Among the sector exchange traded funds hitting new highs Friday was the SPDR Kensho New Economies Composite ETF (NYSEArca: KOMP), a unique spin on the technologies of tomorrow.

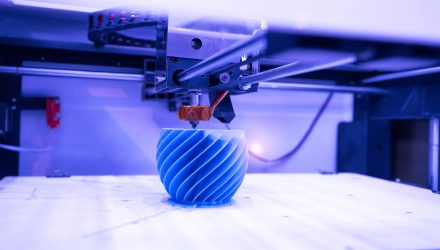

KOMP, which debuted last October, includes “New Economy” industries, ranging from 3D printing to genetic engineering, can provide investors access to a comprehensive and diversified set of companies propelling the new economy.

KOMP follows an “index utilizing artificial intelligence and a quantitative weighting methodology to pursue the potential of a new economy fueled by innovative companies disrupting traditional industries by leveraging advancements in exponential processing power, artificial intelligence, robotics, and automation,” according to State Street.

Kensho Technologies leverages alternative data and artificial intelligence to identify and analyze large amounts of data, from companies that are developing the products and services driving the new economy, including those in the entire ecosystem, such as suppliers and service providers, in addition to the pure play companies.

The ETF features broad-based exposure to multiple disruptive technology themes and offers a deep bench of almost 370 stocks. Fifteen industry groups are represented in the fund.

More On KOMP ETF

“Remembering that big data has applications across multiple industries, KOMP is a relevant big data ETF because the fund features exposure to 15 industry groups with aerospace and defense, application software and semiconductor names combining for 22% of the fund’s weight,” reports InvestorPlace.

Disruptive technology is not relegated to certain sectors as it will permeate into all industries in some form or fashion. For example, augmented reality is technology comprised of digital images superimposed over the real world, and its use is primed to drive industry growth–industries like real estate and manufacturing are already putting the technology to use in a variety of ways.

AI, in particular, is gaining widespread attention for its ability to disrupt a variety of sectors. In the financial space, AI can be used to perform risk-reward analysis, fraud detection and advisory services.

According to a report by multinational professional services firm Ernst & Young, robotics process automation in finance “radically improves cost efficiency under growing pressure on costs, it “helps to remain in control in the constantly changing environment,” and “allows to focus skilled resources on driving value creation for the business.”

For more news and strategy on the Technology market, visit our Technology category.