues. Thankfully, the Invesco S&P 500 High Dividend Low Volatility ETF (SPHD) fits the bill.

The timing for SPHD couldn’t be more auspicious given the current market environment. Inflation fears and stimulus measures are dousing the markets with volatility.

“The pullback in the second half of February coincided with a fast spike in U.S. Treasury yields, as investors speculate about the possibility of inflation that could be driven by increased government spending and the potentially huge economic comeback once the coronavirus vaccine is widely distributed,” a Yahoo! Finance article noted. “Despite these worries, the recent decline could be nothing more than a healthy and common pullback as the market continued to rip higher in 2021. Therefore, investors might want to search for stocks that have grabbed more analyst attention amid the recent volatility.”

SPHD seeks to track the investment results (before fees and expenses) of the S&P 500® Low Volatility High Dividend Index. The fund generally will invest at least 90% of its total assets in the securities that comprise the underlying index.

The index provider compiles, maintains, and calculates the underlying index, which is composed of 50 securities in the S&P 500® Index that historically have provided high dividend yields with lower volatility. To get a piece of SPHD, ETF investors are looking at a net expense ratio of 0.30%.

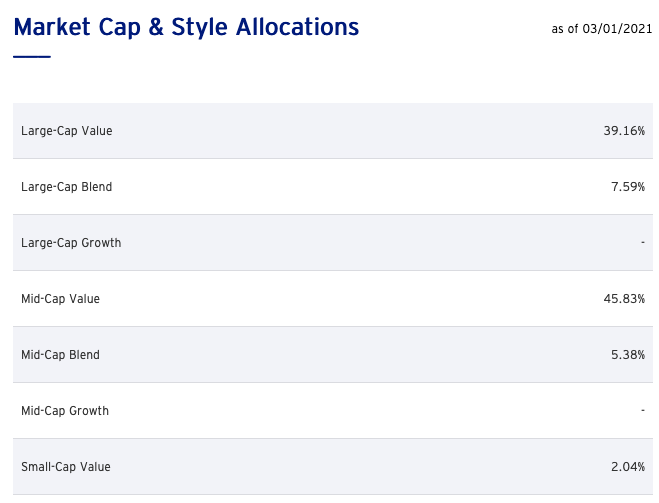

Currently, SPHD skews toward large- and mid-cap value. Equities that err on the side of the value factor tend to mute downturns better than small cap growth names.

Heavy on Value

With the value factor looking to make a comeback, SPHD can also capture strong upside as well as a little bit of growth thanks to its mid cap exposure.

“Not surprisingly, SPHD tends to be heavy on utility stocks and light on fast-growing tech companies,” ETF Database analysis noted. “SPHD imposes guardrails that prevent a single sector from dominating the portfolio, with each sector limited to ten stocks and 25% of the portfolio at rebalance. Between rebalances, better-performing sectors can become a bigger slice of the pie. As of March 2020, the fund has 37% of its money in financial stocks.”

When it comes to income, SPHD has a SEC 30-day yield of 4.45% and a 12-month distribution rate of 4.51%.

For more news and information, visit the Innovative ETFs Channel.