Key Takeaways

- Despite thematic ETFs representing just 2% of the U.S. listed fund market, assets tied to these long-term growth strategies climbed 78% in the fourth quarter aided by strong net inflows.

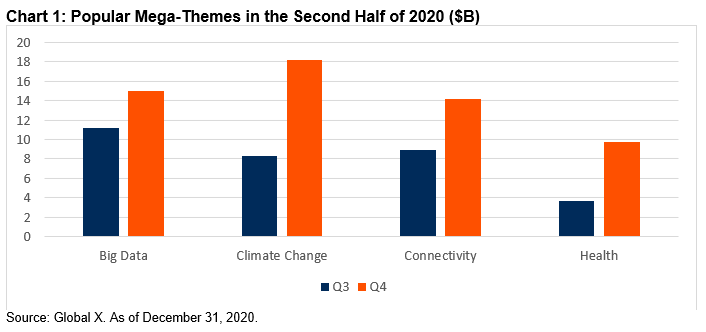

- Clean energy ETF assets doubled in the last three months of 2020 to $18 billion, amid optimism of the Biden administration. These ETFs manage more assets than funds focused on big data or connectivity mega-themes.

- Invesco Solar (TAN), Invesco Wilderhill Clean Energy (PBW), and iShares Global Clean Energy (ICLN) were highly popular in the fourth quarter but provide distinct exposure to clean energy sectors.

Fundamental Context

At the end of 2020, there were 148 thematic ETFs managing $104 billion in assets according to Global X. While thematic ETFs represent just 2% of overall ETF assets, the base grew a whopping 78% in the last three months of 2020, aided by strong performance and $26 billion of net inflows. Relative to the end of 2019, thematic ETFs jumped 274%. Global X characterizes thematic ETFs the company and its peers offer as following long-term growth-focused strategies; unconstrained by arbitrary geographic and sector definitions; and having relatable concepts. These mega-themes include big data, climate change, connectivity, health, and mobility. CFRA thinks thematic ETFs provide targeted exposure and the benefits of diversification as not all companies connected to powerful, disruptive macro-level trends will succeed as winning investments.

Investors embraced climate change themed ETFs in the fourth quarter of 2020. Joe Biden’s election provided a boost to climate-related ETFs, as investors anticipated that his administration would prioritize fighting climate change more than Donald Trump and team did. Stocks connected to the transition to renewable energy sources, such as solar and wind, have climbed in value. Climate change ETF assets more than doubled in the fourth quarter to $18 billion, from $8.3 billion at the end of September 2020, and ended 2020 with higher assets than the $15 billion in the Big Data mega theme. Big data includes popular cloud computing and cyber security ETFs such as Global X Cloud Computing (CLOU) and First Trust Nasdaq Cybersecurity (CIBR) that performed well and received net inflows in the fourth quarter of 2020.

During the fourth quarter, iShares Global Clean Energy ETF (ICLN) tripled in size to $4.7 billion aided by $2.0 billion of net ETF inflows, while Invesco Solar ETF (TAN) and Invesco Wilderhill Clean Energy (PBW) swelled to $3.6 billion and $2.2 billion, up from $1.6 billion and $760 million, respectively.

Although all three ETFs more than doubled in value in 2020, they are constructed differently. ICLN has just over half of its assets in Utilities with the remainder split between Industrials and Information Technology stocks. Meanwhile, PBW’s largest holdings are from the Industrials sector (39% of assets), while the fund has just 6% in Utilities. In addition to Information Technology (22% of assets), PBW also has a meaningful stake in Consumer Discretionary (21% of assets) companies. In contrast, TAN’s heftiest stake was in Information Technology (55% of assets), with most of the remainder in Utilities (31%) and Industrials (10%).

Other established ETF peers include ALPS Clean Energy (ACES), First Trust Nasdaq Clean Edge Green Energy (QCLN), and SPDR Kensho Clean Power ETF (CNRG).

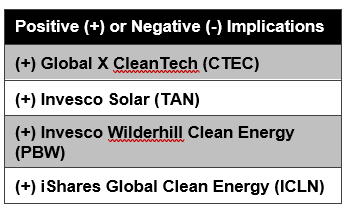

At yearend, there were 20 climate change focused ETFs with Global X CleanTech ETF (CTEC) the latest addition rated by CFRA. CTEC stands out relative to more established peers by including Materials (11% of assets), along with Industrials (49%) and Information Technology (36%). After having launched in October, the fund earns a CFRA four star rating.

Conclusion

Climate change related ETFs soared in value during 2020 and investors piled in these products in the second half of 2020. However, we encourage investors to look inside the funds to understand the sector exposure they are receiving as well as the risk and reward attributes of their holdings using CFRA ETF reports.

Originally published by CFRA, 1/12/21

All of the views expressed in this research report accurately reflect the research analyst’s personal views regarding any and all of the subject securities or issuers. No part of the analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this research report. For more information and disclosures, please refer to CFRA’s Legal Notice at https://www.cfraresearch.com/legal/.

Copyright © 2021 CFRA. All rights reserved. All trademarks mentioned herein belong to their respective owners.