When it comes to investing in exchange-traded funds (ETFs), an obvious theme in 2020 has been riding the strength of technology. Amid social distancing measures, tech has been the go-to play. With the QQQ Innovation Suite, ETF investors can get access to the Nasdaq 100 through traditional and alternate ways.

One of the funds to consider in the suite is the Invesco NASDAQ 100 ETF (QQQM), which, as mentioned, is based on the NASDAQ-100 Index (Index). The Fund will invest at least 90% of its total assets in the securities that comprise the Index.

The Index includes securities of 100 of the largest domestic and international nonfinancial companies listed on Nasdaq. The Fund and Index are rebalanced quarterly and reconstituted annually.

“The Underlying Index includes 100 of the largest domestic and international non-financial companies listed on The Nasdaq StockMarket LLC based on market capitalization,” the prospectus mentions. “Non-financial companies are those companies that are classified under all Industry Codes except 8000 according to ICB, a product of FTSE International Limited.”

“The Underlying Index reflects companies across major industry groups, including computer hardware and software, telecommunications, retail/wholesale trade, and technology. It excludes financial companies, including investment companies,” the prospectus added. “Security types generally eligible for inclusion in the Underlying Index are common stocks, ordinary shares, tracking stocks, shares of beneficial interest, and limited partnership interests, as well as ADRs that represent securities of non-U.S. issuers.”

Can’t Get Enough of QQQ?

For ETF investors who can’t get enough of the QQQ suite, there’s the obvious exposure they can get to the Invesco QQQ ETF (NASDAQ: QQQ). Speaking to the popularity of QQQ, it’s been seeing heavy, billion-dollar inflows as of late, according to a recent Bloomberg article.

QQQ seeks investment results that generally correspond to the price and yield performance of the NASDAQ-100 Index®. The composition and weighting of the securities portion of a portfolio deposit are also adjusted to conform to changes in the index.

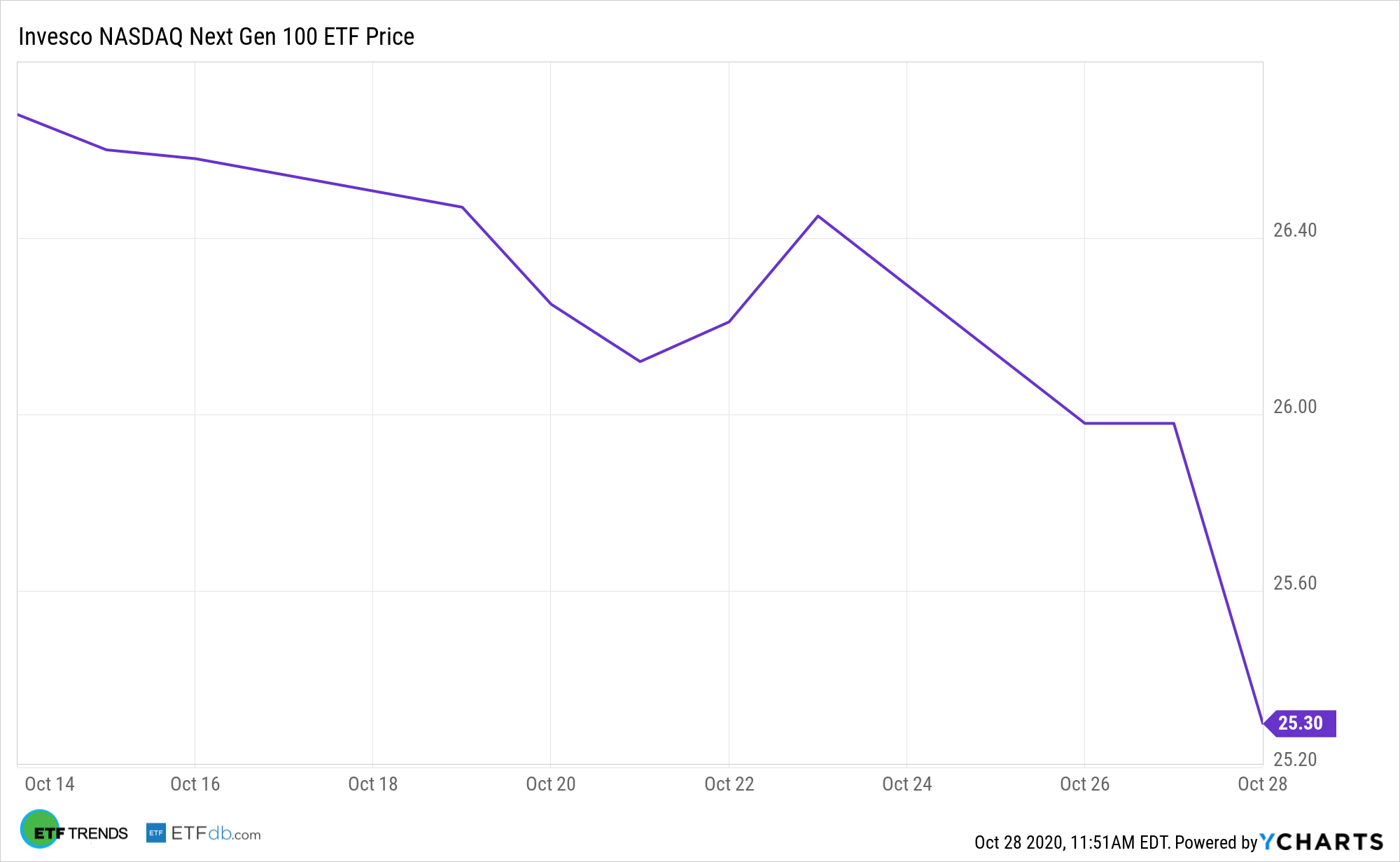

Investors piling in on QQQ can also take advantage of a mid-cap option that can capture upside in growth without taking on the risk of small-caps. Large-cap tech has been having its day in the sun despite the Covid-19 pandemic, but investors may also consider the Nasdaq Next Gen 100 ETF (QQQJ).

QQQJ also gives ETF investors tech exposure, but with a mid-cap twist. While large-cap companies in tech like Apple or Microsoft are solid plays, there are also opportunities to be had in midcap companies that investors may not know about due to a lack of media exposure.

For more news and information, visit the Innovative ETFs Channel.