Fifth survey of 238 factor investors across the globe finds persistent appeal amid volatility; 95% respondents interested in allocating to fixed-income factor investing.

Invesco today released findings from its fifth annual Invesco Global Factor Investing Study, the most comprehensive industry survey tracking factor investing sentiment. Interviews for this year’s global factor study were conducted during a period of unprecedented market conditions in April and May of 2020 driven by the global pandemic. Despite the market turbulence, the findings point to continued adoption of factor investing, especially within fixed income.

“There’s no question that volatility has been a defining characteristic of markets this year. And while this kind of turbulence and ongoing uncertainty can test even the most seasoned institutional investors’ commitment to their long-term strategies, we are very pleased to see that factor investors collectively have persevered through short-term discomfort,” said Mo Haghbin, Chief Commercial Officer and COO, Invesco Investment Solutions. “The evolution of factor investing continues to attract a wide variety of investors, which in turn drives the industry to continue to develop and refine factor offerings to meet those needs.”

Resiliency of Factor Investing Amid Challenging Macroeconomic Backdrop

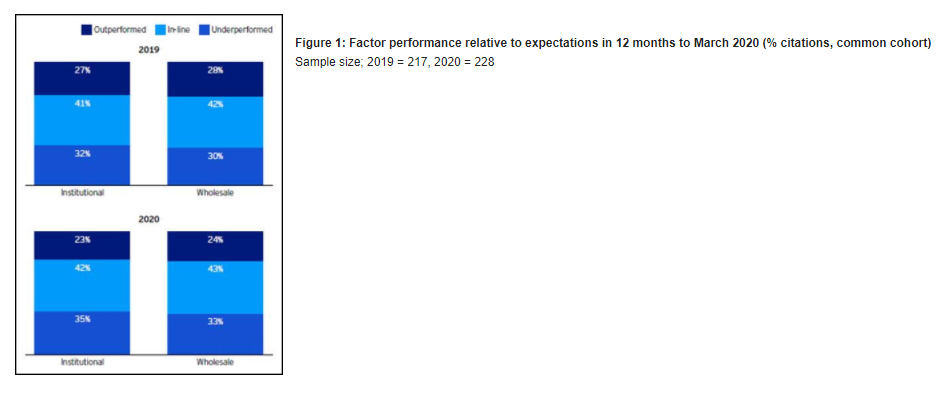

Despite the backdrop of COVID-19, investors expressed confidence in their factor allocations – over 65% of investors surveyed reporters’ factors meeting or exceeding expectations. Interviews for this study were conducted following the initial shockwaves the pandemic sent through financial markets. While the factor investors interviewed understood that the full impact on their portfolios was not yet clear, they were continuing to increase factor allocations despite a challenging period and divergent factor performance. Factor allocations are being assessed against risk and return objectives over a long-term horizon, and most investors surveyed were pleased to see factors behaving as expected during a turbulent period in global markets. (Figure 1)

This long-term approach to factor investing is demonstrated in investors’ commitment to value investing. Despite recent underperformance, investors believe in the merits of maintaining or increasing value exposure within portfolios: only 5% of institutional investors and 16% of advisors doubted that value would perform over the full cycle. This continued interest in the value factor occurred at the same time investors reported slightly tilting exposures to the quality and momentum factors for tactical reasons based on factor metrics.

Confidence in Fixed Income Factors Continues to Increase

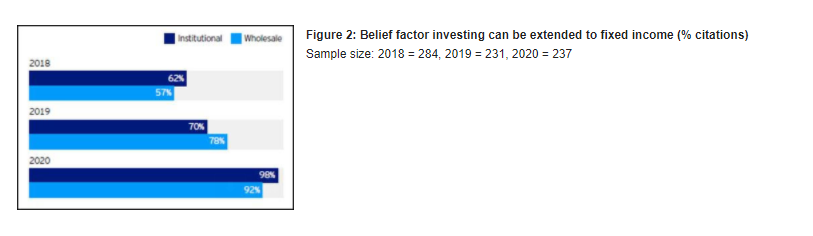

Representing a dramatic increase over the past two years, nearly all respondents in this year’s study believe factor investing can be applied to fixed income — a change from 59% in 2018 to 95% this year. In terms of actual application, two-fifths of those surveyed use factors in fixed income and over two-thirds are actively considering introducing them into their portfolios. (Figure 2)

While the application of factor investing to fixed income is new to many factor investors, systemic approaches, such as factor investing, to fixed income have had steadfast appeal. The study finds a relatively high number of respondents either investing in fixed income via factors or considering introducing factors to their fixed income allocations.

For institutional investors, risk reduction has consistently been the most important driver of adoption, followed by increasing returns. However, the increased focus on controlling portfolios and improving benchmarking over the last two years suggests that investors are increasingly considering factors in the context of the whole portfolio, rather than in select sleeves or asset classes. Investors also cited the potential for a factor approach to shine a spotlight on alpha generation by active fixed income managers and bring more transparency to the market, similar to the advantages they already see with using factors in equities.

