One way to obtain more yield is to look at seniors loans and the Invesco Senior Loan ETF (BKLN), but what are senior loans, and what makes them a viable options in today’s market environment?

“Senior loans are debt securities typically used by companies to finance their operations, support business expansion, and refinance existing debt,” a CION Investments article said. “They are known as ‘senior’ loans due to their position atop of a borrowing company’s capital structure.”

“Senior loans can also be secured by the borrower’s assets (cash, receivables, inventory, property, and equipment to name a few) and have payment priority in the event of a default,” the article added. “Although loans can be structured as fixed or floating rate loans, senior loans are typically structured as floating rate loans, which means that the interest paid on these loans will move with interest rate fluctuations.”

BKLN seeks to track the investment results of the S&P/LSTA U.S. Leveraged Loan 100 Index. The advisor and the fund’s sub-advisor define senior loans to include loans referred to as leveraged loans, bank loans, and/or floating rate loans.

Banks and other lending institutions generally issue senior loans to corporations, partnerships, or other entities. Senior loans are typically used for business recapitalizations, acquisitions, leveraged buyouts, and re-financings. BKLN’s loan portfolio will include the purchase of loans from banks or other financial institutions through assignments or participations.

“As the investing landscape evolves and interest rates continue to hover at near-record lows, it’s important to consider alternative asset classes that may help investors reach their financial goals,” the CION article added. “One such asset class growing in popularity among the retail investing community is senior loans. Senior loans may be an attractive complement to an existing fixed-income allocation as they typically pay higher yields than traditional fixed income investments such as Treasuries and CDs and offer investors the potential for capital appreciation.”

Seeking Strong Inflows

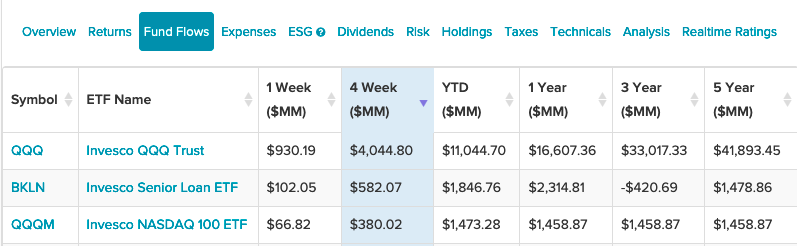

BKLN finds itself right up there with the vaunted Invesco QQQ Trust (QQQ) ETF that consistently garners investor activity. In Invesco’s vast array of ETFs, it came in second on fund flows over the past four weeks.

With a monthly dividend yield of about 3.2%, according to Dividend.com, BKLN is surely a choice for fixed income investors looking to extract more yield out of the current market. With its largest holding at 1.76%, BKLN also spreads around the allocations sparingly in order to minimize concentration risk.

For more news, information, and strategy, visit the Innovative ETFs Channel.