Thought to ponder…

“The trap is this: only after we do the difficult work does it become our calling. Only after we trust the process does it become our passion. ‘Do what you love’ is for amateurs. ‘Love what you do’ is the mantra for professionals.”

– Seth Godin, The Practice

The View from 30,000 feet

With 92% of the S&P500 having reported, the earnings season is in the bag. The Bottom Line: Q1 2023 had the highest percent of companies beating earnings since Q3 2021, signaling analysts had become too pessimistic. Normally, companies rally when their actuals exceed estimates. This was not the experience in Q1 2023, those companies who beat showed only marginal gains, while those that missed were taken to the woodshed, perhaps a sign that investors are nervous and not adding to winners but selling losers. With earnings season in the rearview mirror, all eyes will be turning to the economy/inflation, the debt ceiling debate, banking turmoil and geopolitics. Historically, during the relative quiet following earnings season the markets gravitate in the direction of the underlying trend, which today is a weak upward bias towards resistance levels with a lot of chop. To help matters, incremental positive signs for inflation and a potential resolution for the debt ceiling debate stand to act as positive catalysts in the coming weeks.

- At the margin, the Fed saw what they were hoping for last week from the real economy, signs of moderating inflation and a less pressurized labor market

- A heavy week of survey data included the University of Michigan, NFIB and Senior Loan Officers Opinion Survey telling the same message: Deteriorating sentiment

- Cyclical versus Secular trends in commodities – short-term growth concerns juxtaposed against long-term supply constraints

- The most Frequently Asked Question from client’s this week: What are some of the upside surprises and downside risks the market is not accounting for?

The Fed saw what they were hoping for last week from the real economy

- CPI: Still too high for comfort but signs of moderation

- The Big Three – Things that everyone has to contend with: Food, Shelter and Energy

- Food At Home: Has been negative for the last two months.

- Shelter: The long-awaited flow through from falling housing and lease rates is beginning to be picked up in calculations though recent data suggesting a firming in residential real estate, threatening to stall the trend.

- Energy: Weak petroleum and natural gas prices tied to demand concerns pressuring prices down double digits in last 12 months.

- Services ex-Shelter (Supercore): Showing the first meaningful signs of deceleration.

- The Big Three – Things that everyone has to contend with: Food, Shelter and Energy

- PPI: Downward trend for wholesale should follow through to CPI in coming quarter

- Completed round trip back to Fed’s comfort level with YoY increase now being held to 3% and still falling.

- PPI has been leading CPI since pandemic by about three to four months, pointing to material weakening in CPI by the fall.

- Employment: Leading indicators continuing to show softening

- Initial Jobless Claims and Continuing Jobless Claims continue upwards trends. Taken in conjunction with to upticks in WARN notices (large layoff filings), trends in Overtime and Temp worker demand and downtrend in JOLTS data, signal a softening in the labor markets.

Bottomline: It’s important to not get fixated on one week or one month of data, which can be noisy and subject to idiosyncratic issues and data abnormalities (for example, last weeks questionable Massachusetts claims numbers that influenced a much higher than expected Initial Claims number), rather focus on trends. The Fed has laid out a path to a pause and an eventual lowering of rates, which is continued downward readings of inflation with confidence that PCE is headed towards 2%. Key to this path is consistently lower readings on inflation and a softening of the labor market. At the margin, that’s exactly what we saw in the numbers last week.

Supercore downshifts and PPI leading CPI lower – welcome news for the Fed

A heavy week of survey data telling the same message: Deteriorating sentiment

• University of Michigan:

- Initial data from the survey showed sentiment, views of economic conditions and consumer expectations all tumbling lower, while long- term expectations for inflation moved higher.

- This is a mixed bag, while signs of lower sentiment is welcome news to the Fed because it indicates subdued demand, it’s concerning that long-term inflation expectations is increasing because the unmooring of long-term inflation expectations signals that attitudes about inflation are at risk of becoming embedded in the economy, which make inflation sticky and harder to wring out of the system.

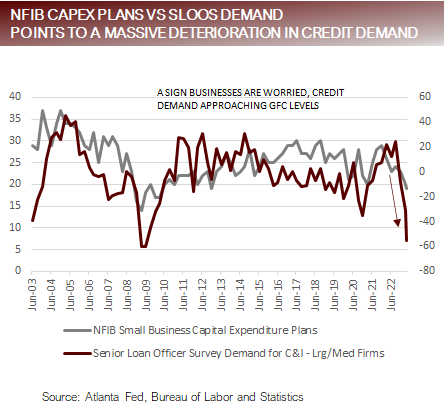

• NFIB Small Business Survey:

- The Survey continued to slide lower, falling well below levels seen during the pandemic, with only the GFC and the recession of the early 1980’s showing eras of worse small business sentiment.

- The headline from the report was the handoff from the largest concern being inflation to that of qualified labor. We’d contend this is really the same issue, as highlighted by the Fed, who continues to drive home the point that until the labor market softens, inflationary pressures will be hard to subdue because labor is a large component of inflation.

