By Todd Rosenbluth, CFRA

Invesco QQQ Trust (QQQ) has been one of the most popular ETFs in 2020, driven by favorable investor sentiment toward Amazon.com (AMZN), Apple (AAPL), Microsoft (MSFT) and other large-cap growth stocks in the Covid-19 driven new normal. However, the ETF misses out on many up-and-coming companies that fall outside of the top-100 non-financial stocks listed on the Nasdaq. That is what makes Invesco NASDAQ Next Gen 100 ETF (QQQJ), which launched today, so interesting. QQQJ will have stakes in more moderately sized and Nasdaq-listed Dunkin’ Brands Group (DNKN), Henry Schein (HSIC), and Lyft (LYFT) along with other growing companies outside of the top-100 listed on the Nasdaq.

At CFRA Research, we think what is inside an ETF matters more than its fee, even as QQQJ’s 0.15% expense ratio is compelling. In rating equity ETFs and mutual funds, CFRA combines ETF holdings level analysis and fund attributes like performance and costs. An equity fund is a basket of securities and with the benefits of transparency, we believe investors can understand the risk and reward prospects of these holdings. We combine this analysis with a review of performance and costs.

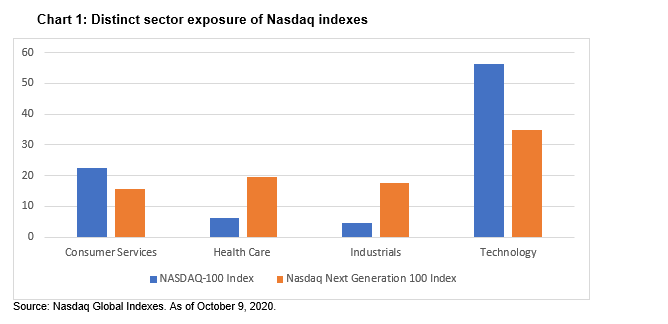

While QQQ is often referred to as a Technology ETF, the NASDAQ-100 index had a 56% weighting in the sector as of October 9, according FTSE classifications data from Nasdaq, with 23% in Consumer Services and 6.4% in Health Care, respectively. In contrast, the NASDAQ Next Generation 100 Index tracked by QQQJ had a 35% position in Technology with 20% in Health Care and 16% in Consumer Services.

According to John Hoffman, Head of Americas, ETFs & Index Strategies at Invesco, currently there are 35 companies that are in QQQ that used to be part of the index behind QQQJ and have graduated. He added the commonality is many of these companies are using technology to disrupt the industries they are in, rather than being classified in the Technology sector.

QQQJ could easily be paired with QQQ or the lower-priced Invesco NASDAQ 100 ETF (QQQM), which also launched on Tuesday, to provide exposure to the top-200 large-cap growth stocks that trades on the Nasdaq. Investors often ignore the mid-cap space, choosing to build portfolios focused on the largest or the smallest companies. But QQQJ will provide unique exposure that warrants further attention.

Todd Rosenbluth is Director of ETF & Mutual Fund Research at CFRA.