The recent decision by the Federal Reserve to keep rates steady did little to quell inflation fears, warranting the help of assets like the Invesco PureBeta 0-5 Yr US TIPS ETF (PBTP).

While the economy continues the healing process, the recurring sentiment is that prices for consumer goods and services will push higher.

As mentioned, the Fed decided to keep rates at near zero last week, but the capital markets appear to be looking past the near-term and eyeing higher rates for the long-term. The Fed is eyeing an inflation rate of 2%, but investors aren’t so keen on that number.

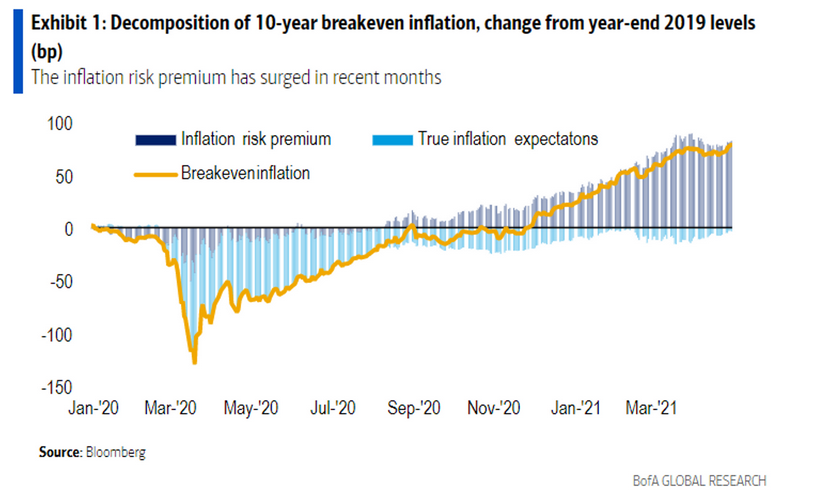

“Investors are pricing in risks of a ‘significant overshoot’ of the Federal Reserve’s 2% inflation target for the first time in several years, according to economists at Bank of America Corp,” a MarketWatch article said.

“Investors are paying close attention to inflation on concern that too much could prompt the Fed to raise interest rates or begin tapering its asset purchases sooner than expected, potentially hurting their portfolios,” the article added. “While trying to discern whether any spike in inflation will be merely transitory in the economic recovery, some investors are weighing shifts to their holdings to prepare for the risk that it will be persistent.”

In the meantime, the U.S. economy is humming along amid a vaccine deployment.

“Economic growth is kicking into higher gear, but with 6% unemployment, an uneven household recovery and more than 2 million fewer Americans in the labor force than prior to the outbreak, the Fed is keeping the throttle wide open,” said Greg McBride, chief financial analyst at Bankrate.com.

A Dynamic ETF with Inflation Protection

Treasury-inflation protected securities (TIPS) can help stem the tide of rising inflation. The principal balance of TIPS increases as inflation rises, and investors are paid the original balance or the inflation-adjusted balance, whichever is greater.

PBTP seeks to track the investment results the ICE BofA 0-5 Year US Inflation-Linked Treasury Index. The fund generally will invest at least 80% of its total assets in the securities that comprise the underlying index.

The index is designed to measure the performance of the shorter maturity subset of the U.S. TIPS market, represented by TIPS with a remaining maturity of at least one month and less than five years. Less years means investors are less exposed to duration risk.

For more news and information, visit the Innovative ETFs Channel.