Some challenges still act as a barrier to investor adoption. For more than half of institutional investors, a lack of consensus around definitions and terminology remains a challenge (56%). Some also pointed to the difficulties of working with different external managers across fixed income factor mandates and the lack of unified definitions when discussing fixed income factors internally.

Growing Sophistication of Factor Investors Boosts Dynamic Allocation

Investors are moving beyond simply buying factor strategies, recognizing the need to adapt and evolve factor strategies as capabilities develop or the market environment changes. 93% of institutional investors and 82% of advisors look to update their approaches continually, whether by making incremental changes to data sources and execution or by making more fundamental changes to allocations.

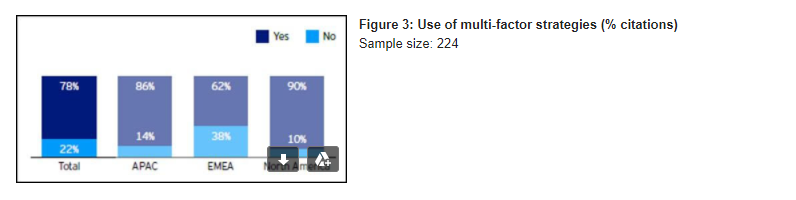

One example of this growing sophistication is the continued adoption of multi-factor strategies, the use of which is now a several-year trend. Multi-factor strategies have become the norm, used by 81% of surveyed institutional investors and 73% of responding advisors. Almost half of the study’s respondents run strategies where multi-factor allocations are built up using numerous single-factor allocations. (Figure 3)

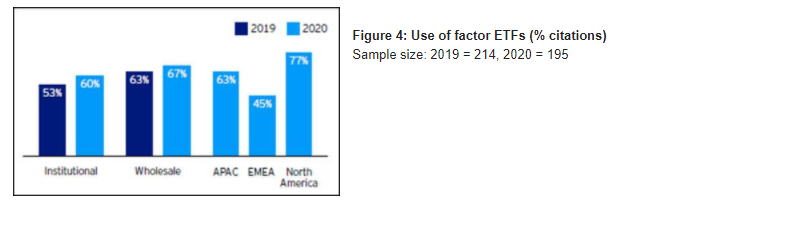

Investors are also increasing their usage of ETFs as they search for more tactical tools against a challenging economic backdrop. For wealth managers, ETFs are usually the primary vehicle for gaining factor exposure, making up three-quarters of the average factor allocation. A majority of institutional investors now use ETFs, accounting for an average of 14% of their factor portfolios. In the wholesale segment, more than two-thirds of investors make use of ETFs, accounting for half of factor portfolios overall. This includes the use of low volatility strategies to help manage overall portfolio volatility, with these cited regularly as an important driver of the trend towards ETF use among both institutional and wholesale investors. (Figure 4)

Respondents stated the underlying index methodology is often an important selection criterion, with different ETFs targeting the same factor or factors not always seen as equals. Investors highlighted the importance of rigorous due diligence when selecting an ETF, as well as the need for full transparency and education regarding composition and methodology from funds providers. This was seen as particularly important when selecting multi-factor and multi-asset products, where similar-looking products can differ widely in terms of definitions, weightings and rebalancing methodologies.

“Investors’ confidence in their factor allocations, even in the depths of the COVID-19 crisis, is a testament to both the growing appeal of factor allocations and investors’ commitment to long-term approaches,” said Marcus Axthelm, Director of Factor Investing, Americas, Invesco. “That sentiment is very much aligned with the overarching findings from this year’s study: factor investing is continuing on its growth trajectory, and investors are increasingly open to adopting new factor strategies — such as fixed income and multi-factor — to help meet their ultimate investment objectives. Greater adoption of these strategies demonstrates the value in the industry’s continued investment in related product development and education for institutional investors and advisors.”

Sample and Methodology

The fieldwork for this study was conducted by NMG’s strategy consulting practice. Invesco chose to engage a specialist independent firm to ensure high-quality objective results. Key components of the methodology include:

- A focus on the key decision makers conducting interviews using experienced consultants and offering market insights.

- In-depth (typically one hour) videoconference and phone interviews using a structured questionnaire to ensure quantitative as well as qualitative analytics were collected.

- Results interpreted by NMG’s strategy team with relevant consulting experience in the global asset management sector.

In 2020, the fifth year of the study, interviews were conducted with 238 different pension funds, insurers, sovereign investors, asset consultants, wealth managers and private banks globally. Together these investors are responsible for managing $25.4 trillion in assets (as of 31 March 2020).

In this year’s study, all respondents were ‘factor users’, defined as any respondent investing in a factor product across their entire portfolio and/or using factors to monitor exposures. We deliberately targeted a mix of investor profiles across multiple markets, with a preference for larger and more experienced factor users. The breakdown of the 2020 interview sample by investor segment and geographic region is displayed in the report. Invesco is not affiliated with NMG Consulting.

To access the full Invesco Global Factor Investing Study please visit the Invesco Factor Investing Website.

Appendix