• Senior Loan Officer Survey:

- The big takeaway from the Survey was the both supply and demand of credit is falling, which was to be expect. Perhaps the only real surprise was the fall in demand was actually larger than the fall in supply, signaling that companies are slowing the willingness to expand in the face of the perceived deterioration in the economy.

- Fall in supply and demand for credit has historically had a high correlation with corporate defaults, suggesting the corporate defaults could rise by as much as 4x over the next year, and bring with it a long-awaited credit cycle that’s been looming.

• Bottomline:

- There were a lot of data points on sentiment last week. The overall conclusion is that sentiment is softening across the board, with worries about inflation, the labor market, the political wranglings in Washington and banking crisis taking their toll on consumers and companies, which together should add up to slowing force on the economy.

Mixed bag for the Fed with rising inflation expectations, but sharp fall of in credit supply and demand

Cyclical versus Secular trends in commodities

• Cyclical Story

- Recession worries, underwhelming re-opening in China and Europe’s good luck with winter weather and success in curtailing energy demand driving weak demand and lower prices in the short-term.

- OPEC+ cut production targets by 500k barrels a day on April 2nd based on their view of deteriorating demand, since then the price of WTI Oil has dropped -12.9%, signaling that OPEC+ may be correct to be worried about reduced demand.

- Copper (the commodity with the PhD – because it so smart) and Iron Ore are both in deep downtrends, signaling weak industrial demand.

- China PMI and Caixin have both fallen back into contraction territory, after briefly spiking into expansionary levels after the re- opening announcements.

- After peaking in January, German, France and Italy have all resumed a downward trend in manufacturing PMIs. Spain and the United Kingdom peaked shortly after and have also begun moving lower.

- German Industrial Manufacturing Orders cratered -10.7% last month, something previously only seen in recessions.

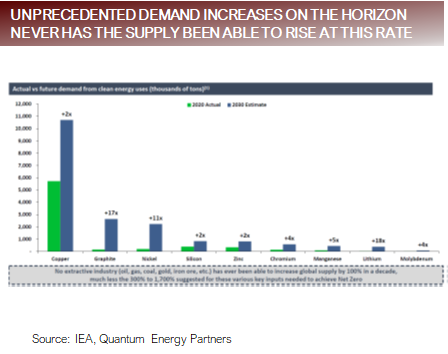

• Secular Story

- Projected demand from the shift to renewables, under investment, higher financing costs and long lead times to develop reserves creating an environment for chronic shortages and upward bias to pricing.

- Regulatory challenges make brining demand online a task measured in decades.

“It’s taking an average of 23 years from discovery of a copper resource to a producing mine”

– Airguide

The transition to renewables fraught with challenges for commodity supply

FAQ: What are some of the upside surprises and downside risks the market is not accounting for?

• Upside Surprises:

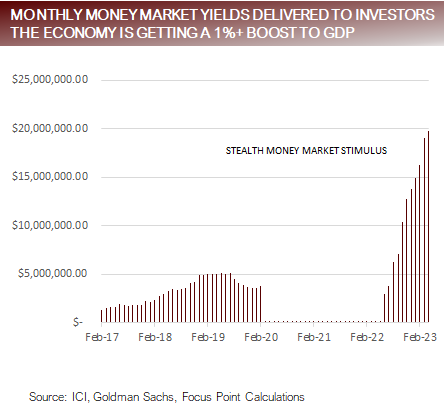

- Cash yield from Money Market Funds

- Assets are being drawn to Money Market Fund because they have a compelling In fact, Money Market Funds interest payments to investors are now contributing an annualized run rate of over 1% of GDP ($250b).

- Broadening out of the rally

- The story that only 7 stocks have accounted for 90% of the gain of the S&P500 this year is well If earnings continue to surprise to the upside, the group of winners will broaden out.

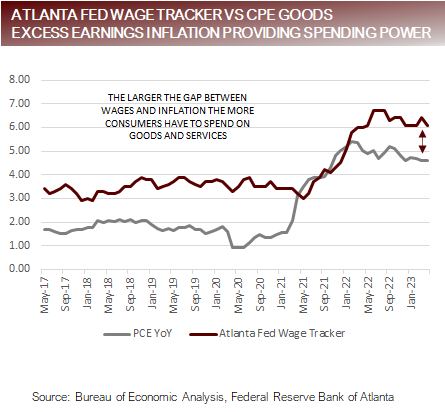

- Structural employment challenges keeping demand for workers persistently .

- Prime age worker labor participation has surpassed pre-pandemic trends, signaling there is little additional slack in the labor market, and may support Fed’s view that they can slow the economy without materially impacting the labor market.

- Wages are rising faster than goods prices providing consumers with excess spending power to support consumption.

• Downside Risks

- Debt Ceiling Resolution

- Progress on the debt ceiling could lead to a short-term relief rally based on the removal of default risk to be followed by long-term reckoning tied to removal of liquidity and austerity.

- The bull case is predicated on continued moderation in inflation, however, this falls in the category of careful what you wish for. If deflation takes hold, nominal sales will fall at the same time margins are falling which will lead to a rapid deceleration in earnings.

