Up about 5% year-to-date and 21% the last few months, the Invesco NASDAQ 100 ETF (QQQM), the miniature version of the popular Invesco QQQ Trust (QQQ), is delivering big gains with help from Amazon, Microsoft, and Apple.

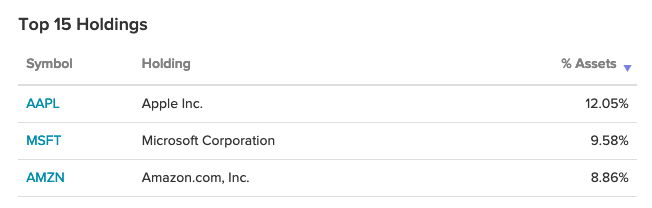

The trio of stocks, which comprise about 30% of the fund’s assets, have been knocking their earnings out of the park. QQQM tracks the top 100 largest non-financial companies listed on the Nasdaq, and is designed to appeal to buy-and-hold investors. QQQ is more trader-friendly.

The ‘Mini QQQ’ is slightly outpacing its cousin. QQQM has grown 12.29% the last 12 months, while QQQ is up 11.26%.

Monster Earnings for Amazon, Microsoft, and Apple

QQQM is getting benefitting of late thanks to strong earnings reports from Amazon, Microsoft, and Apple. Amazon was the most recent to report earnings and delivered “its largest quarter by revenue of all time at $125.56 billion, pushing it past the symbolic $100 billion mark for the first time,” according to a CNBC report.

However, it wasn’t the big quarter that was the only news. Amazon CEO Jeff Bezos announced he would be stepping down during Q3 of this year in order to focus more on product development.

“If you do it right, a few years after a surprising invention, the new thing has become normal. People yawn. That yawn is the greatest compliment an inventor can receive,” Bezos wrote. “When you look at our financial results, what you’re actually seeing are the long-run cumulative results of invention. Right now I see Amazon at its most inventive ever, making it an optimal time for this transition.”

Last week also saw QQQM’s second largest holding, Microsoft, report “fiscal second-quarter earnings Azure cloud revenue growth and quarterly revenue guidance that exceeded analysts’ expectations,” as detailed by CNBC. Cloud growth has been a prevailing theme amid the Covid-19 pandemic as more users rely on internet-based services like cloud computing.

“In the fiscal second quarter, revenue from Microsoft’s Intelligent Cloud business segment totaled $14.60 billion,” the report added. “The segment includes the Azure public cloud, server products such as Windows Server, GitHub and enterprise services. Revenue was up 23% year over year and above the $13.77 billion consensus among analysts polled by FactSet.”

Last, but not least, QQQM’s top holding, Apple, rounded out the trio’s earnings reports with more positive results. The iPhone maker reported $111.4 billion in its first-quarter earnings report for fiscal 2021, making it the first time the company has crossed that $100 billion mark. Its sales climbed 21% year over year.

For more news and information, visit the Innovative ETFs Channel.