- Signals from the commodities markets

- Oil, Copper, iron Ore are experiencing deep selloffs, signaling a weakening in the industrial complex, corroborated by Manufacturing PMIs deteriorating into contraction territory in the three largest economic zones in the world.

- Equity markets are priced for perfection, discounting lower rates in the summer / fall, with accelerating

- There is a blatant contradiction: Expecting lower rates and higher earnings. The Fed cuts rates for one of three reasons: financial stability concerns, deflationary pressures, growth concerns… any of these developments would be bad for equity prices.

Upside Surprise case driven by factors putting extra cash in the coffers of consumers

Putting it all together

• The inflation debate is stuck in a point versus counter-point debate. Each week we are presented with evidence that inflationary pressures are easing as well as reasons to believe inflation will be sticky. Pick your poison.

- Disinflation Points

- Falling goods prices

- Falling commodity prices

- Cooling labor market

- Turmoil in commercial real estate market, and dramatic slowdown in residential real estate market

- Fractured banking system with evaporating credit supply and demand

- Recessionary sentiment from consumers and businesses

- Inflationary Counter Points

- Persistently strong labor demand and wage growth

- Measures of inflation that are “sticky” remain elevated

- Evidence of inflation expectations becoming unmoored

- Unyielding consumer spending

- Continued strength in corporate earnings

- Signs that housing market has stabilized and pricings beginning to move higher

• The Fed has indicated that they will persist with a hawkish bias until it’s clear that the Inflationary Counter Points begin to fade. The challenge with proceeding along this path it’s uncertain how long it will take for the Inflationary Counter Points lose momentum, meanwhile, the Disinflationary Points are gaining momentum like a hurricane, threatening to move from a Category 2 storm to a Category 4 storm.

For more news, information, and analysis, visit the Innovative ETFs Channel.

Performance data quoted represents past performance, which is not a guarantee of future results. No representation is made that a client will, or is likely to, achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Focus Point LMI LLC

For more information, please visit www.focuspointlmi.com or contact us at [email protected] Copyright 2023, Focus Point LMI LLC. All rights reserved.

The text, images and other materials contained or displayed on any Focus Point LMI LLC Inc. product, service, report, e-mail or web site are proprietary to Focus Point LMI LLC Inc. and constitute valuable intellectual property and copyright. No material from any part of any Focus Point LMI LLC Inc. website may be downloaded, transmitted, broadcast, transferred, assigned, reproduced or in any other way used or otherwise disseminated in any form to any person or entity, without the explicit written consent of Focus Point LMI LLC Inc. All unauthorized reproduction or other use of material from Focus Point LMI LLC Inc. shall be deemed willful infringement(s) of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Focus Point LMI LLC Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Focus Point LMI LLC Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

All unauthorized use of material shall be deemed willful infringement of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights. While Focus Point LMI LLC will use its reasonable best efforts to provide accurate and informative Information Services to Subscriber, Focus Point LMI LLC but cannot guarantee the accuracy, relevance and/or completeness of the Information Services, or other information used in connection therewith. Focus Point LMI LLC, its affiliates, shareholders, directors, officers, and employees shall have no liability, contingent or otherwise, for any claims or damages arising in connection with (i) the use by Subscriber of the Information Services and/or (ii) any errors, omissions or inaccuracies in the Information Services. The Information Services are provided for the benefit of the Subscriber. It is not to be used or otherwise relied on by any other person. Some of the data contained in this publication may have been obtained from The Federal Reserve, Bloomberg Barclays Indices; Bloomberg Finance L.P.; CBRE Inc.; IHS Markit; MSCI Inc. Neither MSCI Inc. nor any other party involved in or related to compiling, computing or creating the MSCI Inc. data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice.

Important Disclosures

This communication reflects our analysts’ current opinions and may be updated as views or information change. Past results do not guarantee future performance. Business and market conditions, laws, regulations, and other factors affecting performance all change over time, which could change the status of the information in this publication. Using any graph, chart, formula, model, or other device to assist in making investment decisions presents many difficulties and their effectiveness has significant limitations, including that prior patterns may not repeat themselves and market participants using such devices can impact the market in a way that changes their effectiveness. Focus Point LMI LLC believes no individual graph, chart, formula, model, or other device should be used as the sole basis for any investment decision. Focus Point LMI LLC or its affiliated companies or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. Neither Focus Point LMI LLC nor the author is rendering investment, tax, or legal advice, nor offering individualized advice tailored to any specific portfolio or to any individual’s particular suitability or needs. Investors should seek professional investment, tax, legal, and accounting advice prior to making investment decisions. Focus Point LMI LLC’s publications do not constitute an offer to sell any security, nor a solicitation of an offer to buy any security. They are designed to provide information, data and analysis believed to be accurate, but they are not guaranteed and are provided “as is” without warranty of any kind, either express or implied.

FOCUS POINT LMI LLC DISCLAIMS ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE.

Focus Point LMI LLC, its affiliates, officers, or employees, and any third-party data provider shall not have any liability for any loss sustained by anyone who has relied on the information contained in any Focus Point LMI LLC publication, and they shall not be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the information or opinions contained Focus Point LMI LLC publications even if advised of the possibility of such damages.